Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

May 2023 Market Wrap Up:

The markets in the month of May saw mostly weakness due to anticipated global slowdown stemming from China’s economic data and uncertainty surrounding the U.S. debt ceiling. U.S. Equities were up slightly, thanks to a few top names especially those in tech, which has seen solid year to date (YTD) returns. All other segments were down, specifically developed international and real estate, which had poor relative performance for the month. The worst relative performance came from commodities. Interestingly, commodities had a strong performance in 2022 once again demonstrating the cyclical nature of investments.

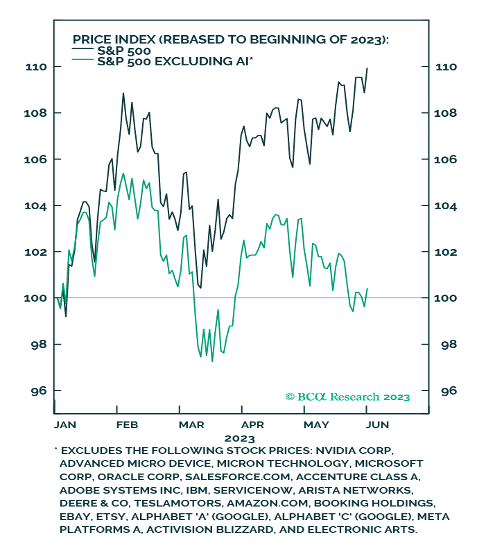

Chart of the Month:

Let’s dig deeper into the performance of the S&P: The S&P 500 has performed exceptionally well this year, up 9.65% so far. Although, I will caveat that most, if not all, of the positive performance has been from just a handful of names. Looking at the chart comparing the S&P 500 to the S&P 500 excluding Artificial Intelligence (AI) related stocks, we can see that without those names, the index is flat for the year. Also note, most of the outperformance came after mid-March. The performance boost could be driven by momentum from a craze to invest in AI-related tech. Regardless, the lack of breadth in the market does raise some concerns over valuations of the top performers. We take issues like market concentration into consideration as we manage portfolios and leverage diversification.

What does this mean for investors? Start with a financial plan. Remember, we tailor investment portfolios to fit your individual planning goals. Long-term planning reduces the uncertainty around situations like this and can positively impact your investment experience. If you do not have a plan, call us today to get started!

If you have any questions, please reach out to your Shepherd Financial Partners advisor.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: Y-Charts and FDIC

Tracking # 444439-2