by: Brian Davies, CFA – Chief Investment Officer

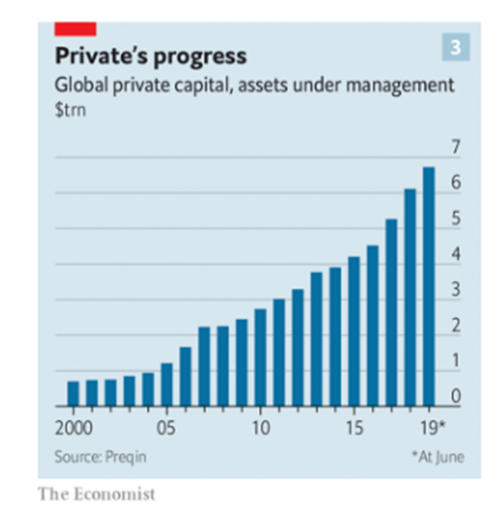

One of the major developments over the past decade in capital markets is the rise in the popularity of private markets. These include private equity, private debt, and venture capital. In a recent paper, Goldman Sachs described the growth in private markets as a “search for smoothness.” Trillions of dollars have flowed to these asset classes (See Chart 1 from The Economist) following the financial crisis in hopes of high returns with minimal volatility (hence the smoothness). We at Shepherd Financial Partners believe the dramatic increases in assets under management in an area like private credit has changed some of the dynamics of the traditional business cycle and helped prolong the current cycle. In this piece, we will define what private credit is, how it might be influencing the current economic cycle and how to think about future returns in the asset class.

Chart 1: AUM of Global Private Assets:

Private credit is lending done by institutional investors like endowments, foundations, and sovereign wealth funds. These groups invest in funds that pool money to lend to private, middle-market companies. Middle market companies are generally businesses with revenues between $10 million and $1 billion. However, these funds have recently been lending to companies with sales north of $1 billion. The attraction of private credit for the institution is twofold. One, there is the potential for them to earn a higher yield than might be available today in public bond markets. Two, because these funds are private, they do not have to mark the value of the loans on a daily basis as the public markets do. Thus, dampening the price volatility of the loans and funds values.

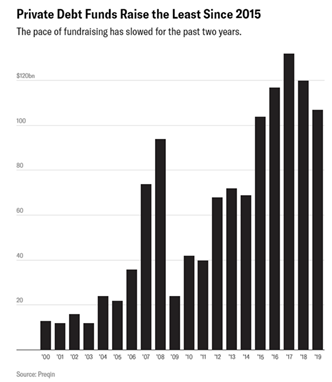

The rise of private credit is in direct response to what happened to the financial system post the great financial crisis. Regulators have forced banks to hold more capital relative to their loan books and limit the amount of risky lending they do. Private, middle-market companies that sought growth capital had to turn to other alternatives. Private debt has seen tremendous growth as the asset class willing to fill the void left by banks taking a disciplined approach to lending. According to Preqin, the size of the global private credit market reached $769 billion in 2018. We have seen over $100 billion inflows into the space for each on the last five years ending 2019 (Chart 2). With this trend, the private credit market will most likely pass $1 trillion sometime in 2020.

Chart 2: $100b of Fund flowing into the category per year since 2015

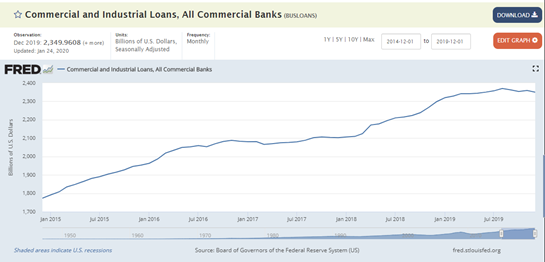

By approaching and soon passing the $1 trillion-mark, private credit has become a major competitor to banks in lending corporations. In 2000, when private credit was only around $42 billion in size, the category was only about 4% of the size of the commercial and industrial lending (C&I) done by U.S. commercial banks. Fast forward to today, after annualizing asset growth of 17% for 20-years, the private credit markets are an amazing 43% of C&I lending at U.S. Commercial Banks ($1tr est. /$2.35tr C&I lending). The industry is clearly a force to be reckoned with and has only been gaining more and more influence over the years.

Chart 3: Commercial & Industrial lending at U.S. Commercial Banks:

As the market share of lending has shifted, the reaction mechanism to this development through the economic cycle has changed. Credit creation this cycle is being driven by private funds that are not Net Interest Margin sensitive (NIM) but rather are yield sensitive. Bank lending is the opposite. Bank lending is a spread (margin) business. When the spread narrows (think flat or inverted yield curve), banks have traditionally slowed lending. Today, with the institutional investor commanding more and more of the corporate lending market, a flat or inverted yield environment most likely has not impacted their desire to lend money. Again, these investors are yield focused and less worried about short-term spread (margin) activity. We believe this could be one reason why this cycle at least, the yield curve, has been less impactful than in past cycles. Private lending activity has grown steadily this cycle despite the narrowing of traditional measures of profitability in lending.

While we are not saying we are on the cusp of a structural change in the global financial infrastructure, we do feel understanding the changes that are taking place and seeing them in light of what macro-indicators are signaling, can better educate us about where and how to take risk in the capital markets. The popularity of private credit over the last five years worries us. We are concerned the underwriting in the face of that growth could be compromised as funds rush to put cash to work in new deals. Today, we have avoided the private credit markets when we consider alternative investments. In public fixed income markets, we continue to take a negative view on credit. This has as much to do with price as it does with concern around any coming adverse credit event. Credit spreads today are at multi-decade lows and don’t represent attractive risk-adjusted returns. In fact, some have argued the pricing of credit today factors in zero credit events (i.e. no credit losses) in the near future. Faced with such an optimistic view on credit, and high valuations, we feel it is prudent to remain cautious on credit markets and be patient for better investment opportunities.

Disclosures

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-948657