Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Key Takeaways:

- Do not let market uncertainty and drawdowns get to your head, stay invested!

- When compared to staying fully invested, switching your stock portfolio to cash or short-term treasures negatively affects your returns following a bear market.

- Data shows that the market fully recovers at an average of two and a half years after the start of a bear market, which is relatively quick when considering a long-term investment horizon.

Overview

Bear Markets, defined as 20% declines in market value, can be daunting for an investor, but they are not unusual and should not be feared. During times of market stress or uncertainty, it can be difficult to keep your emotions in check. At times, people might want to pull out of the market because “this time is different” or “I will buy back when everything recovers.” But, as history has shown, this can be detrimental to one’s portfolio performance once the market begins to recover.

We investigate different investment scenarios and show that being out of the market during the initial recovery can be detrimental to your total return. We’ll also demonstrate that when markets pull back, there is comforting data showing the time it takes to recover may be shorter than you think.

Is it worth investing in stocks or should I put money in cash or Treasuries and wait until the outlook is better during a Bear Market?

This question can be a common response to market uncertainty, especially with short-term Treasuries currently at attractive yields. The short answer? Do nothing and stay invested.

Bear Market recoveries are typically greatest during the early months following market lows. This can be interpreted as follows: when things are at the bleakest, forward returns are historically outsized in the early days of the recovery. If you rotate out of stocks and into cash, you inevitably miss this recovery.

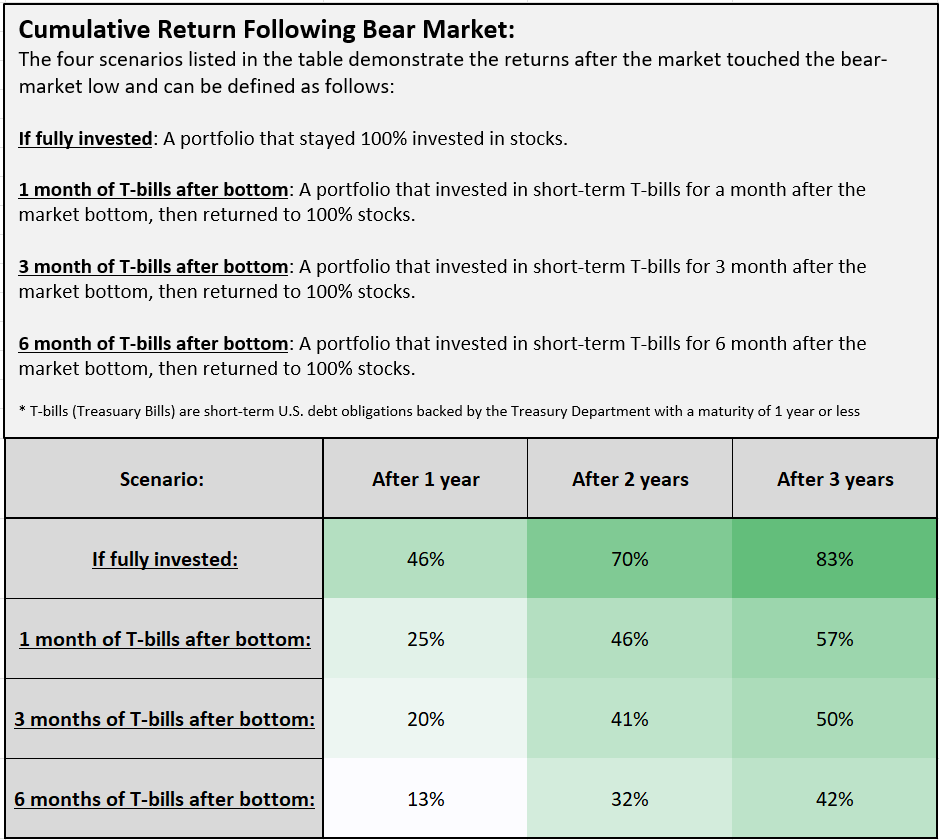

To get a sense of the magnitude of difference between staying invested in stocks versus switching to cash or short-term treasuries, see Exhibit 1 below.

Exhibit 1: Fully invested is represented by the S&P 500 Total Return Index from January 1970 – March 2021. T-Bills are represented by Total Return of the Ibboston U.S. 30-day Treasury Bill Index. This illustration represents data from six periods where the market dropped by 20% or more. The returns in the exhibit are the average of the cumulative returns for each period. Source: https://www.schwab.com/learn/story/bear-market-now-what

As you can see from the data, your highest return is generated by staying invested, whereas switching to cash or short-term treasuries greatly lowers your possible returns. Moreover, this example assumes perfectly timing the market bottom, which no investor can do.

There is power in remaining fully invested during times of market correction. And unless you are planning for a short-term expenditure, stay invested given that “time in the market” beats trying to “time the market.”

How long will it take for the market to recover from market bottom?

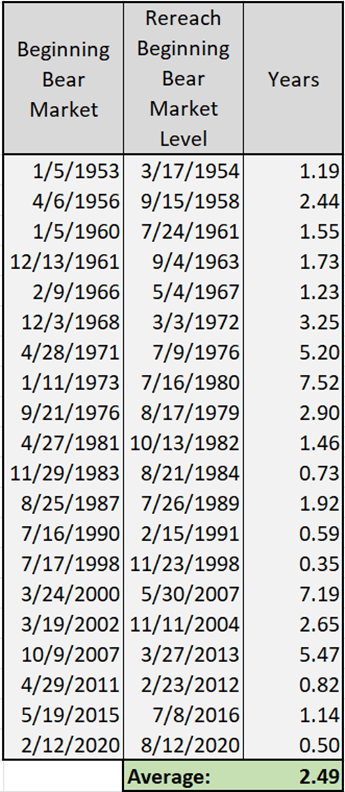

There have been 20 Bear Markets since 1950. From its peak, the market drops on average -25.8% during these times and regains its prior peak within two and a half years. If you are interested in these data points, see Exhibit 2 below.

As was discussed above, much of the gain occurs 12-months following the bottom, which encourages investors to not only sit tight during turbulence, but to embrace the encouraging data showing recovery happens relatively quickly over a long-term investment horizon.

As always, we want to hear from you! If you have any questions, please reach out to your Shepherd Financial Partners team.

Exhibit 2: Source NDR, Research

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: Y-Charts and FDIC

Tracking # 458631-4