by: The Investment Team

2020 was a year like no other year in our lifetimes. Starting in February, the speed with which things changed was unprecedented. The pandemic and subsequent shutdown of the global economy caused the capital market to seize, and assets found themselves in the quickest bear market ever. Usually, we measure corrections in quarters or months. This time we measured it in weeks. Over 35% in value was wiped away from the S&P 500 in just over four weeks. The response by fiscal and monetary authorities globally was not only the fastest we have ever seen, but the size was at a scale unfathomable before. The Federal Government promised trillions of dollars of aid, and just like that, markets found a bottom in the third week of March. With monetary and fiscal policy support in place, investors gained confidence in the thought we could see our way out of this disaster. Risk assets rallied aggressively, and by mid-summer, equity indexes were back to their pre-pandemic levels. From there, risk assets have run higher, as positive news on the vaccine front has driven even more confidence that there is a light at the end of the pandemic tunnel.

The investment returns we ended up seeing in 2020 were but a pipe dream during the earlier parts of the year. In this writing, we will discuss what took place during the 4th quarter from an economic and markets perspective that helped cement the year’s returns. We take a broad look at markets and discuss the winner and losers (shockingly, there were very few losers). Finally, we will end with some thoughts on what the year 2021 might hold for investors and how we are positioning portfolios.

Economy in the 4rd Quarter 2020:

While the 3rd quarter economy was characterized by wide spread recovery, the 4th quarter saw some of that recovery take a pause. As the virus resurged here in the U.S. and abroad, more stringent lockdowns were reinstated and thus parts of the global economy slipped. The service sector continues to be the most influenced by the ebb and flow of the virus. Restaurants, hotels, and air travel bore the brunt of the pain initially and again are struggling as the virus surges this winter.

With that being said, some areas of the global economy, like Manufacturing and Housing continue to see a robust recovery. Single family residential construction in the U.S. finished the year up amazingly strong and provided great support for GDP. Housing starts are in a V-shaped recovery from the depths of spring and single-family housing starts have recently shot past their pre-pandemic levels. Low interest rates and demographics are just a few factors behind the strong momentum in housing. While housing activity might see a slowdown in momentum, we do think it will continue to be a positive factor in economic growth for 2021.

Manufacturing is another area of the economy where the momentum is strong as we enter 2021. A look across the globe shows many countries seeing a robust recovery in manufacturing activity in the fourth quarter. Most of the developed and emerging economies in the world ended the year with manufacturing activity signaling expansion. This is an amazing development when you consider the environment we were in April as every economy saw contraction.

In the U.S., Manufacturing activity ended the year hitting multi-year highs. This is one of the quickest turnarounds in manufacturing we have ever seen. Low inventory levels and the consistent level of demand for goods on the part of the consumer has manufacturing on solid footing as we head into 2021.

Consumer spending is one area where things plateaued in the quarter after a robust recovery in Q3 from Q2. Every month on the fourth quarter saw negative month-to-month sales growth, although the year-over-year sales growth remains positive. The resurgence of cases and subsequent local restrictions on business and employment caused consumers to slow spending. While the momentum heading into 2021 has slowed considerably on the sales front, the large amount of fiscal support on the come should help stabilize retail activity until the widespread disbursement of the vaccines can take hold in the spring and early summer.

The labor market probably saw the most significant impact from surging case numbers. We have seen little to no improvement in weekly unemployment claims, and the December jobs surprised to the downside. As we have moved into January, the employment picture has gotten weaker. We expect that the first few months of the year will see the employment picture struggle to regain its momentum. We will be hard-pressed to see a strong employment recovery until we see both virus cases numbers come down significantly and the vaccine rollout gains momentum. Since we are in the early stages of the rollout, the picture for employment will be slow until the spring. Then, hopefully, business restrictions can be lifted, and those service-based industries mentioned earlier can start to get back to some semblance of normalcy. That recovery will happen this year it is just a matter of when. In the meantime, as we grind through these winter months, fiscal support will continue to be very much welcomed to get those who are struggling over the hump. There are still a large number of people and businesses in need of support. While some areas of the economy have grown despite the pandemic, other areas have been decimated, and support is still called for. Support was passed as the end of the year and as of this writing it sounds like a sizeable amount of additional support could be on the come. This is welcome news and hopefully is the support needed to get those in need over the hump as we get the economy back to some sense of normalcy.

Capital Markets Performance in Q4:

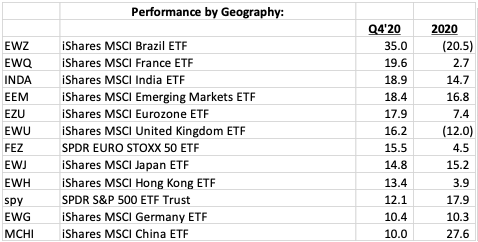

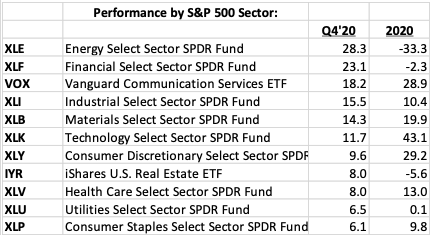

Much like the 2nd and 3rd quarter, the 4th quarter favored risk and saw almost all asset classes positive. The most significant difference was who the winners were. While U.S. large-cap growth stocks dominated the performance in prior quarters, the 4th quarter was one by cyclical names in sectors like Energy and Financials. These sectors have lagged considerably not only in the pandemic sell-off but for most of the past few years. As investors gained more confidence that effective vaccines were close to approval, they shifted their focus to cyclical areas of the market that could benefit dramatically from a reopening of the global economy.

The shift in investors’ preference was not only about going from growth stocks to cyclical/value names. The shift also allowed small companies to have one of their best quarters ever. The Russell 2000 index, a proxy of small company stocks, was up over 31.0%. That puts the 4th quarter at the top of the list of best small company’s quarterly performance ever. The broadening of the stock market’s move is a very positive development. Concentration in performance into the top technology or FAANG names was not healthy. Most sustained market moves occur when the moves higher are broad-based and more and more names are either making new highs or are trading above moving averages. This should provide support to global stock markets in 2021.

Stocks outperformed bonds in the quarter as bonds were a mixed bag. Overall, the Barclays Aggregate Bond Index was up only 0.7%. Credit drove performance as high yield bonds were close to 6.0%, and investment-grade bonds were up a bit over 3.0%. Interest moved higher throughout the quarter, and that challenged the performance of treasury bonds. The long-end of the treasury curve saw negative performance. The 10-year treasury rate moved higher by 24 basis points as investors started to price in an economy returning to normal soon along with expectations around inflation given a large amount of stimulus in the system.

Bonds ended the year with solid performance, with the long-dated treasury bonds up double digits. The majority of this return was generated in the first few months of the year the pandemic unraveled chaos developed in the capital markets. Interest rates seem to have bottomed in early August at 0.50% on the U.S 10-year treasury note. While we don’t expect a dramatic move higher in interest rates anytime soon as the Fed has stated they are not looking to move off their current loose policy stance for dome time. We think August was the bottom for rates and we probably are not going back to that for some time. Our thought is rates will be higher through 2021 but not dramatically higher as the Fed is laser-focused on maintaining their current policy. We will cover more of this in the section ahead.

Outlook for the year ahead:

So here we sit after one of the most challenging yet positive years for investors in nearly the history of investing. The sentiment swing from March (doom and more doom) to the year-end (double-digit returns abound) was something we might see but a few times in our lifetime. With that, we start 2021 with a lot of positives that favor risk assets:

- Global monetary policy is still extremely loose, and that does not seem to be changing anytime soon. Global Fed Reserve banks continue to support capital markets with trillions of dollars in asset purchases. The U.S. Federal Reserve has not only committed to maintaining asset purchases through 2021, but members have repeatedly stated a move in the Fed Funds rate is years away. Remember Chairman James Powell said over the summer, they are not even thinking about raising rates. Based on fed communications lately, clearly, that thought has not changed. History tells us that when monetary authorities provide support to capital markets, global risk assets like stocks do well.

- Fiscal policy in the U.S. and around the globe is still underway as economies need a bridge from here to the other side, where vaccines will be widely disbursed. The U.S. passed a $500 billion relief package in December, and as of this writing, the new administration is proposing as much as $1.9 trillion in another relief bill. This is a major amount of economic support, and with this capital flowing through the economy, when we potentially find herd immunity this summer, the economic recovery could be substantial.

- Inflation to date is still low. A lot of talking heads think inflation will explode with all this money being supplied to the economy. Maybe it does, but as of right now, inflation is low and the Fed is not in a rush to change monetary policy due to a change in inflation expectations. The Fed has stated on numerous occasions that they want to see inflation over 2.0% for an extended period before they would even consider changing their policy. That extended period could be measured in quarters or even years.

- Corporate earnings are recovering. The bottoms-up consensus expectation are that the S&P 500 will see earnings growth of around 22% in 2021. Outside the U.S., the expectation is that corporate earnings growth this year in developed economies will exceed 30%.

- A new economic cycle has begun. While an official end to the 2020 recession has not been called, based on the macro data we follow, we feel confutable saying the recession has ended. We are in the early stages of the next economic cycle. As mentioned previously, data on global manufacturing, global services, retail sales, and residential real estate looked to have bottomed and have rebounded. The beginning of cycles historically favors a risk-on asset allocation.

While there are many positives for investors to consider, a rational investor always studies both sides. For us, there are a few concerns as we begin the new year.

- Valuations are, by historical measures, not cheap. That is commonplace across asset classes. At all-time low-interest rates, most of fixed income land looks expensive. While most stocks look cheap relative to bonds, there are certain areas where valuations look high. Speculation is rampant in certain areas surrounding big secular trends like electronic vehicles or clean energy to name a few. We believe in these significant trends but are fully aware the valuations on some of these companies are euphoric, to say the least. When considering investments in these areas, we spend a lot of time understanding the tradeoff between today’s valuation and long-term earnings potential. We will always target participating in secular trends, but the battle between risk and reward will push us to balance the two and seek an optimal price for that risk.

- The employment picture is stubbornly weak as we move into the new year. 2020’s final months showed a clear slowdown in the momentum we might have seen in employment in Q2 and Q3. As we talked about above, the virus surge has impacted some segments of the economy in a big way, and the employment picture for the first part of the year will challenging. As of this writing, many states are slowly lifting restrictions that have been in place to help prevent the spread of the virus. This hopefully will help employment trends, but we know the real significant improvement we all are waiting for will be when the vaccine can be widely disbursed sometime this spring and summer. We expect to see positive employment trends in the back half of this year, but the first half will be a grind. Also, remember that employment cycles take years to play out. It was never rational to expect the employment picture to be a pre-pandemic level right away. Cycles take a long time to play out, and the employment recovery will play out over years, not months.

- Geopolitical tensions will always be a risk to weigh. We have little feel for how the new administration will handle relations with China or situations in the middle east. This might not be a risk today, but we always want to at least understand how these situations can influence asset prices.

While these are only a few of the pros and cons we are considering, we feel the optimal approach to asset allocation as we enter 2021 is to favor risk assets but be broadly diversified. On the equity front, we are now overweight stocks outside the U.S. and have been funding those positions by bringing down our U.S. large-cap Growth holdings. While we are not completely abandoning our U.S. large-cap position, we do see many positive reasons to broaden out our equity positioning. For the first time in almost 13-years, indexes that represent emerging markets and developed international stocks are challenging, and in the case of emerging markets breaking through the all-time highs of 2007. This is a major development and could be the sign of a new cycle taking hold. Valuations also point to better pricing in international equities as they are considerably lower than large-cap growth stocks in the U.S. Also, we like that tradeoff and believe at the beginning of the cycle here is favors overweighting international stocks as they tend to have more cyclicality in their earnings and as we mentioned before, 2021 is estimated to be a solid year for earnings growth in international markets.

Inside the U.S., as we enter the beginning of the next economic cycle, our study of history tells us to favor small companies over large ones. While we increased our holdings in small companies early in the 4th quarter, we are still somewhat underweighting the group relative to benchmarks. Small caps had an epic quarter in Q4, returning over 30%. Despite that, we are hesitant to increase our position size from here as the category looks like it’s in a technically overbought condition. We do want to own more of the group as again we are early in an economic cycle, but our focus on balancing risk and reward has us looking for better prices. We think we will see another opportunity and will react accordingly when we do.

On the Fixed Income side, we are underweight bonds vs. equities. The level of income is just too low for us to get excited about bonds. Credit has performed very well since we overweighted it in March. Credit spreads on both junk and investment grade have narrowed aggressively, and the risk/picture does not favor investors here. We are looking to trade the credit risk for opportunities in equities. For instance, utility stocks had a rough Q4 but now have dividend yields greater than 3.0% and in some cases over 4.0%. These yields are double and triple what you can get in investment-grade bonds, yet the categories have similar correlations in the S&P 500. That tradeoff is attractive and we continue to favor equities that are could be considered “bond-proxies,” especially in portfolios that have income mandates.

Duration is fixed income has now become a significant risk. While we don’t expect the Federal Reserve to raise rates anytime soon, we also do not think they will be going much lower. Chairman Powell has been on the record as saying negative interest rates in the U.S. is not something the committee is in favor of. So, the 50bps level we hit in August on the 10-year treasury rate could be the bottom. As we move into this new cycle, we do expect the move in rates will be higher, just not aggressively higher. As such, we have taken out duration down over the last few months and now sit below the Barclays Aggregate Bond index at 6-years today. As we move through this cycle, we would naturally expect GDP growth to mean higher rates, but that’s not going to happen all in one quarter or year. It will take time and happened over the cycle. As we know, the Fed is not in any hurry to move its Fed funds rate higher anytime soon, and some Wall Street strategists think it does not happen until 2023 at the earliest.

Summary:

As we enter the new year, we are at the beginning of a new economic cycle. As such, we have a risk-on but diversified approach to asset allocation. A diversified approach should allow portfolios to weather the rough seas that pop up from time to time. Monetary and fiscal policy will be the fuel to drive the economic cycle through 2021 as we seek to recover from the Covid-19 recession. We are in tune with the fact that, in the short-term, risk assets can have corrections. As we are early in the economic cycle, we would use these corrections to increase our positions in areas that work well in the early stages of a new cycle (small & cyclical companies). Risk is always top of mind for us. We will continue to monitor for pockets of the markets that seem euphoric and where the near-term risk dramatically outweighs any rational thought of return. Overall, the theme for asset allocation in 2021 is to broaden exposures as diversification will prove beneficial when you are in the early stages of a cycle.

In closing, we recognize that 2020 was a most trying time for everyone. We thank you for putting your trust in us to manage through these challenges with you. It’s an honor that you have allowed us to accompany you on your financial journey, and oh, what a journey 2020 was. If you have any questions after you read this or have any other concerns that are top of mind, please reach out to your advisor and let’s talk. Please be safe and stay healthy.

The Shepherd Financial Partners Investment Team

Disclosures

Source: Factset

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 1-05107513