Here are three major takeaways.

On Monday, the House of Representative’s released their much-anticipated proposal on tax increases intended to fund the infrastructure bill still under negotiation. While this proposal is not yet law, we thought it prudent to share three key takeaways that could impact you. We will continue to update you as the legislation develops.

Personal Income Taxes

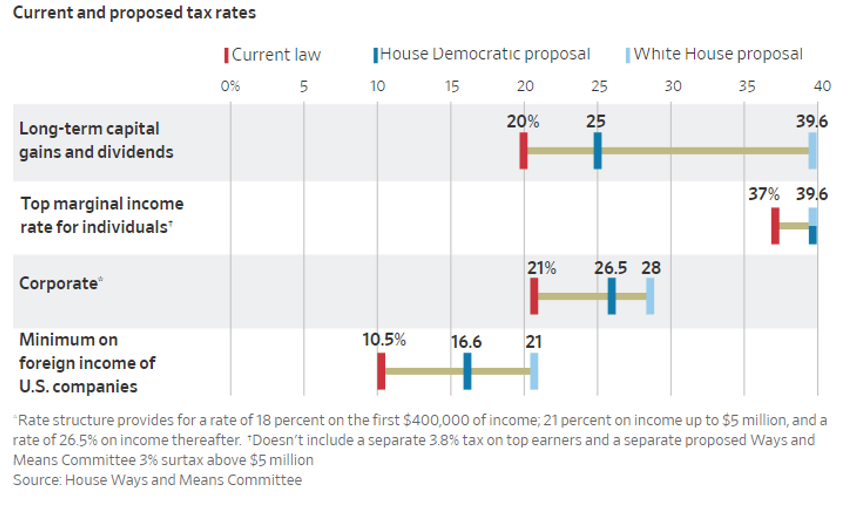

On the personal level, the primary tax increase affects the top income-tax rate. The proposed top rate would increase to 39.6% from 37%. There is also a reduction in the threshold for the top bracket, which is proposed to be $400,000 for individuals and $450,000 for married couples. The proposal also calls for a 3% surtax on individuals and married couples with adjusted gross income above $5 million.

Capital Gains Taxes

The capital gains tax changes were among the most watched by investors as prior proposals included many structural changes to the way investment gains are taxed. However, the plan released Monday did not include these major changes and instead would increase the long-term capital-gains and dividends rate to 25% from 20% at the top tax bracket. A provision left out of the proposal was imposing taxes on unrealized gains at death.

When combined with an existing 3.8% investment-income tax and the surtax, the new top rate on capital gains could be as high as 31.8%.

According to the proposal, the capital-gains tax increase would be effective as of Monday 9/13/21, meaning that gains taken up to this point would be treated under the old rules.

Corporate Taxes

For businesses, there were several key proposals that have implications for investors and business owners. The plan would raise the corporate tax rate to 26.5% from 21%. This is below previous calls for 28% that the Biden administration originally floated. The higher corporate tax rate has many investors asking, how will this impact earnings? Just as the 2017 TCJA provided a one-time boost to earnings growth for corporations, raising the corporate tax rate will create a drag on earnings. However, given that the newly proposed rate of 26.5% is lower than anticipated, the projected hit to corporate earnings is also now lower than anticipated.

There are several proposals that business owners should have on their radar. First, under the proposal, the flat corporate rate is replaced with a graduated rate structure at the following levels: 18% on income up to $400,000, 21% on income up to $5 million and a 26.5% rate on any income above that. The graduated rate would phase out for companies earning more than $10 million a year.

Second, the proposal reduces a tax break for businesses that pay their taxes on their owners’ individual tax returns (known as pass-through businesses). The plan would limit the deduction at $500,000 for joint filers and $400,000 for individuals for owners of such entities as partnerships and S corporations.

See the chart below for a summary of these proposed changes.

There are many other provisions and nuances within the proposal that may impact your financial plan. We welcome any questions and can strategize with your tax advisor to address the proposed changes.

Source: Wall Street Journal

Disclosures:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All indices are unmanaged and may not be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performances not indicative of the performance of any investment.

Past performance is no guarantee of future results.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05