Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- Mixed results for the month of January, with U.S. Large Caps and Commodities up, and Small Cap and Emerging Markets down.

- The labor market was strong, continuing booming growth from 2023. This can indicate a strong economic forecast in the near future.

Market Recap:

The markets in the month of January had mixed performances across all asset classes. U.S. Large Cap equities were up 1.7%, but other parts of the equity markets, such as U.S. Small Cap and Emerging Markets—down 3.9% and 4.6%, respectively—did not fare as well. Commodities followed U.S. Large Cap’s positive performance, up 1.3%, after two negative months in a row, but are still struggling mainly due to the energy category. Fixed Income came in relatively flat after a strong finish to 2023. These moves were largely driven by investors’ increased certainty around rate expectations going forward.

Chart of the Month:

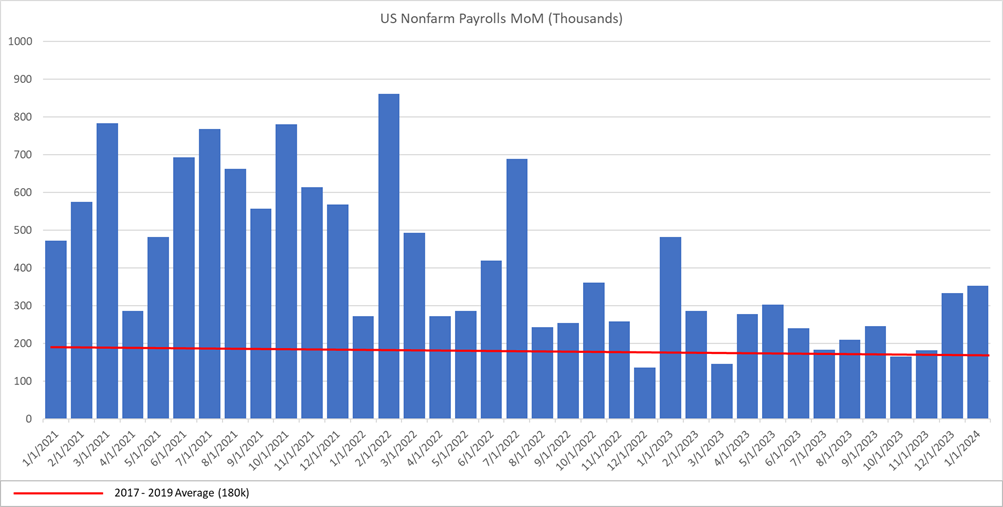

January’s Chart of the Month shows U.S. Nonfarm Payrolls on a month-over-month in thousands scale. This indicator is important because it helps gauge the strength or weakness of the labor market from the perspective of new additional jobs added. The red line is the average (180k) from 2017 – 2019, which is the period just before the COVID-19 pandemic. Looking at the data from 2021 to present, you can see we came out of the pandemic strong, adding many new jobs, but have since cooled off just a bit in 2023. Despite this, 2023 saw the fastest growing jobs market, minus the pandemic, since 1999. What is also important to note is that the past two readings are significantly higher than the 2017 – 2019 average.

Most economic forecasts predicted a recession in 2023, which we did not get. One main reason was that the employment picture is quite strong and is still trending even stronger. Typically, we see low or negative readings around economic downturns, but this has not been the case. The employment picture is a major indicator of how the economy is doing because we are a consumer driven economy. When individuals have gainful employment, they are more apt to spend money, stimulating the economy. U.S. Nonfarm Payrolls, along with many other labor market statistics, are an essential part of our process in determining the state of the economy. We use these indicators like these to help guide our long-term strategic positioning for investors.

What does this mean for you?

Have a long-term plan and balanced portfolio that fits your individual needs. This type of planning helps eliminate the uncertainty around situations like this and can increase your experience as a long-term investor. If you have any questions, please reach out to your Shepherd Financial Partners advisor.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Source: YCharts

Tracking # 541692-4