Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Welcome to our monthly market update.

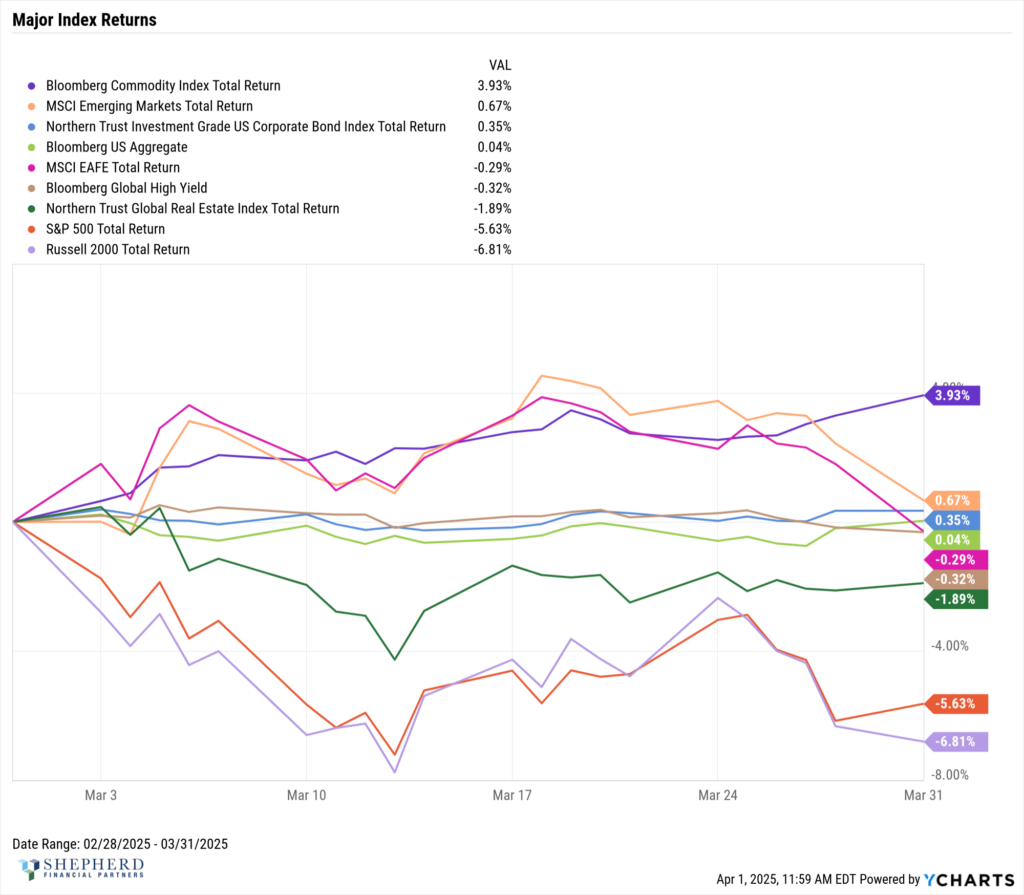

This chart shows the performance of various financial indices for March 2025. Let’s discuss the key trends and their underlying drivers:

Key Takeaways

- The markets looked to commodities, emerging markets, and fixed income as investors processed mixed economic signals and waited for clearer directional indicators

- U.S. Equity markets showed declines due to uncertainty surrounding new tariff policies and their potential impact on corporate profits.

- Markets have shown concerns about stagflation—a toxic combination of slowing economic growth alongside persistent inflation.

Commodities (+3.93%)

The Bloomberg Commodity Index emerged as the top performer with a 3.93% gain. This strong performance can be attributed to a weaker U.S. dollar during March, which typically makes dollar-denominated commodities more affordable for foreign buyers. Additionally, precious metals saw increased demand due to their dual role as both industrial inputs affected by new tariffs and as safe-haven assets during periods of uncertainty. This combination of currency weakness and heightened demand created favorable conditions for commodity investment.

Emerging Markets (+0.67%)

The MSCI Emerging Markets index posted a modest gain of 0.67%, outperforming most other equity categories. This relative resilience stems from the strong connection between emerging economies and commodity production, as many developing nations derive significant portions of their economic output from raw materials and natural resources. The positive performance in commodities provided support for these markets, offsetting some of the broader global equity weakness.

Fixed Income (Flat to Slightly Positive)

Bond indices showed minimal movement, with the Investment Grade US Corporate Bond Index returning 0.35% and the US Aggregate barely positive at 0.04%. This stability reflects interest rates remaining at similar levels from the beginning to the end of March, resulting in limited price movement. The fixed income market essentially treaded water as investors processed mixed economic signals and waited for clearer directional indicators.

Global Real Estate (-1.89%)

The Global Real Estate Index declined by 1.89%, reflecting significant challenges in property markets. This underperformance was driven by decreased mortgage origination activity as potential buyers remained cautious. Furthermore, new tariff concerns raised the specter of higher construction costs, particularly for materials like steel, aluminum, and lumber, potentially squeezing profit margins for developers and creating headwinds for the sector.

U.S. Equities (Significant Declines)

U.S. stock indices were the worst performers, with the S&P 500 falling 5.63% and the Russell 2000 dropping 6.81%. This sharp correction reflects mounting concerns about stagflation—a toxic combination of slowing economic growth alongside persistent inflation. Market sentiment deteriorated due to uncertainty surrounding new tariff policies and their potential impact on corporate profits. Additionally, escalating geopolitical tensions further dampened investor confidence, prompting a flight from risk assets to more defensive positions.

Overall Market Environment

The divergence between commodities and U.S. equities during March 2025 highlights a market that is concerned about inflation without corresponding economic growth. The trend lines on the chart clearly show the accelerating decline in U.S. stocks after mid-March, while commodities continued their upward trajectory. This pattern is consistent with a risk-off sentiment where investors sought protection from potential economic turmoil in traditional stores of value.

If you have any questions, please reach out to your Shepherd Financial Partners team.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All indices are unmanaged and may not be invested into directly.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Source: YCharts

Tracking #: