Savings plan limits have increased

You can now save more in your company retirement plan.

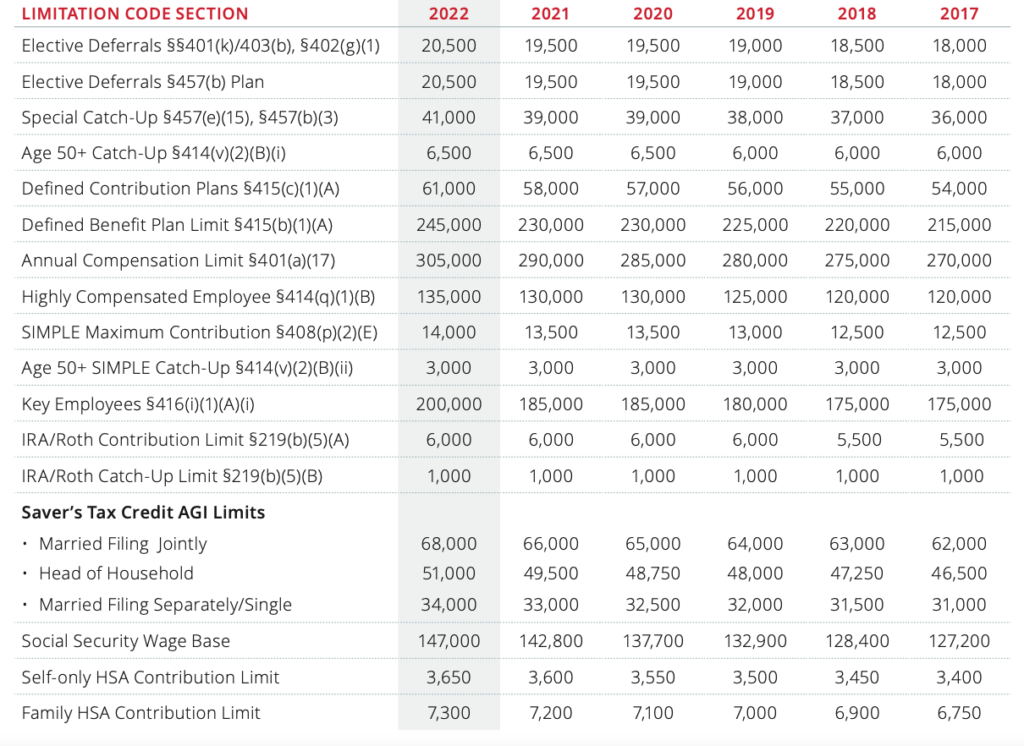

The table below provides the benefit and contribution dollar limits for years 2022-2017. As the limits increase, you have more opportunity to save for your retirement. Remember to “pay yourself first” and contribute as much as you can to secure your retirement.

Final Thoughts

If you would like to understand your retirement readiness, contact us for a financial planning review. We are here to serve you!

Disclosures:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All indices are unmanaged and may not be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performances not indicative of the performance of any investment.

Past performance is no guarantee of future results.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

This information is not intended to be a substitute for individualized legal or tax advice. Please consult your legal and/or tax advisor regarding your specific situation.

Tracking #: 1-05220989