Market Summary

Top Market News

Black swan worries quickly give way to renewed melt-up talk:

Reuters pointed out that it was just last week that a ramp in coronavirus concerns left investors wondering if the outbreak could be a “Black Swan” event that would trigger a sharp decline. However, with S&P rallying 4% from last week’s lows to new record highs, focus has instead shifted to a market melt-up. Noted reversal has revived concerns market participants are too complacent, particularly when it comes to expectations that easy monetary policy from leading central banks will continue to underpin prices. However, also said that despite repeated worries about stretched valuation and sentiment, trying to time market’s declines and betting against more gains has been a losing strategy over more than decade-long bull market in stocks.

January nonfarm payrolls beat, though wages a bit soft:

January nonfarm payrolls of +225K beat consensus for 161.5K gain. Prior two months revised up 7K. Manufacturing payrolls down 12K, though December revised up 5K. Unemployment rate up 0.1pp to 3.6%. Average hourly earnings up 0.1pp to +0.2% m/m (+3.1% y/y) missing m/m consensus for +0.3% (+2.9% y/y). Average workweek unchanged at 34.3. Labor force participation rate up 0.2pp to 63.4, matching highest since Jun-13. Employment-to-population ratio of 61.2% highest since Nov-08. Benchmark revisions to year ended Mar-19 showed decline of 514K total jobs, higher than 500K estimate. Report isn’t expected to have much of a Fed impact, as the bar for a move in either direction is very high.

Trump, Xi reaffirm commitment to implementing phase one trade deal:

Bloomberg reported that on a Friday call, President Trump and Chinese President Xi reaffirmed their commitment to implementing the phase-one trade deal signed between the two countries last month. Follow’s China’s announcement on Thursday that it would cut tariffs on $75B of US imports in half. The cut will be effective on 14-Feb, the same time as the US will implement reductions in tariffs on Chinese products. While China’s move was simply part of its trade deal commitments, it was still viewed positively given that the coronavirus outbreak had exacerbated concerns about its ability to hit aggressive purchase targets. There were also reports this week Beijing could use a disaster-related clause in the trade deal due to the outbreak.

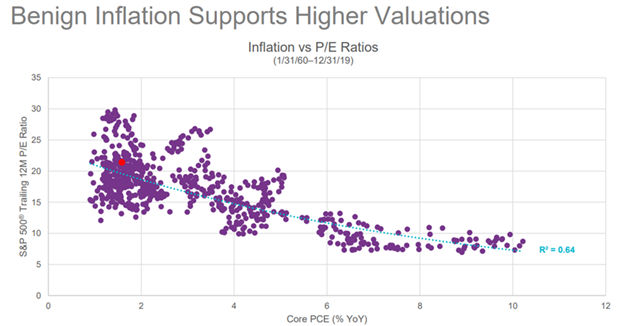

Chart of the week

Interesting regression line forms when you chart PE’s & Inflation over the last 60-years. Since we have been in this low inflation environment for a while now, most of the recent data points are to the left of the chart. There is a wide range of PE’s are the current level of inflation. The numbers range from just under to 15x PE to up to 30.0x (think tech bubble). At the current PE we seem to be right in the middle of where valuations have found themselves at this level of inflation. Maybe a little to the high-end.

Disclosure

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-948877