This is part one of a series of reports where we will discuss the realities of investing in a low interest rate world.

Key Takeaways:

• Interest rates are at multi-decade lows

• When designing portfolios to address clients’ long-term withdrawal needs, low rates in bonds means allocations to stocks are higher than the past few decades

• We see three essential considerations for assessing a client’s long-term withdrawal needs:

› Your savings rate leading into retirement

› Your spending expectations during retirement

› Creating a balanced portfolio that aligns with today’s expected asset class returns

“Successful investing is about managing risk, not avoiding it.” Benjamin Graham

For many people, taking risks in the capital markets is not a comfortable endeavor. Many investors worry about the stock market and wonder why they need to put up with the volatility that comes with equity investing. At Shepherd Financial Partners, we point to the reality that interest rates are at 70-year lows in the U. S., and therefore a source of income that once provided returns with minimal volatility may no longer be present.

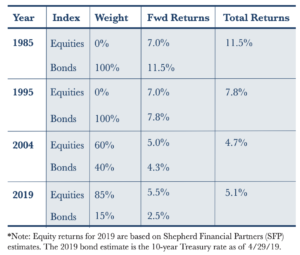

Callan Institute published a research paper in 2016 that gave startling examples of how times have changed for asset allocation. In the 1980s, interest rates were so elevated that you could achieve 5-7% targeted returns by having 100% allocated to bonds. That allocation came with volatility that we all would be jealous of today. In the mid-1990s, as rates continued to fall, you still could earn that target 5-7% return with an equity/bond allocation of 25%/75% . In contrast, because rates are now at multi-decade lows, it can be impossible to earn that same targeted return without assuming some level of volatility.

In fact, at today’s ultra-low 10-year U.S. treasury note rate of 2.5% , you would need an allocation of more than 85% to stocks in order to achieve the low-end of the 5-7% return target (based on forward estimates for equity returns presented below). Remember, asset allocation does not ensure a profit or protect against a loss as if is designed to help minimize risk in a portfolio.

Table: Low Interest Rates are forcing investors to step out the risk curve*

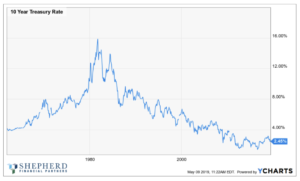

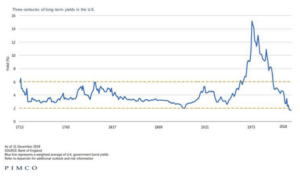

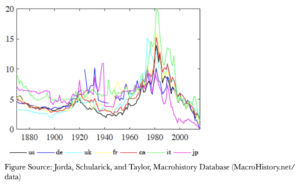

A Historical Perspective So, what’s an investor to do? First let’s take a trip back in time and look at rates over a very long time period. As you can see from Chart 1, U.S. Government Treasury rates are at multi-decade lows. Taking a much longer-term view on rates, Chart 2 from PIMCO Investment Management goes back for a 300-year view of rates in the U.K. The point here is not only to show that we are at multi-decade lows, but also that maybe the 1970s and 1980s were decades of abnormally high interest rates. Maybe our expectations for peak rates need to be more in-line with the period prior to that. Yes, rates are still at lows relative to these elongated time frames, but the upside could be more like 5% or 6% if we exclude the inflationary periods of the 1970s & 1980s. History does not guarantee anything, but we present these charts just to give a feel for what could be rational expectations going forward.

Figure 1: 55-Year History of U.S. 10- year Treasury Rates

Figure 2: Per: PIMCO

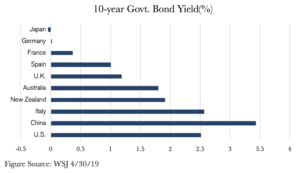

Should we be considering fixed income outside the U.S. to search for income? As Chart 3 shows, when you move away from the U.S., the interest rate environment gets even worse. Many developed economies have set interest rates lower than the U.S. with the hope of stimulating their economies. Given the subpar level of economic growth we have seen from developed economies this cycle, it is highly unlikely we will see a higher movement in interest rates in the near future. Emerging Markets like China offer higher yields than the U.S. However, we do not believe the current incremental increase in yield is enough to compensate us for the risks inherent with investing in Emerging Market debt. Also just like in the U.S., when you take a long-term view as you can see from Chart 4, most countries have rates that are at multi-decade lows. With sovereign yields so low across the globe, it becomes clear that fixed income alone may not be enough to accomplish most clients’ withdrawal goals.

Figure 3: Nominal yields across the globe are low

Figure 4: Global interest rates are also low relative to history

Dealing With Reality

In setting asset allocation today, we have to address the realities of low interest rates. We cannot set allocation based on results of the past because the current and forward interest rates will make it very difficult for clients to earn targeted returns over time. Our process for analyzing a client’s portfolio design in this environment focuses on savings rates, rethinking proper distribution rates in retirement, and balancing the need for more capital market risk through a higher allocation to more volatile asset classes. The key for our clients at Shepherd Financial Partners is to reflect on the Benjamin Graham quote that began this piece. We have to take risk in today’s market but we have to do so through proper management of that risk. This includes having a deep understanding of the risk/return potential of all investments under consideration, then placing client’s capital to work in areas where we believe they are getting paid properly for that risk. The markets are dynamic and therefore we spend every day trying to understand where risk is building and where opportunity might exist.

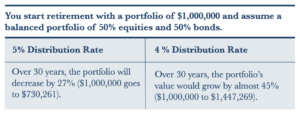

Distribution rates in retirement are an important factor that require an in-depth discussion between a client and their advisor. For a tangible illustration, we wanted to put forth an example of how different distribution rates can impact a portfolio’s value in this low interest rate world. For a balanced portfolio of equities and bonds (50%/50% allocation), let’s assume that for the first ten years of retirement the portfolio earns 4.0% per year (Equities for 5.5%/Bonds for 2.5%) and for the next 20 years, the portfolio can earn 6.0% (Equities 7.0%/Bonds 4.5%)6 . These return assumptions seem reasonable to us and don’t feel extreme one way or the other. If you have $1,000,000 at the beginning of retirement and assume those returns with a 5% distribution rate you would actually see the portfolios value decrease by 27.0% ($1,000,000 goes to $730,261). If you were able to afford a 4% distribution rate the portfolio’s value would actually grow by almost 45% ($1,000,000 to $1,447,269).

While this is a simplistic example, the purpose is to show how a small change in expected distribution rates can be impactful in today’s low-interest rate world. If a lower rate of distribution does not accomplish your withdrawal goals, then it may be necessary to target a portfolio allocation with slightly more risk. This again highlights the importance of risk management and why we at Shepherd spend so much time evaluating risk in the investment landscape.

Summary

In summary, we live in an investing world where interest rates are at historic lows. We do not see a dramatic change to this environment anytime soon. As a result, asset allocations must be laser focused on balancing risk and returns. As you know, the investment philosophy at Shepherd Financial Partners is grounded in risk management and the proper balance of risk in order to earn returns necessary for our clients to achieve their financial goals. We don’t avoid risk; we try our best to understand the pricing of risk and take advantage of dislocations that arise from time to time across asset classes. In a low rate environment like today, we strongly believe this is a prudent practice that will best serve our clients.

Shepherd Financial Partners 1004 Main Street, Winchester, MA 01890 Tel 781.756.1804 Fax 781.729.4356 ShepherdFinancialPartners.com

Disclosures:

1 Source: St. Louis Federal Reserve Bank (fed.stluoisfed.org) 2 Source: Callan Institute: Risky Business September 2016 3 Source: FACTSET 4 Source: WSJ (4/25/19)

5 Source: Equity returns equal SFP 10-year estimate of 5.5% per year. Note this is lower than historical rates due to higher equity valuations today relative to history. Bonds 10-year return equals current 10-yr U.S. Treasury rate (4/25/19)

6 Source: Assume S&P 500 equity returns are closer to long-run averages of 7.0%. Bond rates are closer to long-run averages of 4.5% on U.S. Treasury’s.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult me prior to investing. All performance referenced is historical and is not a guarantee of future results. All indices are unmanaged and cannot be invested into directly. The hypothetical example provided is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing. All investing involves risk including loss of principal. NO strategy assures Success or protects against loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. In addition, international debt securities involve special additional risk, and risk associated with varying settlement standards. These risks are often heightened for investments in emerging markets. Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training. Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.