by: Brian Davies, CFA – Chief Investment Officer

The old adage, markets climb a wall of worry, indeed was the case for the stock market in the 3rd quarter. The constant drumbeat of the Covid-19 pandemic and another contentious presidential election in the U.S. did not prevent the S&P 500 and other risk assets from having a solid quarter. The S&P 500 was up 9.0% in the quarter while emerging market equities and U.S. growth stocks saw double-digit returns. As the world continues to navigate the ebb and flow of the pandemic, investors continued to favor companies whose business models show accelerated growth during these times. On the other hand, stocks in more cyclical industries like energy and regional banking lagged as investors seem to lack confidence around the strength of a cyclical economic recovery that would benefit these industries. In this update, we will review what happened from an economic and capital markets perspective during the quarter. We will also discuss our thoughts as we approach year-end and our asset allocation views in light of the current environment. Enjoy!

Economy in the 3rd Quarter 2020:

The economy in the 3rd quarter continued to show gradual improvement off the depths of the recession seen in March and April. Areas like housing, manufacturing, and consumer spending are showing signs of a strong rebound. Historically low mortgage rates, combined with shifting buyer demographics and preferences, have the housing market leading the economic recovery. Builders’ confidence, housing starts, prices, and inventory levels are all pointing to a robust period for residential real estate. Those who are employed and have access to capital are interested in spending on their home or acquiring a new one. Refinance activity is also spiking, which could free up money for real estate owners to spend.

From a global perspective, manufacturing and services activity have both come back to levels that point to economic expansion across many countries. The U.S, China, Eurozone, India, and Australia are all showing expansionary manufacturing activity. Most of these same countries are showing similar expansion in services activity also. These two critical economic indicators point to a global economy in the early stages of recovery.

Retail sales in the U.S. have also been showing positive growth trends since May. September was the fifth straight month of positive monthly growth. Areas like auto’s, building materials, home furnishings, and sporting goods have been particularly strong. On the other hand, retail sales in clothing, movie theatres, and restaurants have been slower to regain momentum post-April. Overall, the picture around retail sales is positive and again paints a picture of a recovery taking hold, although the rising tide has yet to lift all boats.

Employment also showed improvement in Q3, although probably not as much progress as most would like. We ended the quarter with Unemployment Rate at 7.9% and companies adding to payrolls for the fifth straight month. However, we still have many workers receiving unemployment benefits, as only fifty percent of jobs lost have come back. So, while we have a long way to get back to pre-pandemic employment levels, this gradual improvement in fundamentals is what markets are looking for. We have written in the past that history tells us employment recoveries take years to play out. It’s not rational to expect a typical job market so soon after a recession. Usually, the job recovery is measured in years, not months. This slow but gradual recovery in employment also highlights the need for more fiscal policy action in the U.S to assist those who struggle to regain employment. As we know it takes years of gradual improvement to get back to past employment levels, we must support those who have and will continue to struggle in periods like this.

A breakdown of employment by education level goes a long way in explaining the need to provide further assistance as we move forward through this period. Currently, the unemployment rate for those with a bachelor’s degree or higher is near 5.0%. This helps explain why the above-mentioned economic expansion is taking hold. However, for those with only a high school degree or less, unemployment is still in double-digit territory (around 10% to be exact). That’s double the unemployment level of those with a higher education level. This again highlights the need for more assistance as we move through this recovery. History is a useful tool when looking at employment by education. Normally during a recession, the unemployment spread by education widens out, and peaks after the recovery has started to take hold. As the cycle moves forward, that spread will decline, but this takes years. So today, we are at a peak spread of unemployment based on education. This peak spread speaks to the need to continue to support those in the education demographic that are facing double-digit unemployment rates. Over time, that need will lessen, but for right now, that is not the case. Fiscal support is still needed to carry those that need it further into the recovery until sustained economic growth can occur.

Capital Markets Performance in Q3:

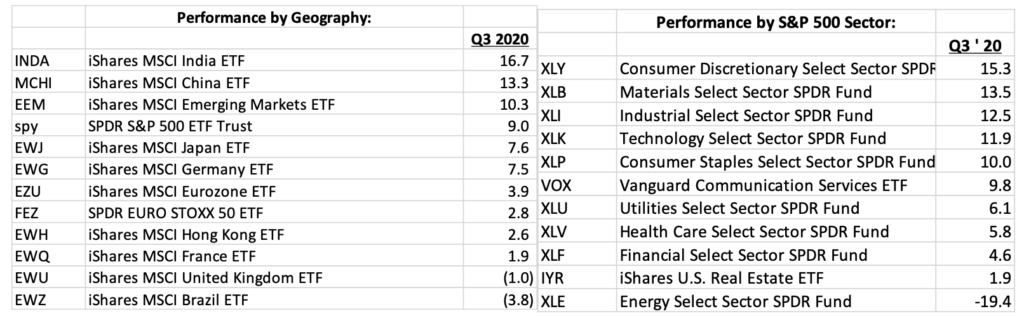

As we stated previously, risk assets had an excellent quarter overall. The S&P 500 was up 9.0% thanks to strength in technology, consumer discretionary, industrials, and materials sectors. Laggards included energy, real estate, and financial stocks. Emerging markets (ishares MSCI EM Index) led the international markets with a return of 10.3%. India (ishares MSCI India +16.7%), China (ishares MSCI China +13.3%). Brazil and the U.K were laggards during the quarter as they were down 3.8% and 1.0% respectively.

From a size and style perspective, large-cap stocks continued to their outperformance relative to small companies. For Q3, small returned 5.0%, which lagged the S&P 500 by 400 basis points. Versus a broader subset of large-company growth stocks (ishares Russell 1000 Large Cap growth ETF), small-cap stocks performance of 5.0% for the quarter was 820 basis points behind large-cap growth. Growth stocks outperformed value stocks across styles also. Large-cap growth stocks (ishares Russell 1000 growth) outperformed large-cap value stocks (ishares Russell 1000 value) by 770 bps. As discussed in the opening paragraphs, growth stocks have seen their business momentum accelerate during the pandemic. Value stocks usually are heavily populated with cyclical companies whose business models have struggled during the pandemic. Investors have favored investing in companies that are growing despite the pandemic and have avoided the cyclical/value names that need a sustained economic recovery to see a robust turnaround in their fundamentals. At some point, fundamentals will improve, but it most likely won’t happen until we see more confidence in a vaccine or that the ebb and flow of the virus has been tamed through effective treatments and care for those who are susceptible.

In Fixed Income, the quarter was a flat one overall with the Barclays Aggregate Index up only 40 basis points. Credit exposure was positive in the quarter as high yield bonds returned 4.0%. Investment Grade bonds returned just a bit more than the aggregate index at 80 basis points. Treasury securities performed about as you would expect during a quarter which saw risk assets do well. The front end of the treasury curve (1-3 years) produced a flat return for the quarter while the long end of the curve (20+ years) saw a loss of about 10 basis points.

The 10-year treasury rate started the quarter at around 54 basis points and ended at 68 basis points. The small move higher contributed to the slight negative performance for the long end of the treasury curve. We continue to view the long-end of the treasury curve as an effective way to hedge equity risk. In our view, there is no income to be had in treasuries today, but their negative correlation to stocks is in place, making their primary purpose a hedging instrument. We saw this in September as stocks had a quick correction of 10%, and the S&P 500 finished down 3.7% on the month. Long-dated Treasuries saw a positive return in September and were an effective hedge during a somewhat volatile month for stocks.

Outlook as we head to year-end:

Amazingly enough, this crazy and chaotic year is only about ten weeks from coming to an end. We have made progress with our ability to test for the virus and effectively treat those who are infected. Unfortunately, we have not stopped the spread, and as we write this case numbers around the world are heading higher. The late fall and winter will challenge us once again, but hopefully, the progress we have made on the treatment front, and ultimately a vaccine will prove effective. These developments are important because the recession was driven by the pandemic and not by excesses in the economy. That means while the pandemic is still around us, full lift-off of the economic cycle will be delayed. Once we can put the pandemic behind us, then the lift-off and thus a full cyclical recovery can take place.

With this as a backdrop, we think we are in the very early stages of an economic recovery that will be part of the next economic cycle. As we pointed out earlier, many parts of the global and domestic economy have recovered and shown growth. Businesses and consumers are doing their best to adapt to the pandemic. We think this will be ongoing, will have fits and starts, and will take time to play out. Remember, economic cycles last years and take time to develop. Confidence on the part of businesses and consumers begets more confidence, leading to different stages of the economic cycle. It’s wrong to think or expect we can turn things around on a dime. We believe we are on the right track but are not ignorant to the fact that the pandemic is still with us, and as a result, not all boats have risen with the tide. In fact, the tide is in the very early stages of moving in.

Our Asset Allocation views, as a result of that macro view, lead us to overweight equities relative to bonds but to also maintain some risk exposure within our fixed income. Interest rates across the spectrum are so low that stocks still look relatively attractive. Yes, stocks valuations are historically high, but interest rates are historically low, so the relative view still favors stocks. That view should be in place until interest rates rise again. Based on what we hear from the federal reserve, that does not seem to be in play for several years.

We have made changes to our equity mix recently as we have moved some exposure away from large-cap equities in favor of small-cap equities. Our study of past cycles shows that early in an economic recovery, small companies tend to outperform large companies. As we get to the later stages of the economic cycle, large will beat small as the economy slows down and runs at slower speeds. This played out to a tee last cycle. Small outperformed large for over two years as the economic recovery started in June of 2009. Since 2018, large has beaten small as we entered the late stages of the cycle and then the recession. We have significantly benefited from this, as we have held underweight to small stock and an overweight to large for the last few years. Times are changing, and since we do believe we are at the beginning of an economic recovery, we lean on our process, which tells us that small could outperform large and that trend could be in place for a number of years. While we are not back to neutral or overweight small companies just yet, we have taken steps to move off the underweight and add to our small company exposure over time.

Our bond exposure changed a bit during the quarter as we lowered our overweight to credit that existed at the start of the quarter. High yield and investment-grade spreads have come in aggressively and are both now below long-term averages. We sold credit during the summer months and currently have a neutral exposure to the category. Credit still has some room to run, and we are comfortable that the next few quarters will be positive for the exposure. However, we recognize the spread narrowing has changed the risk dynamics in the category. Now is a good time to reign in that exposure a bit.

Within fixed income we still have an overweight to duration and are comfortable today with that exposure despite historically low rates. Our duration comes from positioning at the far end of the treasury curve. As we mentioned before, given the negative correlation that exists today in treasuries versus equities, we find long-dated treasury ETF’s a highly liquid, low-cost way to hedge our equity exposure across balanced portfolios. As long as the federal reserve is signaling a near-zero interest policy for the next 12+ months, we feel confident in this position for its hedging purposes.

One last thing to cover is the election. We are only weeks away, and the topic is top of mind for everyone. Since we don’t know who will win, we don’t make aggressive investment decisions based on guessing the outcome. History tells us that markets tend to look through partisan politics. While we might see some volatility around election day and the result, our inclination would be to, as always, find opportunity in the volatility.

One thing we are in full agreement on is that no matter who wins, taxes will be going up for a number of people and companies at some point in the future. We don’t know if it’s next year or in five years, but we know it will happen. We have to pay for our federal deficit at some point in time. That does not mean it has to be a market crashing event. Depending on the structure (again, we don’t know it today), companies most likely will adjust sufficiently. The long-term structural trends that are driving businesses today will not change. Ultimately, those structural trends will be a greater force in the long-term performance of those companies than the tax rate they pay.

For taxable accounts, we have tax-efficient balanced portfolios that can help manage a higher tax regime effectively. We focus on the long-term with low turnover. That low turnover can help minimize a taxable client’s yearly tax bill. Also, our models incorporate ETF’s, which are much more tax-efficient than mutual funds.

Summary:

The capital markets continue to recover and heal from the chaos of March and the third quarter was an extension of this recovery. The global economy is on a similar path, although we are early in the recovery, and the pandemic will continue to present challenges. Given the historically low level in interest rates and starting yields on bonds, we favor overweighting equities on a relative basis. We are starting to move away from large-company stocks in favor of small-company stocks that can benefit significantly at the early stages of an economic cycle. While bonds provide little income today, they still have some redeeming qualities in a balanced approach to asset allocation. The ride ahead will be bumpy as it always is for risk assets, and some hedging can help in periods of rising volatility. A diversified approach to asset allocation will benefit investors over the long-term.

In closing, we extend our appreciation to you and your family for allowing us to come on your financial journey. At Shepherd Financial Partners, we are using multiple mediums to keep in touch with you these days. Market commentary can be found on our website in written and video form. We encourage you to check it out and see what we have done to date. We consider any feedback you provide very valuable. Also, remember, we are here for you. If you have any questions or concerns, please reach out to your advisor, and let’s talk.

Disclosures

Data Sources: FactSet

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05069956