by: Brian Davies, CFA – Chief Investment Officer

Highlights

- Note this is part two of a series of reports where we discuss the reality of investing in a low-interest rate world.

- Interest rates are at multi-decade lows and we take a stab at examining why.

- When designing portfolios to address clients’ long-term withdrawal needs, historically low rates in bonds means allocations to stocks are higher than in the past decades.

- We see three reasons why rates are low and discuss each in this paper:

- The long-lasting impact of the financial crisis.

- Demographics and its impact on the demand for goods and investment.

- Productivity and the lack of it this cycle.

“Successful investing is about managing risk, not avoiding it.” –

Benjamin Graham

Lasting Impact of the Financial Crisis

In their book This Time it’s Different: Eight Centuries of Financial Folly, Carmen Reinhart and Kenneth Rogoff argue that after credit busts economic activity can be sluggish for a prolonged period of time as economic participant scars heal. This cycle seems to be falling right in line with the eight centuries of studies they discussed in their book. After growing leverage on their personal balance sheets significantly before the financial crisis, households have been deleveraging this cycle. Financial institutions have been forced, by beefed up regulation, to take less risk by deleveraging and keeping more reserves on hand relative to past cycles. This has resulted in the subpar credit growth this cycle and thus overall growth that is well below past cycles.

Monetary policymakers have decided one way to help offset this lower demand for credit is to lower the cost of it. Interest rates around the world have stayed lower for much longer than most experts had expected. The U.S. tried to normalize rates with nine hikes over the last few years but, the markets told them they went too far. Now they need to reverse course. Today, we have $16 trillion dollars in negative yield sovereign debt in the world. We think this is partly driven by investors’ appetite for risk as a result of a financial crisis hangover. The credit bubble popping is having a lasting impact on investor psychology. Investors continue to worry that the next financial crisis is around the corner. The stress of the financial crisis is still fresh in their minds. They seem to constantly look for ways to minimize risk. The desire for global investors to hold negative-yielding debt in light of their risk appetites has turned bonds into insurance products instead of income generators. You acquire a bond with a negative yield if you think in a period of market stress, that bond will go down much less than other asset classes. Thus, the insurance analogy. You are buying insurance against market volatility. We feel this type of attitude toward investing is a direct result of investors’ psychology after the Great Recession.

Demographics

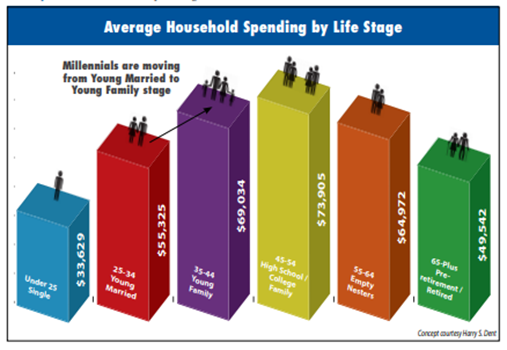

We have known for a long time now that current demographics trends are a net headwind for demand. The millennials and Generation Z’ers are larger demographic groups than the boomer generation today. However, their spending patterns are not to the point where they can offset the negative impact of the declining spending patterns on the part of boomers. Chart 1 from a recent Ned Davis Research report on demographics captures these spending patterns. The boomers are moving down the spending curve and are now all the way to the right of the chart. At some point, as the millennials move up and to the right the, net spending patterns will change for the better. For now, in the immediate future, the headwind will be in place. As a result of these changing and lower spending patterns on the part of boomers, we have seen less demand for things like credit, residential real estate and risk assets. This has had a big impact on growth in this cycle and likely will continue to cap growth into the future.

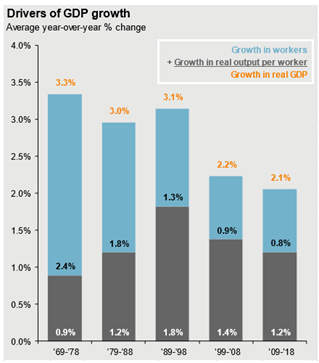

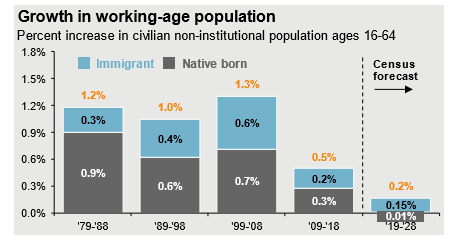

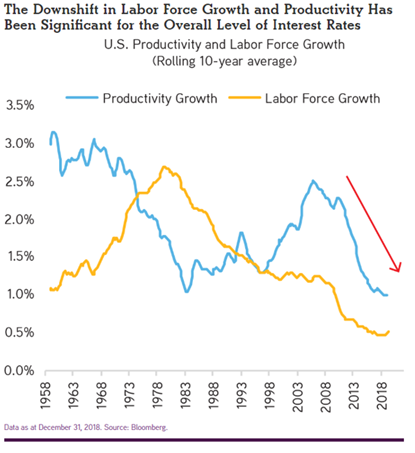

The basics of Gross Domestic Product (GDP) growth are growth in the workforce plus productivity of the workforce (discussion to come). The developed economic world is seeing a consistent decline in workforce growth. Chart 2, from J.P. Morgan, looks at these drivers of growth. The growth in workers in the U.S. has been declining since 2000, as boomers enter their retirement years. This will be a headwind for at least the next five years or more. Chart 3 shows this. The working-age population is expected to barely grow between now and 2028 (0.15%). This is the boomers leaving the workforce offsetting the millennials and Generation Z’ers coming in. Again, a headwind in the growth of U.S. workers. As an aside, Chart 2 shows the importance of immigration policy going forward. Rational immigration policy can have a big impact on future GDP growth by helping maintain a healthy growth rate in the working-age population.

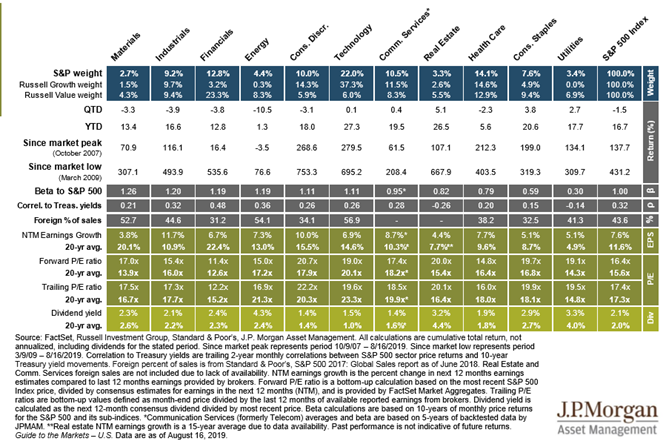

The growth in real GDP has fallen from 3.0% in the 1970s, 1980s, and 1990s to just about 2.0% today (Chart 2). This year we are running close to that 2.0% number. The recent trade rhetoric has the potential to move that near-term run rate below 2.0%. Again, Investors have reacted to this by pushing interest rates on risk-off securities (i.e. U.S. 30-yr Treasuries) to record lows. This also a trend based on demographics. Retirees are sensitive to risk assets drawn downs. They have an insatiable appetite for income or yield. They are pushing sovereign yields lower to protect against volatility and driving up the valuations of “bond proxy” equities like Utilities and REITS to grab income via dividends. Chart 4, again from J.P. Morgan, looks at returns and valuations by sector. Sectors like REITs, Utilities and Consumer Staples are seeing valuations today that are much higher than historical averages. Utilities’ price to earnings ratios (P/Es) are 33% higher than their 20-year average. REITs and Staples are 30% and 17% above their 20-year averages. The demand of income is clearly at play and demographics are driving income heavy equity sectors to new highs. We call this out not to make a valuation call, but to understand that there is a real, structural driver to why these sectors are so rich. This will change at some point in the future but for right now low interests are the equity income generators best friend.

Chart 1: Average Spending by Life Stage

Chart 2: Drivers of GDP Growth

Chart 3: Growth in the Working-Age Population

Chart 4: “Bond Proxies” Returns and Valuations

Productivity

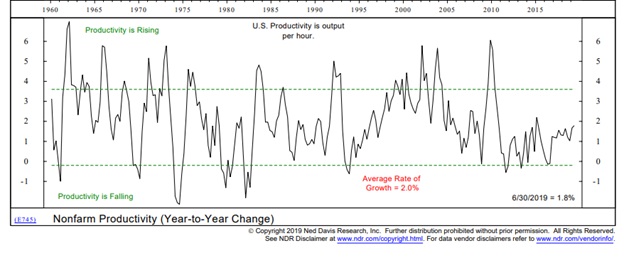

One of the more puzzling facts about this cycle is how come productivity has not been strong? Today year over year growth in productivity at 1.8% is still below the long-run average of 2.0% and well below past cycle peaks that occurred above 3%. Given the amazing progress we have seen as a result of technology why is productivity growth so hard to come by. Quite frankly it puzzles us and we think the data might not be measured correctly. Maybe it’s a result of the transition over time of the U.S. economy from manufacturing heavy industries to services heavy industries. We are puzzled but we know, as we talked about above, productivity is a key to GDP growth. Part of this cycle’s low growth rates can be explained by the current subpar productivity trends. Chart 6 from KKR shows the long-term trend downward in productivity growth and labor force growth (discussed above). Remember, these two data points combine to paint the GDP picture. We are somewhat encouraged by the fact that recent productivity reports have seen an uptick in growth. If the subpar trend of this cycle is reversing that would go a long way in supporting better GDP growth trends. Hopefully, the technology investments of the past 10-years can lead to a productivity boom like we saw in the 1990s and early 2000s.

Chart 5: Productivity Yr./Yr. Change

Chart 6: Productivity Growth and Labor Force Growth

Summary

Interest rates have moved dramatically lower this year and have either tested new lows or made new lows depending on the security. We are seeing the amount of negative-yielding sovereign bonds reach new highs as investors seek safety. We believe these are trends that have been and will continue to be with us for a while. The three structural trends mentioned in the paper are significant factors in why interest rates are behaving as they have. These structural forces can and will change with time but for now and looking out a number of years we are going to be stuck in a lower for longer rate environment.

The lower for longer interest rate dynamic has put, in our opinion, major emphasis on the importance of risk management in setting asset allocation. You cannot hit targeted portfolio returns by allocating significant portions of portfolios to risk-free bonds that are yielding less than inflation. Today, the reality is you have to introduce some form of risk to make your money work for you over the long-term. That’s just the environment we live in and we have to deal with the reality of the situation. At Shepherd Financial Partners, we pride ourselves on understanding the pricing of risk across asset classes. We structure asset allocation based on how that risk is being priced and what are potential long-term returns. Our clients’ time frames for investing are measured in decades not months or quarters. We have to think long-term and determine what risks are inherent in securities with negative yields over long periods. U.S. Treasury yields could go lower from here. We can’t tell you whether they go negative or not. But buying after such a strong rally in the short-term seems sub-optimal. The lower for longer mantra does mean we are attentive to moves both up and down in rates. Giving the reasoning we have laid out in this paper, going forward we probably don’t wait for rates to hit 3%-4% before we find U.S. long-dated treasuries attractive. As always, our process is dynamic and we will react dislocation appear and long-term, risk-adjusted returns appear attractive to us.

We truly hope you have found value in reading this paper. If you have any issues, comments or questions please reach out to us and let’s discuss.

Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult me prior to investing. All performance referenced is historical and is not a guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The hypothetical example provided is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

All investing involves risk including loss of principal. NO strategy assures Success or protects against loss.

Stock investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.