Written by: Chris Cogliano, Portfolio Specialist/Investment Analyst

Welcome to our new segment entitled “Coffee with Chris.” Each month, Chris will provide a quick recap of market activity from the preceding month.

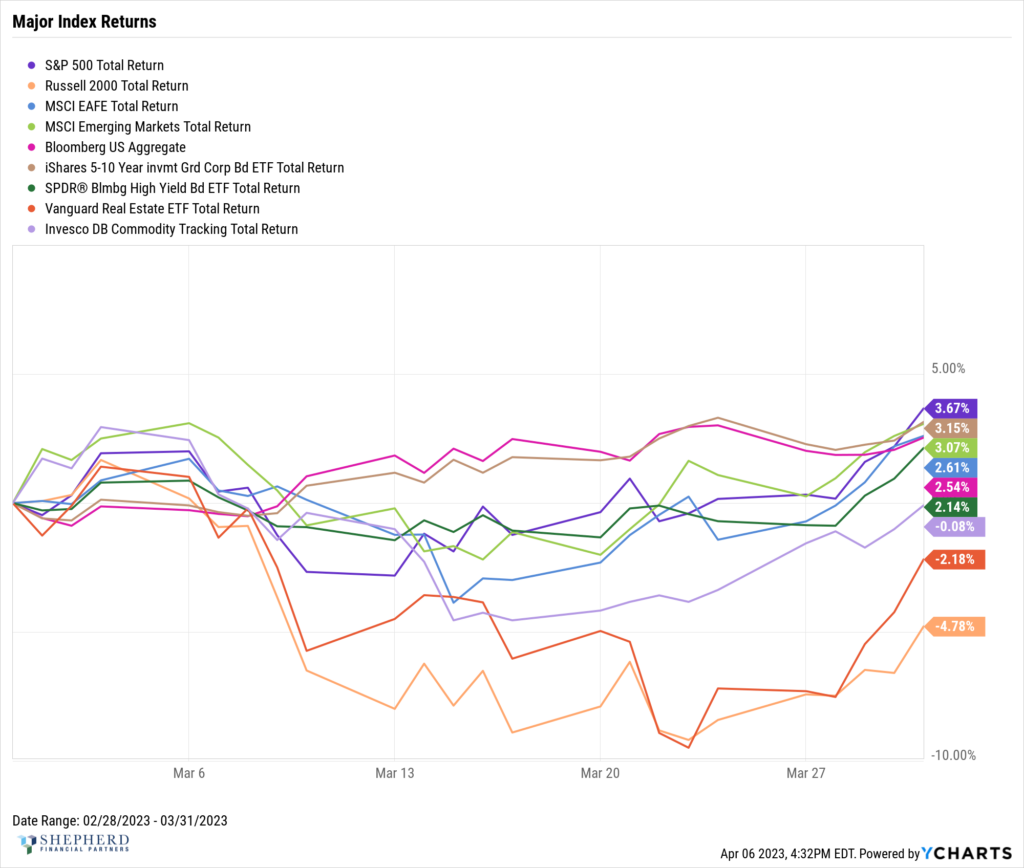

The markets in the month of March mostly saw a rebound from February’s decline. After a strong start to the year in January and a weaker February, US and Developed International Equities and Fixed Income were up. Major relative underperformance came from the Russell 2000 and Real Estate, which had seen outsized gains in January, suggesting a reversal from overbought. Commodities were flat for the month and down for the quarter after outsized gains in 2022.

In an environment of high fixed income volatility, investors have piled into treasuries and driven rates down in anticipation of rate cuts sooner rather than later. During the month, Silicon Valley Bank was put into a receivership and we saw the 2-Year treasury bill go from just above 5% to, at points, below 4% in a matter of days. The expectations of higher volatility and a potential recession can explain why investor’s demand for treasuries increased. Overall, markets had a strong start to the year and current events in March had investors positioned for safety.

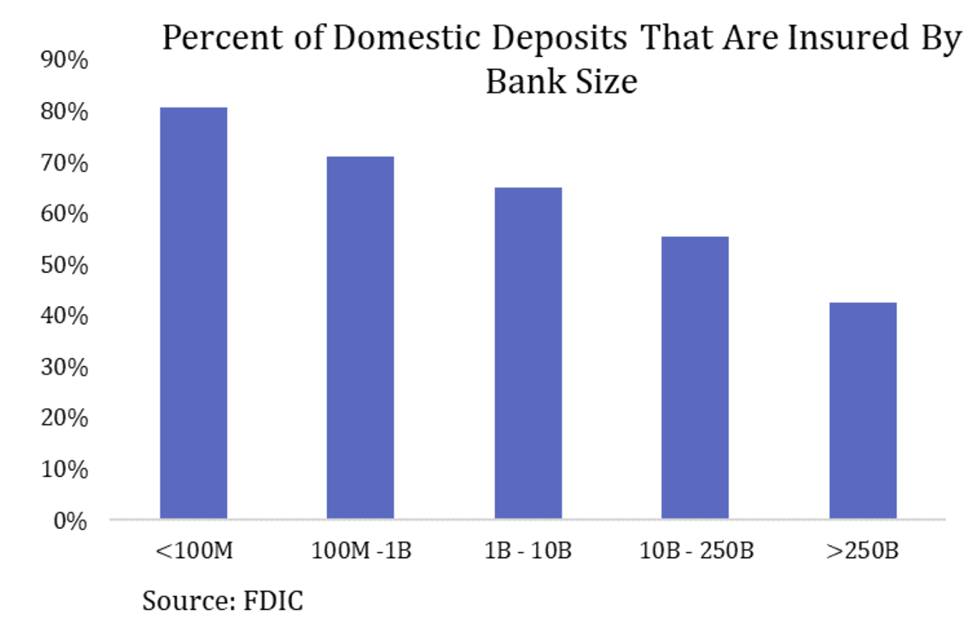

Chart of the month:

The chart of the month shows the percentage of deposits that are insured by bank size. At first glance, you may notice that banks under $10B in assets have about +70% in insured deposits whereas banks above $10B in assets have over 50%. The narrative that small banks are at risk of failing due to a run is false. This chart shows that smaller regional banks have a large part of their deposits FDIC insured. The risk is minimized to the consumer because the high percentage of deposits are insured.

Reach out to your Shepherd Financial Partners team with any questions or comments.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Sources: Y-Charts and FDIC

Tracking # 426638-2