by: Brian Davies, CFA – Chief Investment Officer

No Risk-Free Returns Today!

According to a recent Financial Times article1, as of the end of June, 86 percent of the global bond market yields no higher than 2.0%. More than 60 percent of the $60 trillion global bond market yields less than 1.0%. Only 3 percent of the entire investable bond market yields more than 5.0%. Compare that to the late 1990s when over 75 percent of bonds sported yields over 5.0%. This is the great conundrum facing all investors today: How do we earn an acceptable return when risk-free bonds yield nothing? At Shepherd Financial Partners, we believe the answer is a heightened focus on risk management.

Chart 1: 10-year Treasury Yields at other crisis points (Source: BofA Global Research)

At other points in time, you could unload risk assets and buy risk-free government bonds and earn a decent return, while at the same time hedging equity risk. As you can see in Chart 1, that is not the case today. Zero-interest rate monetary policy is forcing investors higher on the risk spectrum to earn a return on their capital. We all strive, and almost all of us need, to earn some semblance of a return on our investments to achieve our long-term goals. Because starting yields are so low in the majority of bonds, the return profile of the capital markets has changed. This is one reason why, long-term, we still favor stocks over bonds. Yes, the valuation of stocks might be higher today than recent history, but the yield profile of stocks (earnings plus dividends) is still greater than almost all of the fixed-income world. The only way to get starting yields in bonds close to stocks is in areas of fixed income like Junk Bonds that are highly correlated to stocks. This point emphasizes the importance of risk management when creating a balanced portfolio today.

We don’t want to give the impression that low-interest rates in treasuries mean they are to be avoided. At rates today, treasury securities are still a quality equity risk hedge, but only an equity hedge. They are not in a portfolio to earn income or for capital appreciation. They are held to help hedge the risk and thus volatility that may be present in equities and equity-like instruments. When we added risk to portfolios in March and April, we also purchased treasuries to help balance the risk we were introducing to balanced portfolios. Think of it this way: by buying high yield bonds in balanced portfolios in March, we introduced more equity-like risk to the bond allocation of the balanced portfolio. Therefore, there is more volatility than a traditional neutral asset allocation would imply. We can dampen some of that risk by allocating a portion of a balanced portfolio to equity hedges like government bonds. This allows us to seek income within our bond allocation, but also manage risk at the same time.

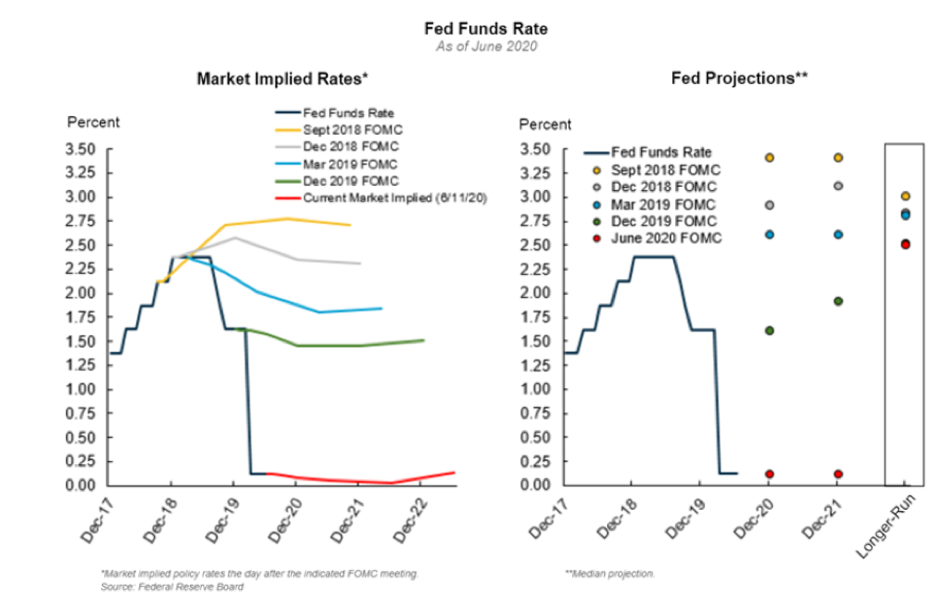

The hedging ability of treasury bonds won’t be in place forever. At some point in time, the economy will recover and the Federal Reserve will move away from the current interest rate policy. However, based on recent Fed meetings that is a long way away. According to the data in the chart below from Prudential Global Investment Management (PGIM), both the Market and the Fed, think it’s at least 2-years until interest rates move off this zero-bound level. As such we are comfortable using U.S. treasuries to hedge equity risk in balanced models.

Chart 2: Market Implied and Fed Projected Fed Funds Rate (Source: PGIM)

In summary, we are at record lows for interest rates in global bond markets. The monetary authorities are attempting to push investors out the risk spectrum to earn a needed return. This environment will be in place for some time to come. As a result, risk management of investment portfolios is of ultra-importance. At SFP, understanding risk is a top priority in our investment process. We use many resources to gauge the level of risk in all investments held and under consideration. If we feel downside risk is not appropriately priced into an asset, we have no problem either stepping aside or avoiding altogether. On the other hand, we will be opportunistic and invest in areas where the risk/return profile favors the long-term investor. Despite what some people might be saying today, investing is not easy. Challenges surround us every day. We believe having a long-term view with a laser focus on understanding risk in building diversified portfolios will serve investors especially well moving forward.

1 Financial Times; https://www.ft.com/content/b44281c0-2ddb-46ae-83e2-150461faed65

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Stock investing involves risk including loss of principal.

Tracking #: 1-05042944