Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- Equity markets showed strength through the month of June. This included both U.S. and international equities.

- Bonds were the laggards.

- What does this mean for you? Have a long-term plan and balanced portfolio that fits your individual needs. This type of planning helps eliminate uncertainty and can increase your experience as a long-term investor.

June 2023 Overall Market Recap:

The markets in the month of June saw strength off the back of many important economic releases. Specifically, inflation came in at 4.05%, its lowest level in two years. In addition, the Fed stress test on the 23 major financial institutions showed that all would be able to withstand a severe global recession. Lastly, we had solid consumer confidence figures and new home sales. All this data proved to be a catalyst for risk-on assets during the month. Leading the pack was US equities with international equities close behind. We also saw a rebound in real estate and commodities, which were down meaningfully the previous month. The laggards of June were mostly fixed income where we saw the Bloomberg US Agg slightly down and High Yield and Investment Grade Corporate slightly up.

As mentioned above, global equities rallied greater than anticipated, except for China within EM, which has seen ongoing weakness. In the US, robust economic conditions may be supporting the equity rally we have seen, despite hawkish monetary policy. Within fixed income, higher rates are to be expected over the next few months with the Fed signaling potentially two more rate hikes.

Chart of the Month:

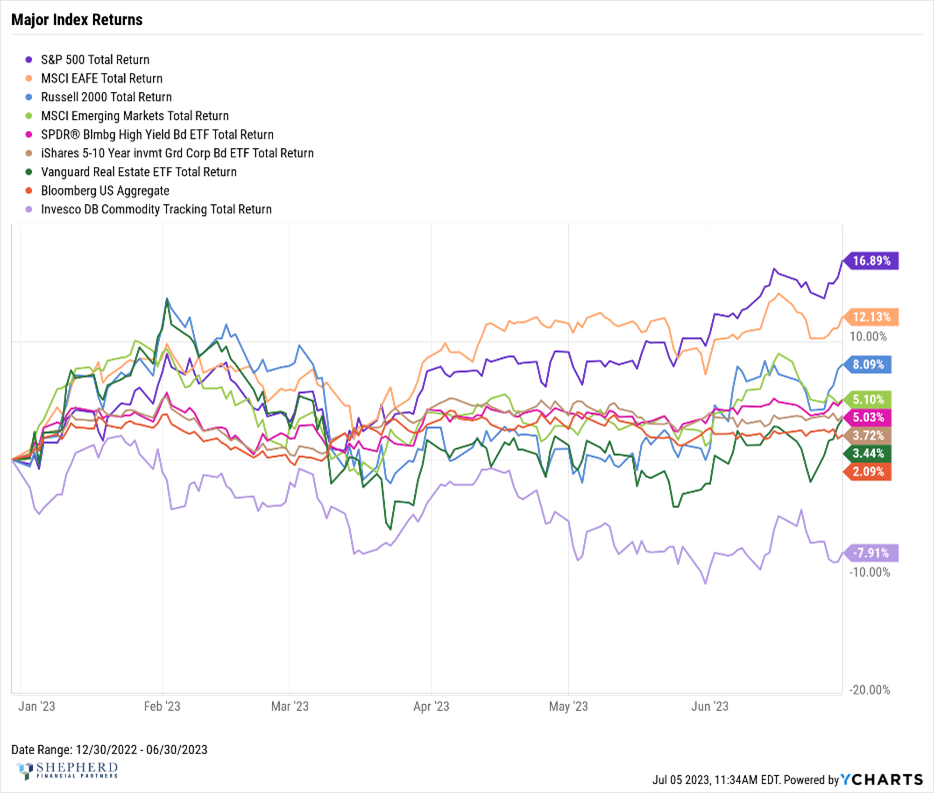

As shown in this year-to-date chart of major index returns, equity and fixed income markets have rallied off the 2022 lows with the S&P 500 up 16.89% in that time followed by the international developed MSCI EAFE index up 12.13%. Fixed income is also higher, starting with high yield up 5.03% and the Bloomberg US Agg up 2.09%. Although we have seen some narrow leadership YTD within the US tech space, June provided a more robust rally in risky assets such as small cap and international equities. The laggard YTD has been commodities which is down 7.91%, but was coming off an excellent run in 2021 and 2022.

The YTD story has been unique with a banking crisis averted, successful debt ceiling negotiation, high inflation, and rates at the highest levels in almost two decades. Nevertheless, market performance has been solid and economic data is still strong. What does this mean for investors? Have a long-term plan and balanced portfolio that fits your individual needs. This type of planning helps eliminate the uncertainty around situations like this and can increase your experience as a long-term investor.

If you have any questions, please reach out to your Shepherd Financial Partners advisor.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: Y-Charts and FDIC

Tracking # 454326-3