Late last month, the House and Senate negotiated and agreed upon a second stimulus package to provide aid to millions of Americans impacted by the COVID-19 pandemic, all in many different financial circumstances. The new bill (the Bipartisan-Bicameral Omnibus COVID Relief Deal) is extensive and over 5,500 pages long. If you are a small business owner, your business may have been directly impacted by the pandemic, and this new bill outlines new support opportunities.

The CARES Act

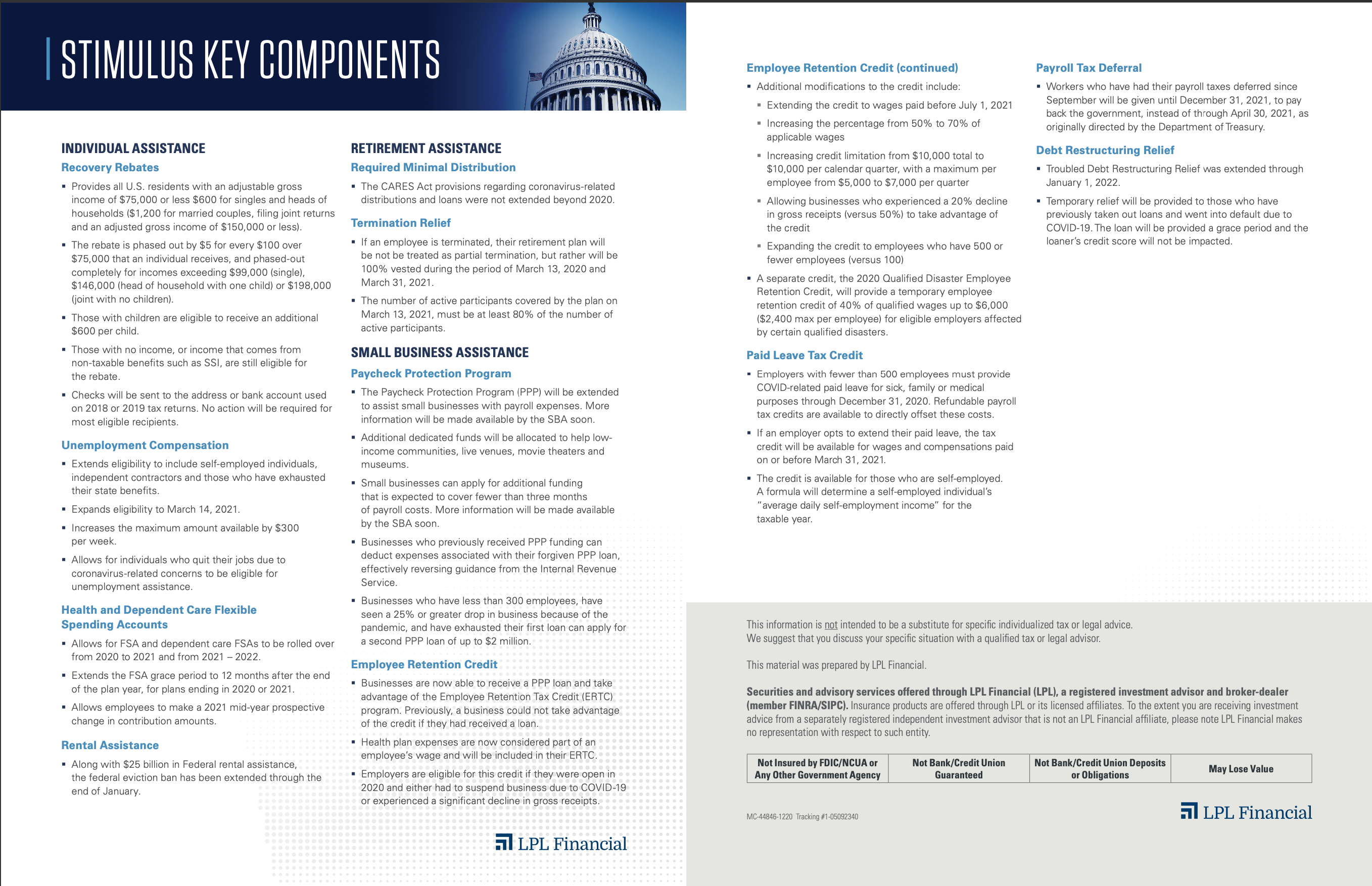

The initial Coronavirus Aid, Relief, and Economic Security Act (CARES Act) passed in late March included a Paycheck Protection Program (PPP). This program was implemented in an effort to help certain businesses, companies, and organizations whose businesses were thwarted by the global pandemic by providing loans for operation expense relief. It also allowed some businesses to continue employing and paying their employees. The bill also provided a second form of aid through a program called the Employee Retention Tax Credit.

The second stimulus package

Paycheck Protection Program

This second stimulus bill provides $284 billion for a second round of PPP loans. This funding is available to both first-time participants of the PPP and those businesses that had previously borrowed through the first PPP in March. An additional $20 billion are allocated for businesses in low-income communities.

New modifications have been made to the guidelines of the second PPP. These will be applied to both first and second-time borrowers.

It also expands eligibility for businesses in more industries to accommodate the great financial burden that the pandemic has had on nonprofit organizations and small businesses, specifically the hospitality industry and independent restaurants. Companies that are eligible must have been established prior to February 15, 2020.

New types of companies are now able to apply for a PPP, including:

- Nonprofit organizations

- Churches and faith-based organizations

- News outlets

- Transportation companies

- Corporations, LCCs, sole proprietors, self-employed, independent contractors can all apply

Participation status and information

You participated in the first PPP and are seeking a second PPP

Eligibility: You can apply for a second round of PPP loans up to $2 million if:

- Your business has less than 300 employees

- You have seen a 25% or greater drop in business because of the pandemic

- You have exhausted your first PPP loan

- The Small Business Administration has 10 days after the bill is signed to provide guidance on logistics for issuing new loans and how to report a 25% drop in business

Owners in the hospitality industry (bars, restaurants, and hotels)

- As some of the hardest hit businesses throughout the pandemic, additional aid will be provided

- Able to borrow 3.5 times average monthly payroll, but cannot exceed $2 million

You participated in the first PPP and you have already applied for loan forgiveness

- Now allowed to deduct the costs of the loans on your upcoming federal tax return

You participated in the first PPP and are considered a “small borrower” (received less than $150k)

- Implemented streamlined forgiveness reporting for loans of less than $150,000

- Now reports consist of only a one-page online, and will only be subject to audit if suspected of fraud or improper uses of loans

- Forgiveness amounts caused by slashing salaries or slashing headcount will not be reduced for small borrowers

You did not participate in the first PPP and want to participate in the second PPP

Eligibility:

- Your business has less than 300 employees

- You have seen a 25% or greater drop in business because of the pandemic

The Small Business Administration has 10 days after the bill is signed to provide guidance on logistics for issuing new loans and how to report a 25% drop in business

Important changes to PPP

- Loan amounts

- Loans can be up to 2.5 times your monthly payroll in 2019. Payroll includes all costs for W-2 employees including wages; commissions; bonuses; health insurance; retirement and state and local taxes

- New covered expenses (non-payroll):

- Include:

- Operations expenditures

- Property damage costs

- Supplier costs

- Worker protection costs.

- All non-payroll costs cannot exceed 40% of the total costs eligible for forgiveness.

- Include:

- Forgiveness

- Fully forgiven if spending at least 60% on payroll expenses and a maximum of 40% on other qualifying expenses during the time frame

- After 8 weeks of receiving the loan, you can apply for forgiveness

- Loans can now be written off in the upcoming tax return

- New options for covered periods:

- Borrowers can now choose the selected period of time that they can receive the loan, anywhere from 8 to 24 weeks (Before, required to choose between either 8 or 24-weeks).

- Businesses can expense restaurant meals purchased from 2021 to 2022 (with restrictions)

- Economic Injury Disaster Loan advance will no longer be taxable and expenses will remain deductible

For more information and to receive an invitation to apply for a PPP loan, please visit: http://go.sbaloangroup.com/PPP

Employee Retention Tax Credit

A separate program under the bill, the ERTC encourages businesses to keep employees on the payroll despite financial impacts on their business that would otherwise call for termination of employees.

Taxpaying small business owners may now claim both the ERC and take out a PPP loan.

Eligibility:

- Business experienced a decline of at least 20% in gross receipts (instead of a 50% decline in original CARES Act) as compared to the same calendar quarter in the prior year

- A “small employer” is now classified as any business with less than 500 employees (from the original 100 classification on the CARES Act)

Changes to the Employee Retention Tax Credit (ERTC)

- ERTC will be extended for wages paid before July 1, 2021

- Credit percentage is increased from 50-70% of qualified wages

- For businesses with more than 500 employees, qualified wages are also increased from $10,000 total per employee to $10,000 per quarter per employee

- Paid Leave Tax Credit (Families First Coronavirus Response Act)

- Extended through March 31 to businesses who provide paid sick leave

- Business with less than 500 employees are not required to provide sick and medical leave after December 31, 2020

- The bill places limits on employers’ ability to obtain an advance payment of the credit

Self-employed and participating in the ERTC

- For paid leave tax credit, individual amounts will be based off a formula taking into account the individuals average daily self-employment income for the taxable year.

If you are a business owner, we encourage you to reach out to us to review your particular circumstances and discuss how the new stimulus package applies to you. As always, please contact us with any questions or concerns.

Sources:

https://www.washingtonpost.com/business/2020/12/20/stimulus-package-details/

LPL Coronavirus Fiscal Stimulus Package, December 22, 2020

Disclosures

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05095642