Top Market News

US-China trade deal attracts lots of skepticism

This week’s signing of US-China phase one trade deal (text) has dominated the headlines. There has been a lot of discussion about the deal’s shortcomings, particularly in terms of leaving ~$360B of tariffs in place (WSJ, FT) and not addressing difficult structural issues like industrial subsidies, “Made in China 2025” and Huawei (BBC). Multiple reports have continued to highlight skepticism about China’s ability to hit aggressive purchase targets (Bloomberg), particularly given the “market condition” caveat (Reuters). In addition, while the US side has touted the enforcement mechanism, it could also trigger China’s exit (Reuters).

NY Times Upshot column noted that the US-China trade reprieve was bound to underwhelm following two years of rapidly escalating rhetoric and tariffs, along with the accompanying concerns about a more structural decoupling between the world’s two biggest economies. However, argued that the deal is still a blueprint for progress. Pointed out that companies that do extensive business in China now have a bit more uncertainty. Also noted deal improves IP protections while not undermining China’s ability to compete in advanced industries. In addition, deal buys time for all parties and shows US and China can achieve basic steps of deal making, building trust and respecting red lines.

Housing starts beat, hit 13-year high

December housing starts increased 16.9% m/m to a 1.608M SAAR, ahead of a 0.5% gain to a 1.379M consensus. November revised higher by 10K to 1.375M. Print was highest since Dec-06, largest percentage gain since Oct-16. Building permits light, falling 3.9% m/m to a 1.416M SAAR, missing 1.465M SAAR. Single family permits down 0.5%, breaking seven-month streak of gains. Extends recent string of solid housing data, including yesterday’s NAHB housing market index report, which fell one point m/m to 75, still near highest level since 1999. Other data today include Michigan consumer sentiment (10 ET). Expectation for a slight 0.1 point decline m/m to 99.2.

China GDP in line, activity data beat

Q4 GDP growth was steady at 6.0% y/y, matching expectations. 2019 GDP expanded 6.1% — also in line though still the weakest in 29 years — following 6.6% in 2018. Affirms Vice Premier Liu He’s earlier remark that annual growth would be above 6%. While this was within the government’s 6.0-6.5% target range, consensus looks for further deceleration to 5.9% in 2020, already posing downside risks to the government’s expected target of around 6%. Meanwhile, monthly activity data were firmer than expected. Industrial production rose 6.9% y/y in December, above consensus 5.6%, and follows 6.2% in the previous month. Fixed asset investment grew 5.4% YTD vs consensus 5.2%. Retail sales were up 8.0% vs consensus 7.9%.

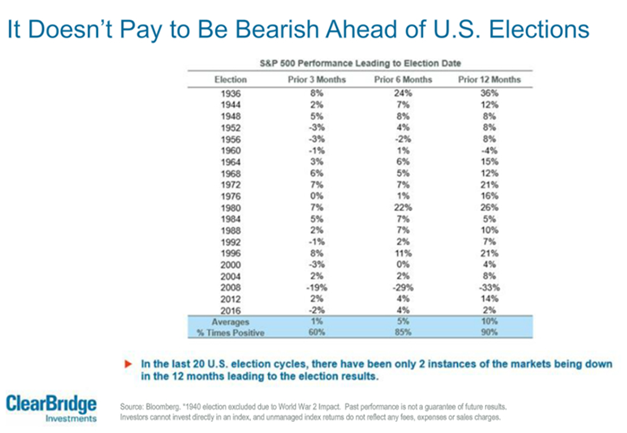

Chart of the Week

The upcoming US presidential election in 2020 has many clients asking about portfolio positions amid political uncertainty. The below table from Clearbridge Investments provides great data on US stock market returns ahead of US elections. The data shows that there have only been 2 instances in the last 20 election cycles when the market has been negative in the 12 months going into an election. Those occurred in 1960, and 2008. Returns are positive a majority of the time and when they are not positive it was because the fundamentals are driving markets not speculation around the election’s outcome.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-939754