Market Summary

Top Market News

Per the Wall Street Journal, Expectations for Volatility Near Lowest Levels Since 2018

The Cboe Volatility Index, or VIX, finished Wednesday at 11.75. That was just a hair above where it ended Tuesday, which was its lowest closing level since Aug. 9, 2018, according to Dow Jones Market Data. While it is an imperfect predictor of future stock volatility, some analysts have found a reason to worry about the VIX’s recent decline, questioning whether it points to excessive complacency among investors.

Stronger durable goods orders highlight positive data

October durable goods orders up 0.6% m/m vs consensus -0.5% and September’s revised -1.4% (was -1.2%). Orders ex-transportation up 0.6% vs consensus of 0.2% (prior month -0.4%, revised lower from -0.1). Core capital goods orders (non-defense, ex-aircraft) rose 1.2%. Consensus fell in a range of -0.2% to 0.2%. The September reading was -0.5%, revised up a tenth. Initial jobless claims came in at 213K, below 223K consensus and down from the prior week’s revised 228K. Four-week average now 220K. Q3 GDP was revised to an annualized 2.1% q/q rate from the 1.9% reported last month on stronger investment and consumption.

China industrial profits fall sharply

Industrial profits dropped 9.9% y/y in October, following a 5.3% fall in the prior month and marked the biggest decrease since Jan-Feb. Took the YTD total down 2.9% (weakest since April), weighed down by weakness in manufacturing (auto sector remains a key driver) and state-owned enterprises. Private sector and small business earnings continued to grow moderately at a steady pace. Average operating income margins edged lower. Takeaways reinforced bearish narrative on China’s fundamentals. Reuters highlighted waning profitability aligns with sustained drops in producer prices and exports and underscoring slowing growth momentum.

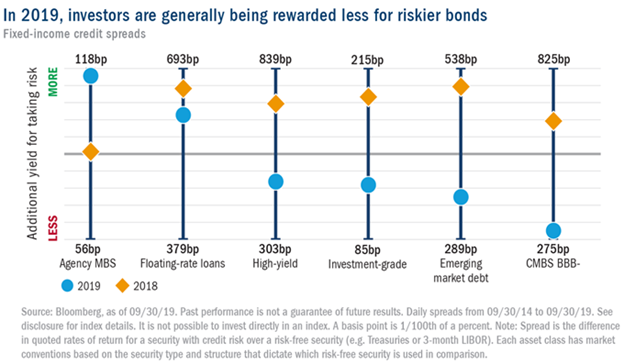

Chart of the Week

Much like stocks, bonds are positioned almost in the exact opposite manner vs. this point last year. In areas like High Yield, EM Debt, and CMBS you are not getting paid much at all to take credit risk. As you know, based on recent trades we have made, one area we really like heading into 2020 is Mortgage-Backed Securities (MBS). You can see below it’s the best-positioned area of fixed income from a risk/reward standpoint. You are getting so much more additional yield per level of risk today vs. last year and vs. all other areas of fixed income. for a number of years. Again, this points to the lack of imbalances in the financial system today.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-922035