by: The Shepherd Investment Team

At Shepherd Financial Partners, the cornerstone of our investment philosophy is risk management. We continuously ask: what is risk in the context of your portfolio? The SEC defines risk as the degree of uncertainty and/or potential financial loss inherent in an investment decision. When volatility and uncertainty enter the market, we have more and more conversations about risk in your portfolio. Therefore, this brings up an important question, are investment risk and volatility the same? We would argue they are not the same and would like to address how we approach risk and volatility.

We view risk as the potential for permanent financial loss incurred by an investment. While volatility is the fluctuation of an investment’s value (which happens daily in public markets), a permanent loss occurs in three primary scenarios:

- An investment is sold at a loss, thereby locking-in a decrease in invested principle.

- An investment permanently lost its value (generally through default or fraud).

- Leverage is used by the investor, leading to default.

3 ways to combat scenarios of permanent loss

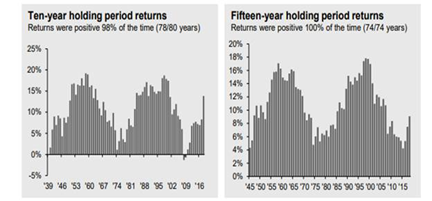

1. Building a portfolio around your time horizon: History has shown that when it comes to investing, time horizon is your friend. Building a portfolio based on your time horizon and distribution needs is imperative to combat the risk of forcing a liquidation at inopportune times. In Chart 1 below, we can see that since 1930, returns were positive 98% of the time when equities were held for 10 years. When you look at 15-year holding periods for equities, returns were positive 100% of the time going back to 1930. As your time horizon shortens, the likelihood of experiencing negative returns in the equity markets gets higher. Therefore, as your time horizon shortens, we will seek to build a diversified portfolio that contains assets with less price volatility, thereby reducing the risk of being forced to liquidate at a loss when you need to distribute.

Chart 1

2. Using diversification to combat single investment defaults: We are strong believers in the virtues of diversification as a tool to manage risk. Throughout the history of capital markets there have been many investments that have permanently erased their value due to either default or fraud. By creating a diversified portfolio with many underlying investments, you avoid “putting all of your eggs in one basket.” While default rates for corporations in the US are currently low (2.1% in 2018 according to S&P Global), they fluctuate throughout history, and it is beneficial to prepare for tight economic times by diversifying your portfolio. If a single investment in your portfolio defaults, consider the impact of a more diversified vs. concentrated position on your broader portfolio.

| Hypothetical $100,000 Portfolio | Investment is 1% of portfolio | Investment is 25% of portfolio |

| Permanent Loss Due to Default | -$1,000 | -$25,000 |

Diversification is also important in guarding against corporate bad actors as was seen in cases like Enron. Many Enron employees had highly concentrated positions in Enron’s stock through employee stock purchase plans. By not diversifying away from this single position, investors were left exposed when the eventual fraud was uncovered.

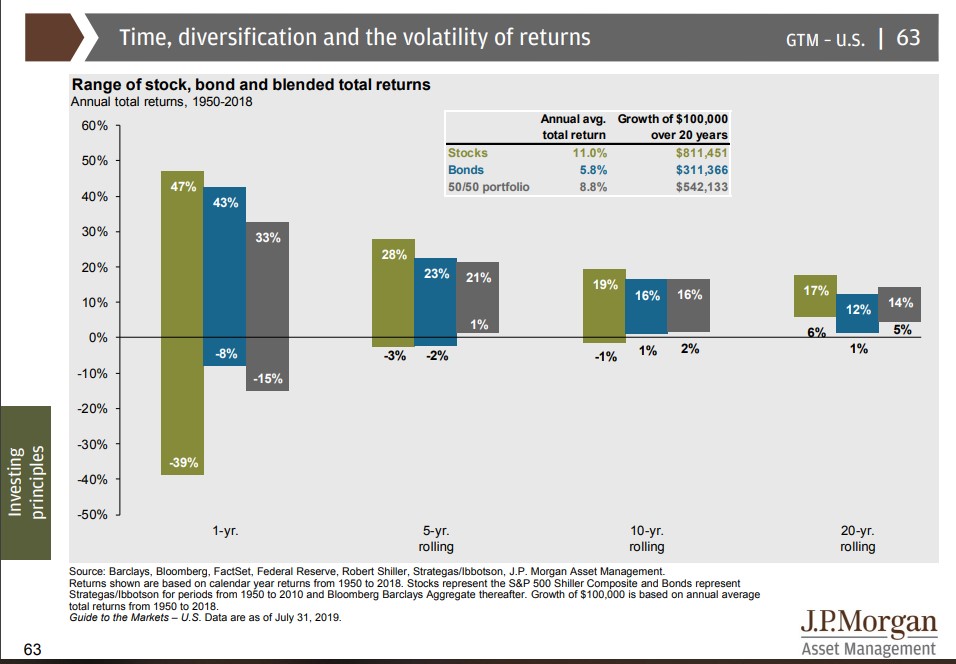

We also seek to diversify across asset classes to dampen risks associated with single areas of the market. As seen in Chart 2, simply diversifying across equity and fixed income asset classes can help to dampen losses over multiple time periods.

Chart 2

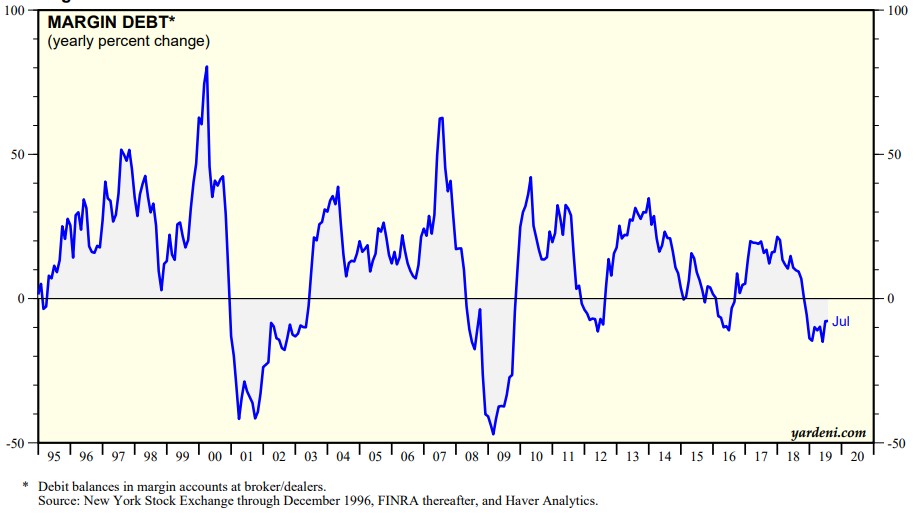

3. Not using leverage or debt to purchase investments: Finally, a significant source of loss for investors over time has been the use of leverage to purchase investments (typically through margin loans in the public markets). Leverage magnifies the volatility of an investment to both the upside and downside, and therefore can create significant risk, and lead to potential for an investor to default. In our studies of past market cycles, the most pronounced market drawdowns were influenced significantly by investor leverage:

- Per the BBC, by the late 1920’s, 90% of stocks were being purchased using margin. This created a far more devastating crash as investors defaulted on their margin loans, erasing value[1].

- In chart 3 below, you can see the rapid increase in margin debt (measured in year over year percent change) during the periods preceding both the 2000 and 2008 crashes.

Chart 3

On the use of margin debt to purchase securities, Warren Buffett recently said:

“Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions.”

We believe risk is necessary to meet long-term goals

The conversation of risk begs the question: why not use cash to combat permanent risk of financial loss? As a financial planning-centric firm, one of the primary risks that we seek to guard against is running out of money during retirement. For the long-term investor, cash may pose more risk than equities or fixed-income (for more detail on this, please see our recent piece entitled “Investing in a Low Interest Rate World”). Appropriately managing and allocating to risk assets based on your long-term goals and time horizon is imperative to outpace inflation and keep up with retirement withdrawal needs. Warren Buffett again provides valuable commentary on the differences between risk and volatility when it comes to cash:

“Stock prices will always be far more volatile than cash-equivalent holdings. Over the long term, however, currency-denominated instruments are riskier investments – far riskier investments – than widely-diversified stock portfolios that are bought over time … That lesson has not customarily been taught in business schools, where volatility is almost universally used as a proxy for risk. Though this pedagogic assumption makes for easy teaching, it is dead wrong: Volatility is far from synonymous with risk.”

Summary

As long-term investors focused on your financial goals, we do not view risk and volatility as synonymous. We see three primary strategies for avoiding the risk of permanent loss of capital: 1. Building a portfolio appropriate for your time horizon, 2. Diversifying across holdings, and 3. Avoiding the use of leverage to purchase investments. Rather than avoiding risk, we seek to best understand the pricing of risk, and allocate your portfolio accordingly. We then seek to take advantage of dislocations that may arise from volatility, viewing these short-term movements in value as a source of future returns. As always, please reach out to us with any questions about the topics discussed in this paper. We look forward to discussing with you.

Download printer-friendly version here.

Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult me prior to investing. All performance referenced is historical and is not a guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The hypothetical example provided is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing. The hypothetical rates of return reflect reinvestment of dividends.

All investing involves risk including loss of principal. NO strategy assures Success or protects against loss.

Stock investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

[1] Source: BBC