What is it and how do I submit?

Wednesday June 30 is the filing deadline for the Free Application for Federal Student Aid (FAFSA®) for the upcoming 2021-2022 school year. Filling out this form is a necessary step for families to take when considering planning and subsequently paying for college. Each year, the United States Department of Education awards nearly $121.8 billion in federal student aid that assists roughly 10 million students. Most students who fill out a FAFSA form qualify for at least some federal financial aid. As such, submission of the FAFSA form has become crucial in the college planning journey. Read below to gain a better understanding of the FAFSA and its submission process.

What is FAFSA?

The FAFSA form is required by all schools in awarding any type of government-provided student aid. Federal financial aid can be awarded in many different forms such as grants, loans, and/or work study. Additionally, states and colleges use information from the FAFSA to determine non-federal aid, such as state-based financial aid, private loans, and institutional financial aid. It is important to remember that the FAFSA form requires a submission every year; however, if you miss the filing deadline or choose to forgo the submission, you can always fill it out the following year!

Who should fill it out?

Anyone who plans to attend college! Any eligible student should fill out the FAFSA to see if they qualify for federal student aid because the FAFSA does not include an income or tax bracket cut off.

What are its components?

The FAFSA collects information about income, assets and demographics such as your household size, the number of children enrolled in college at the same time, gross income of the household, among others. All of these components are used to calculate a family’s Expected Family Contribution (EFC) or financial strength. The EFC is used to determine a student’s eligibility for federal student aid and will inform the preparation of a student’s financial aid package.

Why can it be important when considering college planning?

Completing the FAFSA early or on time is an important step towards establishing a plan for college payment. The loan information generated from your FAFSA submission will be immediately helpful to your planning because it will determine your EFC. A family’s EFC will serve as the index number that will be used by college financial aid staff to determine your aid eligibility. In addition, it is extremely beneficial to file your FAFSA early because many schools award aid on a rolling basis. As such, an early submission will increase the likelihood that your family will receive a generous and appropriate amount of aid. The economic consequences of COVID-19 have caused an expected increase in need for financial aid which has, in turn, increased the number of people who will be filling out FAFSA forms this year. This increase will generate more competition for federal aid, and so, the earlier you are able to fill it out the better!

There is no harm in submitting a FAFSA form as it is a worthwhile step to find out how much aid you may be awarded. If you choose not to submit the form, you will most likely rely on private sources and/or private student loans to pay tuition and fees. Private student loans have high interest rates and lack consumer protections that are offered through federal aid. These consumer protections include federal laws that dictate a number of rights that protect student loan borrowers and establish certain rules that lenders must follow.

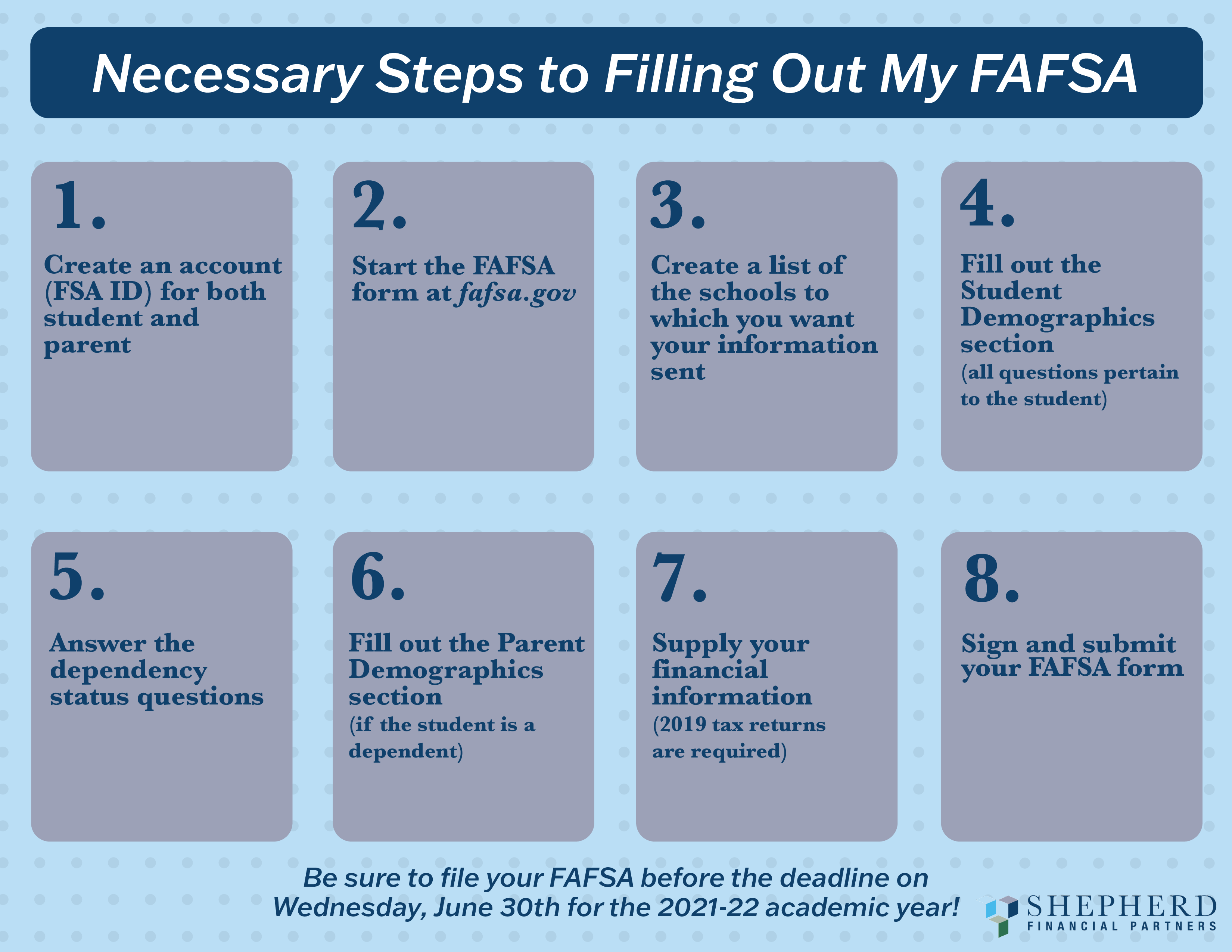

How to fill it out?

There are several ways to fill out the FAFSA form, however, it will be much easier to complete the form online at either fafsa.gov or using the myStudentAid app. Begin the process by visiting these websites to set up your accounts and create a Federal Student Aid ID (FSA ID). Both a student and parent or legal guardian FSA ID are required unless the student is considered independent. The FSA ID can be created online and takes about three days to activate.

What is important to collect?

In order to ensure a seamless process, you should then gather the following information ahead of time:

- Your FSA ID number

- A Social Security number for both the student and the parent or legal guardian.

- In the demographics section, be prepared to answer questions that require the submission of personal information such as your name, date of birth, ect. Much of this information will have already been filled in automatically after inputting your SSN.

- Valid driver’s license number. If you do not have a driver’s license, you can skip this step.

- Tax records from 2019. If you have already filed your 2019 taxes, you may be able to transfer your information into the FAFSA form using the IRS Data Retrieval Tool (DRT).

- Records of all assets within your household. This includes savings and checking account balances, information on your investments such as stocks, bonds, and real estate; and all forms of income, including untaxed income like child support, interest income, and veterans’ non-education benefits

- List of up to 10 schools that you are interested in attending. Once you list a college/university on your FAFSA, the institution will receive your FAFSA information which will be used to determine the types and amounts of financial aid that you are eligible to receive.

Once you collect this material, you will spend time on the FAFSA website submitting your application. This can take some time, so make sure to carve out dedicated time and attention to completing the process, and include a parent or guardian to readily answer any questions.

If there are components that you are unsure of or have questions on, call your financial advisors for clarification. It might even be a good idea to consult them ahead of time and share all the information that you had previously collected so that when you’re ready to fill out the form, you can do so with ease.

What happens after I submit?

After you submit your FAFSA form, the information that you have provided will be processed by the U.S. Department of Education, and within a few days, you will receive a student aid report (SAR) which will list the information that you submitted through the FAFSA. At this point, you should check your SAR for any mistakes and make any necessary corrections. The SAR will also include your Expected Family Contribution number (EFC) which indicates your eligibility for federal student aid. Following this processing period, the schools that you listed on the FAFSA form will receive your information and begin to determine your aid package.

Once you are accepted into a school, your acceptance letter will include your financial aid offer. If you receive a federal loan and are a first-time borrower, you will need to complete entrance counseling and sign a master promissory note which will serve as your agreement to pay back the loan. Finally, the federal grants and loans will be applied to tuition and fees as well as other charges on your student account and any leftover money is paid to the borrower directly.

A FAFSA loan can impact many of the financial decisions a student will be making in the upcoming year. Knowing what is needed and submitting in an appropriate manner can lead to a strong submission, and likely additional aid. As a first step, log on to fafsa.gov to create your profile and begin collecting the aforementioned forms above. The more prepared you are, the more informed your decisions will be when planning your financial and educational future.

It would also be beneficial to reach out to your or your parent’s financial advisors at Shepherd Financial Partners to discuss your college financing options and plan out the best course of action for you and your family. Give us a call, we are always here to help as we join you on your educational journey!

Sources:

https://studentaid.gov/sites/default/files/2020-21-fafsa.pdf

https://studentaid.gov/articles/filling-out-fafsa/

https://studentaid.gov/apply-for-aid/fafsa/filling-out/help

https://www.usnews.com/education/best-colleges/paying-for-college/articles/completing-the-fafsa

https://www.ed.gov/content/8-steps-filling-out-fafsa®-form

Disclosures

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05160503