Federal Funds Rate Increase

The latest news from the Federal Reserve

As of the 3/16/22 FOMC meeting, the US Federal Reserve has increased their Fed Funds rate by 0.25% to a range of 0.25%-0.50%. This move higher was widely forecasted by fed officials and the market, but represents the first interest rate increase since December 2018. Chairman Powell’s remarks were largely focused on a strong commitment to address the risks of inflation present in the US economy.

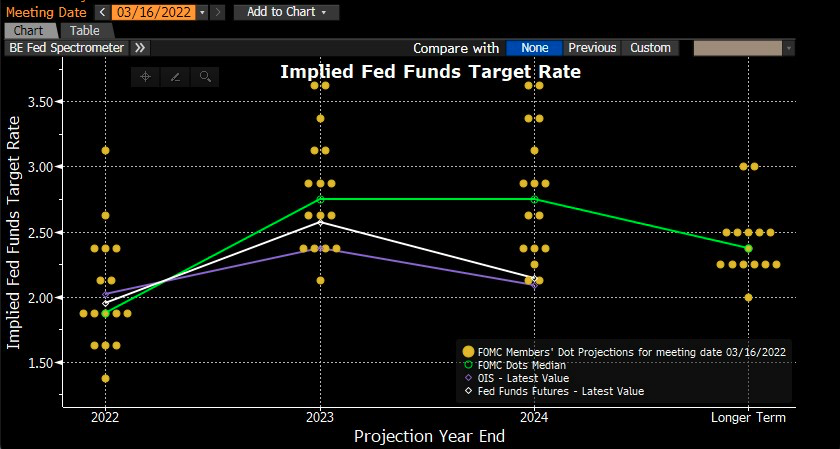

The highly watched “Dot Plot” (which charts Fed Officials’ median projection for the target rate) indicated that several more rate hikes are coming in 2022. The consensus mirrored market expectations of a Fed Funds rate ending 2022 at about 1.9%. In his remarks, Chairman Powell indicated the Fed would be “nimble” in their path given the many uncertainties including continued Covid-19 lockdowns globally and the Russian invasion of Ukraine.

The Fed also outlined plans for its balance sheet runoff. Currently, the Fed’s balance sheet stands at about $8.9 trillion and the central bank expects to start reducing its balance sheet starting in May. Purchases of treasuries and mortgage-backed securities by the Fed have stopped as of this month. The Fed will likely provide more detail for its balance sheet runoff plan at the May meeting. The massive balance sheet increase was a result of the Fed purchasing bonds to provide support to the economy during the Covid-19 recession. The Fed’s decision to move on from this purchase plan demonstrates their pivot from an accommodative stance to a goal of inflation control.

As a result of current economic conditions, the Fed increased their 2022 inflation expectation to 4.3% and reduced their GDP outlook from 4% to 2.3%. The need to control price increases has taken center stage and the Fed has indicated tighter monetary policy will be needed to address the issue.

US stocks initially fell on the announcement, but rebounded to intraday highs as the market digested the conference call and outlook for policy changes. Additionally, the spread between 2-year and 10-year US treasuries dropped back to lows of the year (see below). A flatter yield curve is generally indicative of slower future economic growth.

The major takeaway from the conference call was the Fed’s commitment to containing inflation by tightening monetary conditions.

Final Thoughts

The business cycle is core to our investment process, and a trend towards tighter monetary conditions can often indicate a shift in the business cycle. We continue to make adjustments to asset allocations to reflect the changing business cycle and, most importantly, align portfolios to our client’s long-term objectives.

Please reach out to our team with any questions and we look forward to hearing from you.

Disclosures:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All indices are unmanaged and may not be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performances not indicative of the performance of any investment.

Past performance is no guarantee of future results.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

This information is not intended to be a substitute for individualized legal or tax advice. Please consult your legal and/or tax advisor regarding your specific situation.

Tracking #: 1-05257572