Written by: Sam Shepherd, Wealth Advisor & Portfolio Manager

U.S. Gross Domestic Product (GDP) shrank for a second quarter in a row as the measure of broad economic activity fell at -0.9% annualized. The first quarter’s GDP contracted at -1.6%. The contraction in GDP for the second consecutive quarter came in below the average estimate from surveyed economists, who expected the economy to grow by 0.4%.

As we discussed in our piece earlier this week, expectations for a negative GDP print had gained momentum as many economists moved their forecasts into negative territory (although aggregate consensus was still positive). In the post, we also discussed how two consecutive quarters of negative GDP growth would likely intensify the narrative of an economic recession (after the report, the word “recession” could be found on the home pages of the WSJ, Bloomberg, Fox and CNN).

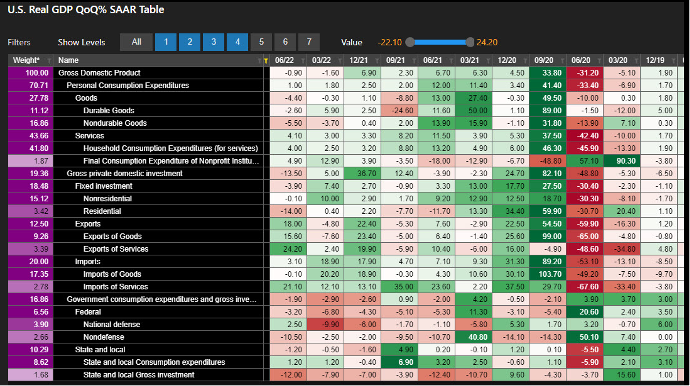

While the National Bureau of Economic Research (NBER) may still hold off on calling it a “Technical Recession” given their qualitative and broad definition, the data does indicate that the U.S. economy is undoubtedly slowing. Many leading economic indicators in recent months have supported this trend. In the table below, we can see the breakdown of all components of GDP, and their impacts on last quarter’s economic activity. Four categories in particular stand out to us:

- Consumer spending on goods has seen a large drop as consumers have transitioned dollars spent to services as pandemic restrictions continue to be lifted.

- On the private consumer side, investment in residential declined as interest-rate-sensitive housing has been hurt by the Fed’s monetary policy (this includes construction on residential structures and remodeling expenditures).

- Private inventories also saw a large decline after booming in the second half of 2021 as inflation has hampered goods spending.

- Government spending as a whole also declined and negatively impacted GDP.

The decline in GDP has already started to filter through to corporate profits as we are witnessing this earnings season, and some softening in the labor market. During the Fed’s conference Wednesday, July 27 (after announcing another 75 basis point rate hike), Federal Reserve Chair Jerome Powell said:

“We think it’s necessary to have growth slow down. We actually think we need a period of growth below potential in order to create some slack so that the supply side can catch up. We also think that there will be, in all likelihood, some softening in labor market conditions.”

Jerome Powell, Chair of the Federal Reserve of the U.S.

Based on this sentiment, and the Fed’s heightened focus on combating inflation, we believe that the slowdown in GDP is unlikely to move the Fed off their tightening path.

The macroeconomic environment is a key input to our investment process. We continue to assess the fast-moving developments as we move through this unique business cycle and use the data to inform portfolio positioning. We encourage you to reach out with any questions you may have and we look forward to our next conversation with you.

Disclosures

The content is developed from sources believed to be providing accurate information.

The economic forecast set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05309796