Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- December was a strong month for most asset classes.

- Our Chart of the Month shows that investing solely based on investment style does not directly tie to performance.

- Both Growth and Value assets have had extended periods of higher performance over the other.

Market Recap:

The markets in the month of December continued the strong rally from the prior month to end the year up for most asset classes. The strongest performer was U.S. Small Cap (also a top performer in November) and finished the year up around 17 percent. Similarly, public Real Estate was up 12% for the year—a massive recovery from double-digit negative returns YTD at the end of October to double-digit positive returns by year end. This move can mostly be credited to the expectations of rates remaining flat or falling in the future. Other groups with solid gains in December were US Large Cap (up 26% for the year); International, both developed (up 19%); and emerging, (up 10%); and fixed income, (up 5.5%). Commodities experienced a different outcome, ending the year negative 6% after being a top performing asset class the prior few years.

Was this expected? Lets discuss.

Chart of the Month:

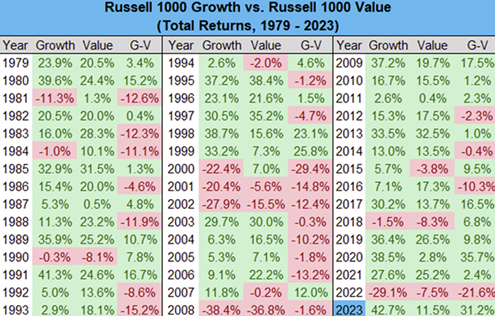

December’s Chart of the Month shows performance of the Russell 1000 index (footnote 1) including Growth vs. Value and the difference between the two. This data is significant because it demonstrates how investment styles (growth vs. value) behave differently over time (footnote 2). If the difference is a positive number, growth has outperformed value and if the difference is negative, value has outperformed growth. In investing, one style does not always dominate, as you can see from the periods of outperformance in growth and periods of outperformance in value. There have been periods where one style has done relatively better than the other, but inevitably there is always a break in that streak.

The real message from the data is twofold: Firstly, the most recent period starting in 2020 has been volatile, where one style has significantly outperformed the other. The average absolute difference between growth and value is 10.26% over the 45-year period. Given that three of the last four years have either doubled or tripled the average is unusual and not unforecastable. Secondly, over the entire data set, growth has outperformed value 24 of the 45 calendar years, whereas value has beaten growth 21 of the 45 calendar years. This shows that over long periods of time, styles come in and out of favor. Thus, we determine that trying to time or invest in one style is detrimental to an individual’s overall investment experience.

What does this mean for investors? Have a long-term plan and balanced portfolio that fits your individual needs. This type of planning helps eliminate the uncertainty around situations like this and can increase your experience as a long-term investor. If you have any questions, please reach out to your Shepherd Financial Partners advisor.

- The Russell 1000 is a stock market index that represents the 1000 top companies by market capitalization in the U.S.

- Growth and value are two fundamental approaches, or styles, in stock and mutual fund investing. Growth investors seek companies that offer strong earnings growth while value investors seek stocks that appear to be undervalued by the marketplace.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Source: https://twitter.com/charliebilello/status/1742199327630479772

Tracking # 525163-3