Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

While interest rates, inflation, and the future health of the U.S. economy are uncertain, fixed income volatility has picked up, and investors have been rotating between risk-off treasuries and Large Cap developed market equities. Investors are also eyeing geopolitical risks on the horizon as well as the U.S. debt ceiling, which is a highly anticipated event leading into the summer months. Overall, markets had a strong start to the year and current events in April had investors adjusting their market sentiment slightly to account for future economic and political events.

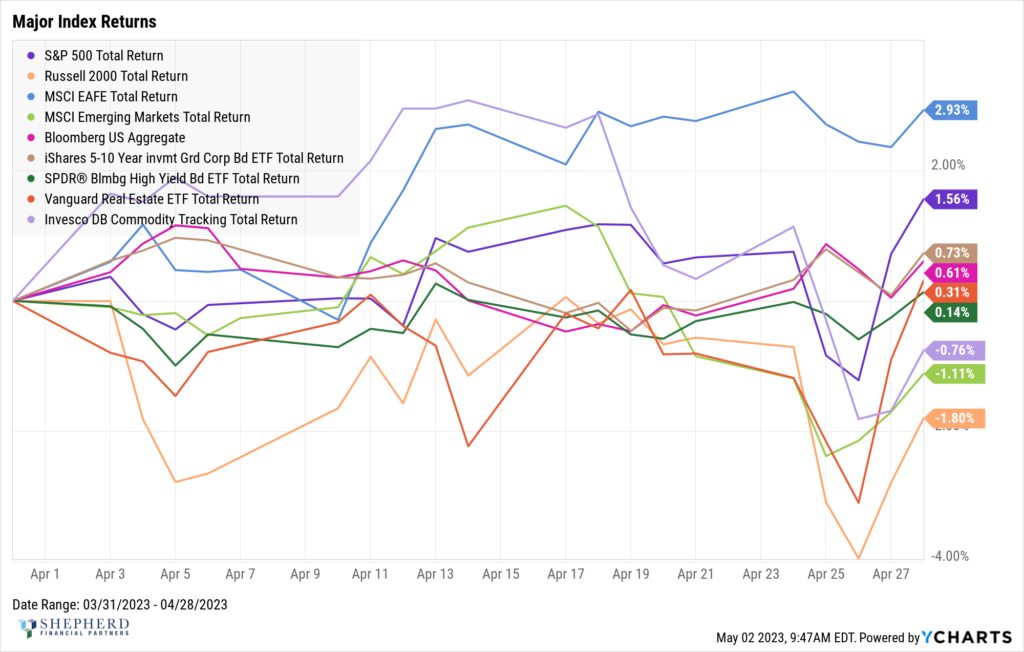

In April, the markets saw continued strength in Large Cap developed markets, with both EAFA and the S&P 500 displaying increases. Comparatively, Emerging Markets and U.S. Small Caps underperformed in a meaningful way. Meanwhile, Fixed Income saw slight positive performance across the board.

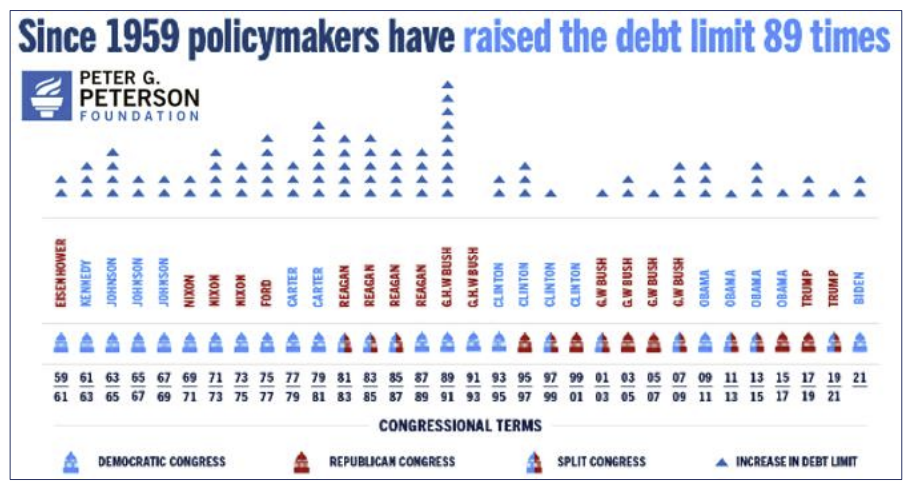

Chart of the month:

On January 19, 2023, the U.S. hits its debt ceiling of $31.4 trillion set in 2021. However, this isn’t the first time investors have been faced with the macro and micro implications of the U.S. debt ceiling—it has been this way for decades. Despite hitting the debt ceiling numerous times (shown in graphic) the U.S. has never defaulted, and we do not expect it to this time around either. The U.S. Treasury Department has the measures in place to keep the government afloat until June, which provides Congress time to come up with a solution. Some discussion in Congress has been centered around raising the ceiling only if accompanied by federal spending cuts, although nothing of note has been reported yet. Regardless of the solution, one might expect higher market volatility until a solution is made clear, especially as we approach the June deadline. What does this mean for investors? It means that having a long-term plan and balanced portfolio that fits your individual needs can help reduce uncertainty around events like this and can increase your experience as a long-term investor.

Reach out to your Shepherd Financial Partners team with any questions or comments.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: Y-Charts and FDIC

Tracking #