Written by: Sam Shepherd, Wealth Advisor & Portfolio Manager

We are entering a busy week for economic data in the US with both the Federal Reserve’s rate decision and the release of second quarter Gross Domestic Product (GDP) numbers.

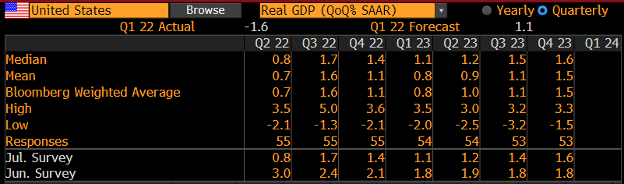

An increasing number of economists are forecasting a negative quarter-over-quarter change in Q2’s GDP report. In July, a survey of 55 economists, Bloomberg forecasted an average GDP growth rate of 0.7%; this is down from an estimate of 3.0% from the same economists in June (see exhibit 1 below). The declining growth expectation is driven by many poor economic indicators that have come through over the last three months. While the consensus average is still positive, we want to discuss the possibility of a negative data readout and why that could be significant.

A recession is often the narrative tied to two sequential declines in GDP. Q1 of 2022’s GDP report was -1.6%, so a negative report in Q2 will likely spur countless headlines about a “Technical Recession” underway. However, this is a misnomer that many use to generalize a recession. Let’s dig into how the NBER (National Bureau of Economic Research – the organization that officially classifies recessionary periods) defines a recession (a bit broader reaching than just GDP).

The NBER defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” The NBER focuses on economic indicators like real personal income, employment, personal consumption, retail sales, and industrial production. They look to see broad-based economic declines (not limited to a single sector) that impact both industry and the consumer via consumption and employment activity. The narrative that is likely to surround a second quarterly drop in GDP will be “recession,” but with unemployment at 3.6%, industrial production still above recessionary levels, and retail sales still growing, we may not see a “technical recession” call just yet.

Exhibit 1

What would a further slowdown in GDP mean? While this does not signal a technical recession as many narratives may suggest, it does indicate a broad slowing of the economy by measuring the following components:

- Private consumption

- Gross Private Investment

- Government Investment

- Government Spending

- Net Exports (Exports – imports)

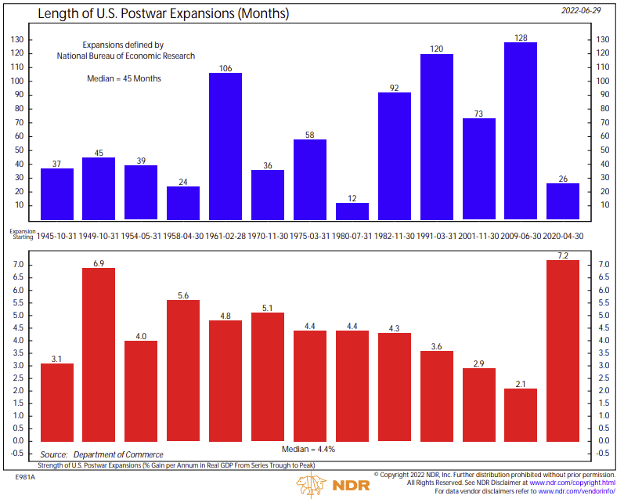

Assessing GDP trends and other economic indicators is vital to our investment process as they help us set appropriate asset allocations for all client portfolios. As we have discussed in recent research and communications, many economic indicators are slowing after robust post-pandemic growth. However, these trends continue to inform our investment decisions. Per Ned Davis Research (see exhibit 2), if we enter a recession in the near term, the current economic expansion will be the shortest in about four decades and well below the median of 45 months. Speed has been one of the hallmark features of the post-COVID economic expansion and many expect an ensuing recession to follow in this same trend.

As we move through the data this week, we look forward to keeping you updated on important developments. As always, please reach out to our team with any questions you may have.

Exhibit 2

Disclosures

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05308570