Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- This month, markets saw weakness in all areas

- Fixed Income has been in a bear market for over the past 3 years; however, today we believe that there is a diversification benefit to holding bonds

Overall Market Recap:

This month, markets saw weakness in all areas. The growth-dominated indices such as the S&P 500, Russell 2000, EAFA, and EM were all down after having a solid start to the summer. From a technical standpoint, growth in general may have been showing signs of being overbought and a pullback seemed necessary. The worst performers in the bunch were U.S. Small Caps as well as Emerging Markets, both of which had big months in July. Although, as we have pointed out previously, China is a heavyweight in Emerging Markets and continues to drive underperformance in this area. Fixed income is flat to slightly down again; a trend we have seen since February. The exception is High Yield, which had slightly positive performance for the month. This highlights, once again, what we mentioned last month that most of the return in the fixed income category is coming from credit exposure, meaning lower quality bonds.

Equity markets overall had negative performance for the month. As we know, Fixed Income, too has been struggling with the expectations that rates might be higher for longer.

Chart of the Month:

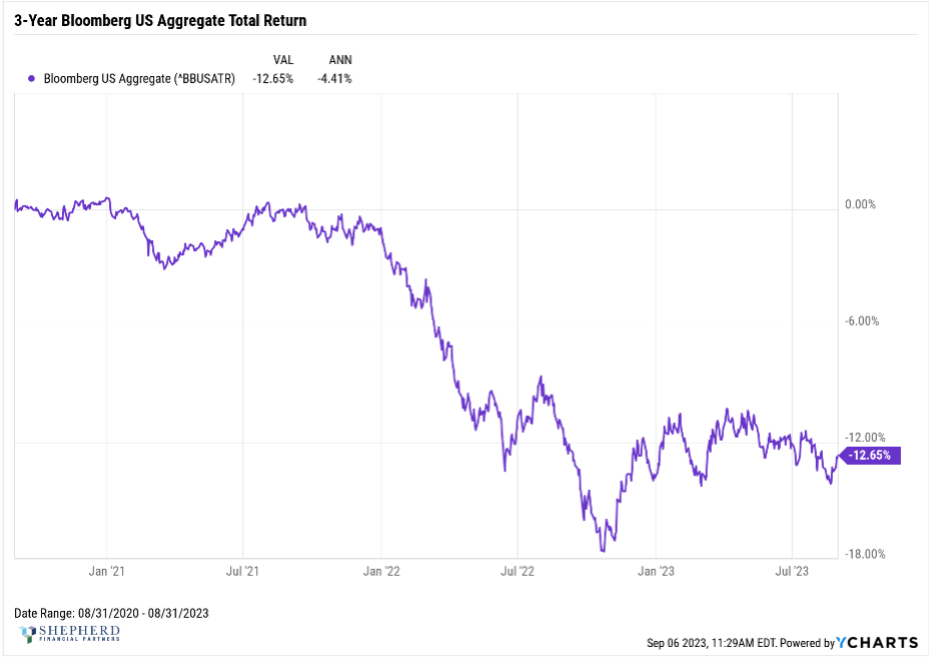

The chart of the month shows the Bloomberg U.S. Aggregate—the standard benchmark for a balanced Fixed Income portfolio. Why is this three-year view important? It shows just how difficult it has been to navigate a diversified portfolio when Fixed Income has provided a negative annualized return of (4.41%). Suffice it to say, Fixed Income has been in a three-year bear market, which we can trace back to when rates first started to rise. The 10-Year Treasury Rate was at .63% at the start of this chart and it currently sits at around 4.09%. As we know, your return from owning Fixed Income is directly related to the Yield to Maturity at the time of purchase. When the yield was extremely low sitting at .63%, the future returns were going to be just that—low. Today, rates are at multi-decade highs and much higher than they were just a short three years ago. Given these higher rates, we believe that there is a diversification benefit to holding bonds and that this will continue to be beneficial in the years to come.

What does this mean for investors? Give us a call to discuss the asset allocation within your portfolio and how your portfolio works within your financial plan. Let’s review whether you are on-track with your goals. As always, if you have any questions, please reach out to your Shepherd Financial Partners advisor.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: Y-Charts and FDIC

Tracking # 477697