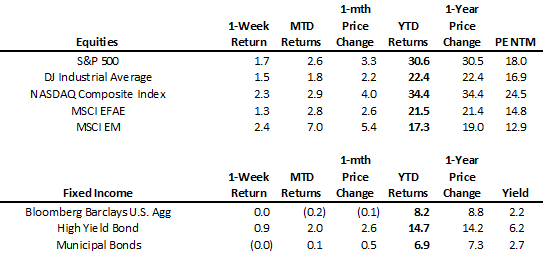

Market Summary

Top Market News

China consultancy says Beijing can fulfill $40B US ag purchase pledge

Reuters noted that JCI, China’s top agriculture consultancy, said on Friday that China can fulfill its pledge to purchase more than $40B of US ag products a year under the recently agreed phase one trade deal between the two countries. It estimates that China can purchase a total of ~$41.3B worth of US farm products annually, including ~$18.7B (45M tons) of soybeans. JCI said its projections were based on a “careful study” of China’s import volume of US farm products in the past and assume favorable weather and pricing throughout. There has been a lot of skepticism in the press about China’s ability to hit the aggressive targets highlighted by the US. A Bloomberg report earlier this week said China may look to re-route trade from Hong Kong to help.

House passes USMCA as expected

The House of Representatives voted 385-41 to pass USMCA agreement, receiving bipartisan support as expected. Treasury Secretary Mnuchin said earlier that the agreement will add 0.5% to GDP growth (CNBC). Politico noted that vulnerable House Democrats are pushing Senate Leader McConnell to push a Senate vote up to this year. McConnell previously said Senate would not consider the bill until after impeachment trial in January. Separately, Reuters, citing Congressional Budget Office (CBO) estimates, earlier reported that President Trump’s NAFTA rewrite will cost automakers nearly $3B more in tariffs over the next decade for cars and parts that will not meet higher regional content requirements.

Sweden exits negative rates policy by hiking key interest rate to 0%

Are we seeing a shift away from negative rates? Rates are not moving dramatically higher but the negative rate experiment could be over.

As expected, Sweden’s Riksbank hiked its key deposit rate to 0% vs (0.25%), ending a five-year period with negative rates policy. Statement said today’s rate hike in line with October assessment and forecast for repo rate unchanged and expected to remain at 0% in the coming years. Noted inflation has been close to target of 2% since start of 2017 and conditions are good for inflation to remain close to the target going forward. Added similar to economies abroad, Sweden has entered a phase with lower growth and inflation has risen to just under 2% after a decline during the summer. Argued that the domestic slowdown is occurring after several years of high growth and strong labor market, and means Sweden is going from stronger cycle to normal. Reiterated QE of SEK45B, with effect from July 2019 to December 2020.

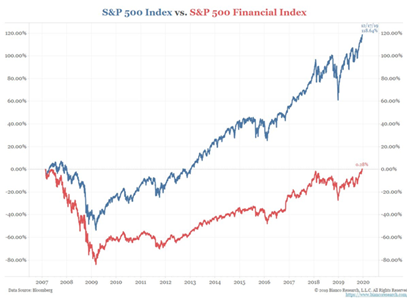

Chart of the Week

While the S&P 500 entered a new secular bull market in 2013, the Financials sector of the S&P 500 just got back to the ’07 peak yesterday. It has taken 13-years for the sector that was the main driver of the financial crisis to claw its way back. Interesting it took the NASDAQ almost that same amount of time after the tech bubble (2000-2014) before it reached new highs. Are financials about to enter a new bull market? They do have the cheapest valuation from a PE standpoint but interest rates will have a lot to do with the move from here.

Disclosure

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-930098