Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- The Markets: Equities continue to out perform bonds.

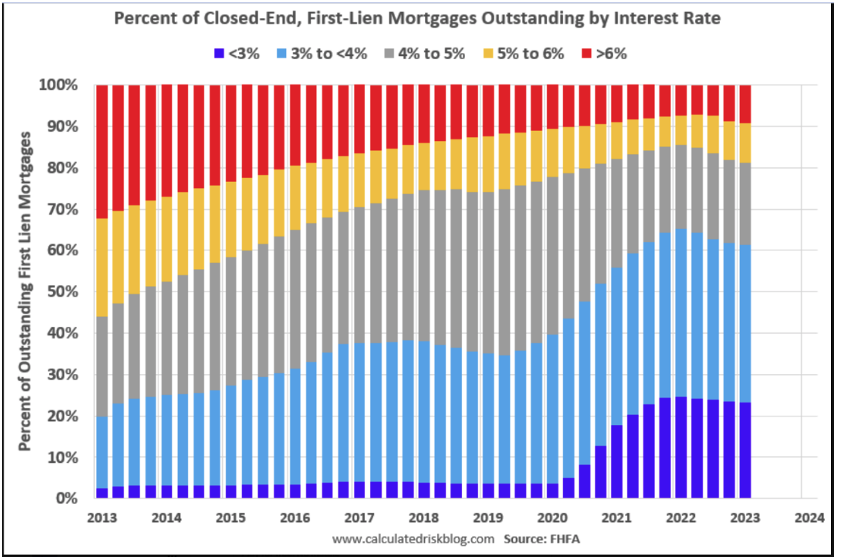

- Housing: The residential housing market has structural strength due in part to the fact that 90% of 30-yr mortgages have interest rates below the 50-year average.

July 2023 Overall Market Recap:

July’s markets saw strength in commodities, emerging market equities, and U.S. small caps. Fixed income again showed weakness. Commodities and Emerging Markets are highly correlated because many emerging economies rely on both soft and hard commodities.1 Commodities staged a significant rally in July of 8.72%. Emerging markets, not far behind, was up 6.29% thanks to help from a 30% weight in China, which was up 11.31%. US Small Caps carried the momentum it gained in mid-June into July and had another month of solid relative performance. Fixed Income had another unremarkable month, finishing mostly flat due in part to the Federal Reserve’s actions to raise rates along with market expectations of higher rates.

Once again we see that, overall, equity markets had positive performance for the month on the back of mostly robust economic conditions. Fixed income has been struggling, with expectations that rates might be higher for longer.

Chart of the Month:

The chart of the month shows the percentage of outstanding 30-year residential mortgages by rate. To summarize, around 90% of current residential mortgages are financed with a rate below 6%. Over the past 50 years, the average 30-year mortgage rate has been 7.75%. This means most people are locked into a rate well under the historical average. Also note that up to 20% of residential mortgages have rates less than 3%. One could argue that this historic wave of low rates provides structural strength to the residential real estate market and could demonstrate more resilience if other economic conditions were to deteriorate.

What does this mean for investors? Housing is an important factor within your financial plan. Call us today to discuss any potential changes you may have in mind.

If you have any questions, please reach out to your Shepherd Financial Partners advisor.

Footnote 1: Soft commodities include agriculture and livestock, whereas hard commodities include natural resources that need to be mined or extracted such as gold and oil.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: Y-Charts and FDIC

Tracking # 464774-2