June 2022

The story of 2022:

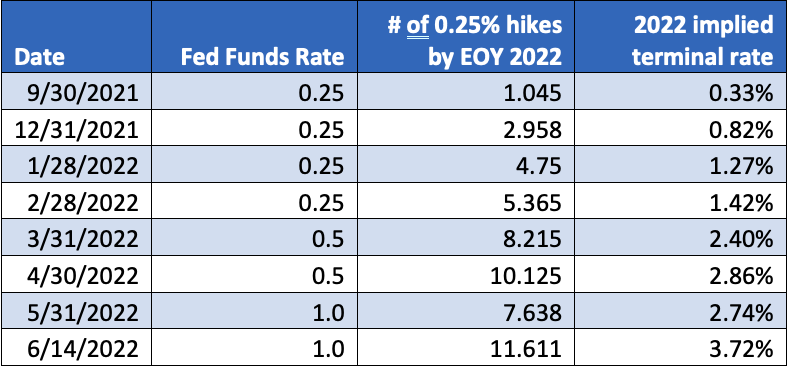

While many factors are involved in explaining the angst amongst investors, the table above is an important one. In our estimation, the table represents the story of 2022 in the capital markets. The table lists the expected number of rate hikes in 2022 by the Federal Reserve and the ending (terminal) Fed Funds rate at various dates since Q3 2021. Coming into this year, the bond market was pricing in three rate hikes this year and a terminal Fed Funds rate of 1.0%. Fast forward six months and the market is seeing 12 more hikes to go (4x the numbers to start the year) and an ending Fed Funds rate of close to 3.75%. The bond market has been paying catch up all year just like the Federal Reserve. The main culprits of the dramatic move higher in interest rate expectations are events that are difficult to predict.

The biggest culprit has been the invasion of Ukraine by Russia and the subsequent effects on food and energy prices. Rate expectations have jumped since the February invasion (only 4-months ago) as the supply issues caused by the war produce an outsized increase in prices. Geopolitical events, like the invasion, are incredibly hard to predict with any accuracy or consistency.

The second reason for such a dramatic increase in rate expectations is ongoing global challenges due to Covid-19. The late winter/early spring surge in cases in China caused the country to lock down again. This lockdown forced supply chains that were in the process of healing from prior lockdowns to take another step backwards. Thus, while we are two years removed from the start of the pandemic, Covid-19 is still causing problems and contributing to outsized inflation and thus higher interest rates.

As we have seen across the capital markets in the first half of 2022, consensus expectations can change quickly in either direction based on events like these. The rapid rise in interest rate expectations caught markets offsides, as illustrated by the fact that the bond market now expects a 4.5x higher Fed Funds rate than they did at the beginning of the year. Our job as a prudent investment manager is to look at the current state of markets and decide if the return in any asset or security at any time is worth the volatility that comes with it. Coming into 2022, the major risks that we highlighted in our outlook were return of volatility and rising interest rates and the risk they posed to long-dated bonds. The Fed and their aggressive fight against inflation has intensified both themes. We remain focused on our process and the data which tells us we are in the later stages of the economic cycle. During these times, focusing on diversification and appropriate time horizon helps sustain portfolios through market turbulence as our clients seek to achieve their long-term goals.

As always, please contact our office with any questions or concerns, and we look forward to speaking with you.

Disclosures:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. We suggest that you discuss your specific situation with a qualified investment or tax professional before taking any action.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners’ Form ADV Part 2. As with any investment strategy, there is potential for profit as well as the possibility of loss. Shepherd Financial Partners does not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk (the amount of which may vary significantly) and investment recommendations will not always be profitable. Past performance is not a guarantee of future results.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Tracking #: 1-05294633