Top Market News

U.S. Makes Tariff-Cut Offer to China as Deadline Nears, per Wall Street Journal

U.S. negotiators have offered to slash existing tariffs by as much as half on roughly $360 billion of Chinese-made goods as well as to cancel a new round of levies set to take effect Sunday, according to people briefed on the matter, as the two sides work toward a limited trade deal that could help prevent their shaky relationship from worsening. Global risk assets rallied on the news.

November PPI and weekly initial claims disappoint

Weekly initial jobless claims at 252K in the latest week vs consensus 212K. up sharply from unrevised 203k in the prior week. Highest level since Sep 2017; economists noted late Thanksgiving could have impacted number. Brings four-week average up to 224K, slightly above the average for the year. Continuing claims were 1667K vs consensus 1685K; down w/w. Elsewhere, November producer price index unchanged at 0.0% m/m vs consensus for 0.2% rise and October’s 0.4% gain. Final goods prices rose led by meats and fuel while food services fell. PPI ex-food and energy -0.2% compared with consensus for 0.2% increase; y/y rate down to 1.3% from 2.7% a year ago. Core goods rose 0.2% while services fell 0.3% with healthcare among the negatives.

European Central Bank (ECB), and The Federal Reserve leave policy rates unchanged:

There were few surprises from Wednesday’s Fed announcements. As widely expected, the Fed left policy unchanged and made only minor changes to the policy statement. While it removed the reference to uncertainties, several previews had mentioned this possibility. Also as expected, the bulk of the 2020 dots showed an unchanged policy rate. Powell reiterated that he would want to see a move up inflation that is “persistent” and “significant” before raising rates.

ECB left its key policy settings unchanged, as expected. It also maintained its guidance for rates at present or lower levels until inflation picks up. Said QE will continue for as long as necessary, and end shortly before it starts raising rates. After September’s broad easing measures and backlash against negative rates, Lagarde’s first decision as president was widely expected to be uneventful.

Chart of the week

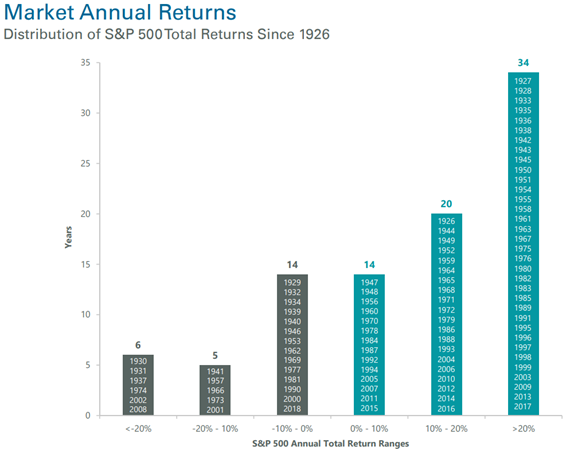

One of the pillars of our investment philosophy is that markets are driven by cycles. As long-term investors, we take time to analyze the history of markets to understand patterns that drive these cycles. The chart below examines the distributions of S&P 500 calendar year returns (going back to 1926) across various ranges. We have two primary takeaways that we would like to highlight:

First, the statistical distribution itself provides a nice reminder of the market’s tendency to move higher over time. The stock market generated positive returns in 68% of years, and 37% of years included a return greater than +20%. This contrasts to only 12% of years since 1926 declining more than 10%. Additionally, since 1926, the S&P 500 has more than 5x the amount of +20% years than it does -20%.

Second, and more importantly for our study of cycles, we sought to point out commonalities of the most extreme negative years (years with declines of more than -10%). There are three factors present in each of instances of annual market declines of over -10%:

- Tightening monetary policy from the Federal Reserve. This factor is most prevalent and overlaps with almost all negative instances. We saw this recently during the market’s adverse reaction to the Fed’s tightening of rates during Q4 of 2018 (although 2018 did not return less than -10% for the entire calendar year).

- Excesses in the financial system (credit or valuation). This factor drives longer cycles in the markets and has contributed to some of the most severe market drawdowns (The Great Depression, The 2000 Technology Bubble, and the Great Financial Crisis).

- War. This final factor has often exacerbated economic and market cycles already being influenced by the first two factors. This was seen especially during WWII, Vietnam, Desert Storm, and immediately following 9/11.

Disclosure

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-927110