by: Brian Davies, CFA – Chief Investment Officer

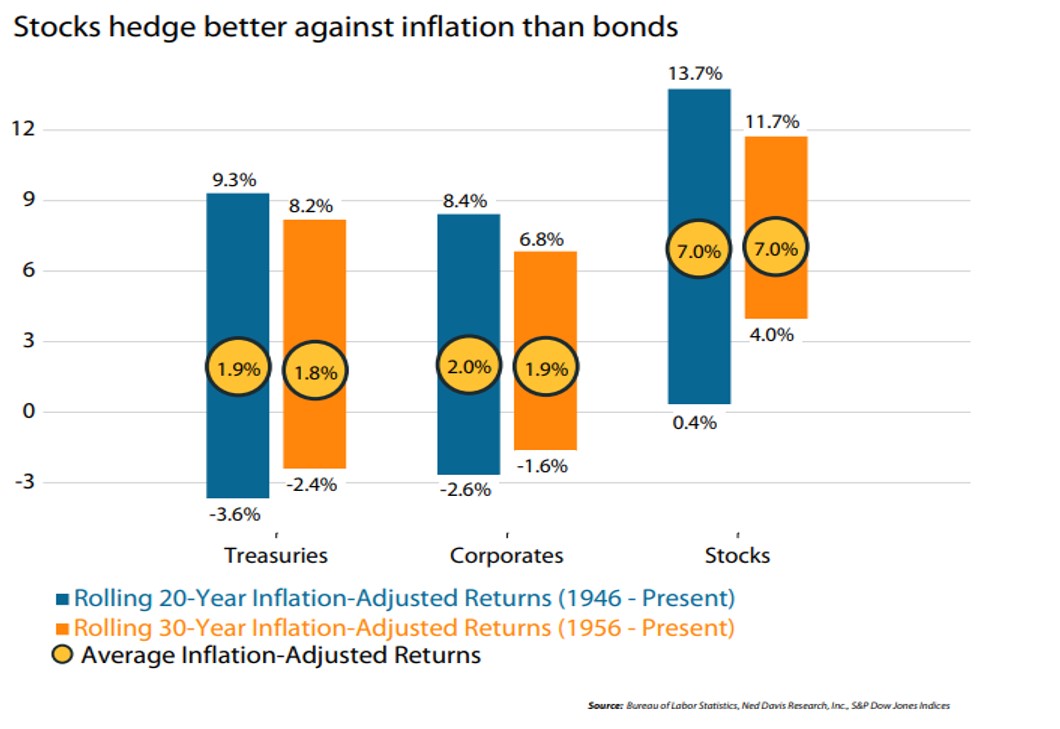

While inflation is minimal to nonexistent today, over long time periods, it can strongly impact security returns. The chart above from Ned Davis Research shows rolling 20-year and 30-year periods for stock and bonds inflation adjusted (real) returns. As the chart shows, stocks tend to provide better long-term inflation adjusted returns. Bonds are very much influenced by the starting level of yield. When the starting level of yields are low (as seen today) the potential for real returns to be negative over long-time periods increase. If the starting yield on the a 30-year U.S. treasury security is only 2.14% today and we know that 95% of that security’s return will be driven by the starting yield at purchase, then inflation only has to be just a hair over 2.0% to make the real return zero. Again, the chart clearly shows that fixed income securities are susceptible to inflation wreaking havoc on returns over the long-term.

As asset allocators and risk managers, we have to consider numerous scenarios when building investment portfolios. We are not calling for an acceleration of inflation anytime soon. We just want to point out that at such low levels, total return in fixed income could be at risk if inflation picks up sometime in the future. Most of our clients have a long-term perspective when it comes to investing. Based on the reality of today, we believe overweighting fixed income at historically low yields may pose more risk for our clients as it limits their ability to earn attractive inflation adjust returns over the long-term.

Disclosures:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.