Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- November saw a surprising upward trend in markets.

- The unexpected nature of this reversal shows once again that “time in the market” is more beneficial than attempts to “time the market.”

Market Recap:

November’s markets had a strong reversal from the prior three months of weakness. The strongest performer of the group was public Real Estate, which was up 12%. Next in line were global equity markets with international and domestic equities from small to large cap returning high single digit gains. International developed and US Equites returned over 9%, while Emerging Markets trailed closely with an 8% return. Also bucking the downward trend was fixed income. The Bloomberg US Aggregate had its best monthly of the year, returning 4.5% and pushing the YTD performance into positive territory. The only laggard of the group was commodities, which was down 2.5%. November served as a major reversal of the late Summer early Fall downward trend.

Was this expected? Lets discuss.

Chart of the Month:

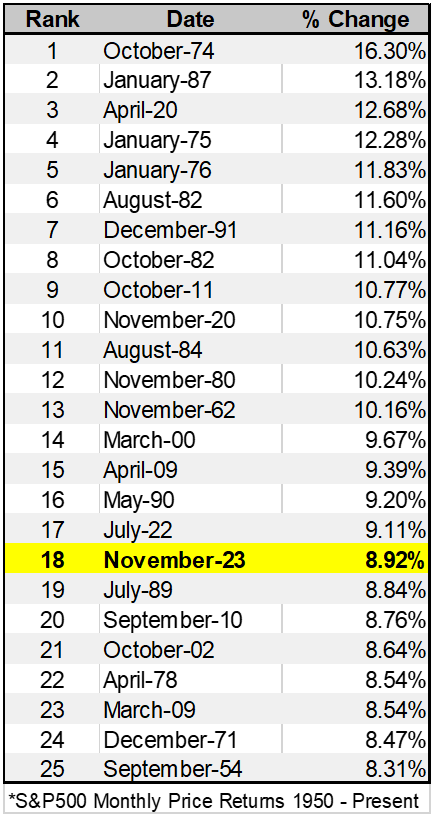

The table below displays the top 25 price return months in S&P 500 history going back to 1950. Highlighted in yellow is November 2023 at the 18th highest monthly return for the S&P 500. Let’s dig deeper into the data to understand the context behind the move. Although the three months leading up to November were subpar and downward trending, we did not consider them to be extremely oversold. What we did see starting in November was an extreme move lower in interest rates from around 5% to 4.3%, stemming from easing inflation and expectations that the Fed may cut rates as soon as the first half of 2024. In addition, economic data has been cooling, which has led consensus to believe that a soft landing may be more possible than previously forecasted. Another contribution could have been seasonality headed into the end of the year.

All this to say, the rally was not one that could have been predicted and is the result of many different influences, not just one data point. So then why is this significant? We are constantly shown that “timing the market” is futile and “time in the market” has shown, time and time again, to produce a positive experience over time, which is an important factor in an individual’s financial plan.

As we often say, have a long-term plan and a balanced portfolio that fits your individual needs. Planning helps reduce uncertainty and can increase your experience as a long-term investor. Reach out to your Shepherd Financial Partners advisor to start planning today.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Source: Factset

Tracking # 489935-1