Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- Another strong month for the markets in March

- Strength was shown across asset classes, with commodities having the best month

Market Recap:

The markets in the month of March saw strong performances from all asset classes that we track. Surprisingly, commodities had the best month of the group, up 4.45%, but were still flat for the trailing 1-year performance. Continuing with the trend of the past 5 months, equities rallied again in March. However, the best performers this month from this group were U.S. Small Caps and International Developed Equities, both returning approximately 3.5%. This was followed by U.S. Large Cap Equities which were up 3.2% and Emerging Market Equities which were up 2.5%. Emerging Markets got a bit of help from China, which had a positive month. Fixed Income and Public Real Estate, both of which correlate closely with interest rates, were positive with performance ranging from 1% to 2%. This was driven by a slight movement down in rates for the month, yet rates are still volatile. Overall, asset class performance in March was headed in the same direction as the previous few, but with broader outperformance beyond the top U.S. tech companies.

Chart of the Month:

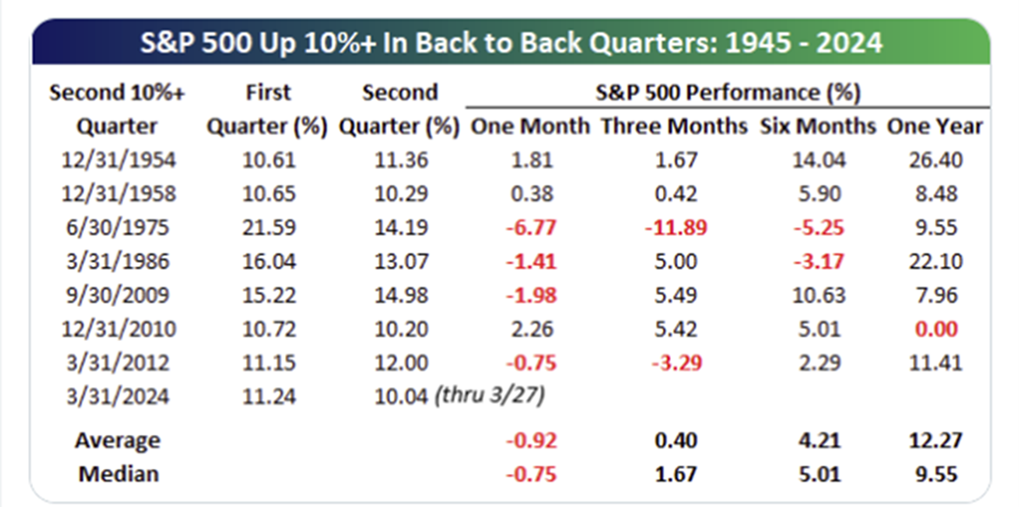

Source: @BespokeInvest

March’s Chart of the Month shows instances of back-to-back 10%+ quarterly returns for the S&P 500. Simply put, the chart exhibits any time the S&P 500 has been up 10%+ for two consecutive quarters. As you can see this phenomenon does not happen often going back to 1945. In fact, this has only happened eight times, including this 6-month period ending March 31, 2024. Given this, one may think the market has run up and may run out of steam. But on the contrary, the data shows that on average the S&P 500 is up the following 3-month, 6-month, and 1-year periods, as presented on the right side of the chart. You may notice that the 1-month average is negative, but not by much. We attribute that to short-term noise and trading rather than long-term investing. As a long-term investor, one may want to focus on the 1-year return figures which show on average 12%+ return after a phenomenon like this. In conjunction with fundamental economic indicators, we often consider indicators like these to help guide our long-term strategic positioning for investors.

What does this mean for you?

Have a long-term plan and balanced portfolio that fits your individual needs. This type of planning helps eliminate the uncertainty around situations like this and can increase your experience as a long-term investor. If you have any questions, please reach out to your Shepherd Financial Partners advisor.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Source: @BespokeInvest

Tracking #: 561792