Written by: Brian Davies, Chief Investment Officer

July Jobs Report:

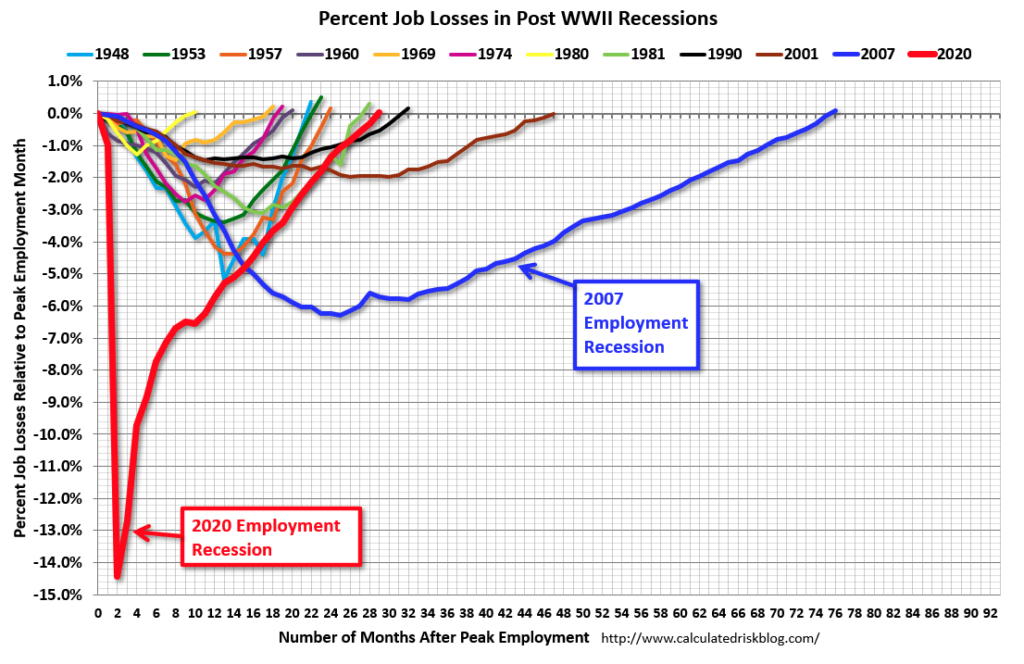

The jobs report came in well above consensus and signaled a continued robust labor market in the U.S. Nonfarm payrolls increased by a whopping 528k jobs in July vs. a consensus of 250k. The unemployment rates decreased to 3.5% vs. a consensus of 3.6%. Wages came in strong hourly earnings up 5.2% year over year. As the chart below shows (per CalculatedRiskBlog.com), we have now clawed back all the jobs lost from the onset of the pandemic in February 2020. The quick bounce back in jobs this cycle (29 months) is dramatically different than the last cycle where it took over six years (78 months) to claw back the jobs lost post the great financial crisis.

The strong job report for July will keep the Federal Reserve on track for interest rate hikes through the back half of this year. The odds have now shifted to favor 75bps (3 hikes of 25 basis points) raise by the Fed when they meet again in September. Those odds were essentially zero one month ago. Recently the bond market was moving as if the Fed had turned dovish, but this data and recent Fed commentary proved that thought to be incorrect. While we might be closer to the end of this hiking cycle than the beginning, its clear from this data the Fed still has more rate increases in store through the end of 2022.

The macroeconomic environment is a key input to our investment process. We continue to assess the fast-moving developments as we move through this unique business cycle and use the data to inform portfolio positioning. We encourage you to reach out with any questions you may have and we look forward to our next conversation with you.

Disclosures

The content is developed from sources believed to be providing accurate information.

The economic forecast set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05312935