Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Over the past 30 years, the Fed has gone through five tightening cycles – each unique in its own right. This time around, inflation is in the spotlight. With 10 consecutive hikes starting March 2022 through May 2023, we now believe the fed will pause unless inflation continues to be sticky. Why?

U.S. labor and credit markets have been in a strong position after a quick recovery post Covid and continue to be on solid ground. However, there has been some concern in commercial real estate and other areas of the markets with rates at multi-decade highs. Regardless, U.S. inflation has come down from a more than 40-year high of 9.1% to about 4.9% currently.

We believe the Fed has learned from the mistakes of cutting rates too early post hike cycle like they did in the 1970s and 1980s, which means holding peak rates for some time is a real possibility. Unless problems in the banking space get more serious, the U.S. labor or credit market slip meaningfully, or the debt ceiling negotiations go south, we believe they will wait until inflation comes back a bit more to achieve their target of around 2%.

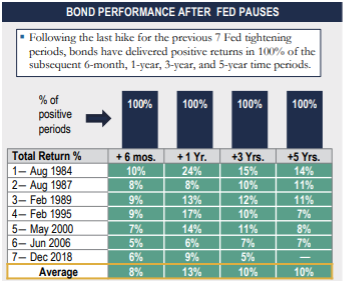

Let’s take a look at historical performance during and after hike cycles to understand trends. In Chart 1, you can see that following the last hike from the previous seven fed tightening periods, bonds have delivered positive returns (in the green) the subsequent 6-month, 1-, 3-, and 5-year periods.

Chart 1

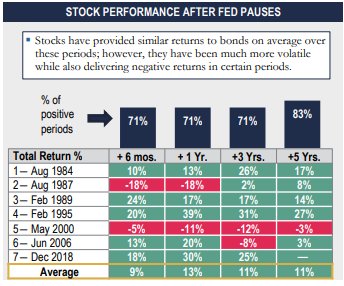

In chart 2 you will see that stocks followed the same pattern on average but with more volatility (red and green).

Chart 2

These charts show that typically there are benefits to staying invested and maintaining a balanced portfolio. Reach out to your advisor with any questions regarding your portfolio or your Shepherd Living Plan.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: PGIM Investments, as of 3/31/23. Bonds represented by the Bloomberg US Aggregate Bond Index and Stocks represented by the S&P 500 Index

Tracking # 438940-3