Market Summary

Top Market News

China Offers Official Reassurance on Trade Talks With U.S., per Wall Street Journal

China’s trade negotiations with the U.S. remain on track, Beijing said, offering official reassurance after tensions flared between the world’s two biggest economies over human-rights issues in China. China’s Commerce Ministry said Thursday that the negotiating teams from both sides have maintained close communication, though it didn’t provide details on progress. The recent strain had spooked investors and stoked concerns over the global economic outlook. “If China and the U.S. strike a phase-one deal, relevant tariffs should be reduced,” Commerce Ministry spokesman Gao Feng said, referring to a proposed interim agreement the two sides are trying to reach.

Initial jobless claims drop; employment report on deck for tomorrow

Weekly initial jobless claims at 203K in the latest week vs consensus 217K. Down from unrevised 213k in the prior week. Second week of decline following higher prints in November. Brings four-week average down to 218K, in line with the average for the year. The November employment report (Friday, 8:30 ET) is expected to show a gain in nonfarm payrolls of 187K, up from 128K in October. Manufacturing payrolls are forecasted to show a gain of 18k after last month’s drop of 36k related to the GM autoworkers strike. Average hourly earnings are expected to tick up 0.1pp to +0.3% m/m, +3% y/y while average workweek is expected to be steady at 34.4 hours. Consensus for the unemployment rate calls for an unchanged reading at 3.6%.

German factory orders disappoint

German October factory orders fell 0.4% versus consensus for 0.3% increase and prior 1.5% gain revised from 1.3%. Renewed weakness in manufacturing underlines ongoing fragility of sector despite some recent signs of stabilization. Numbers unlikely to change ECB policy calculations, particularly with recent pushback in policy and forward-looking PMIs showing signs of improvement. However, it is likely to add pressure on Chancellor Merkel’s government to reconsider its approach to fiscal policy. Merkel, Finance Minister Scholz and Economy Minister Altmaier have played down the need for stimulus but it comes at a difficult time with new SPD leadership pushing for more investment, as it reconsiders its future in the coalition.

Chart of the week

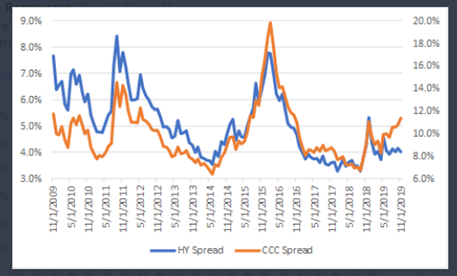

An economic factor that we monitor closely is high yield spreads. This is the difference in yield between a junk bond and a US treasury bond at any given maturity term. When the spread becomes wider, high yield bonds generally lose value (as yields rise, price falls for bonds). While high yield spreads are generally reported in aggregate (showing the average spread across maturity terms and credit ratings), it is interesting to parse the data to analyze how high yield bonds at various risk levels are behaving. During the second half of the year, we have witnessed a divergence between the riskiest portion of the high yield market (CCC rated junk bonds), and the aggregate high yield market. As you can see in the chart below, the spread on CCC junk bonds has widened to over 11%, while the aggregate junk bond spread remains at about 4%. This means that junk bond investors are demanding a much higher yield to be compensated for CCC bonds, and therefore putting downward pressure on the bonds’ prices. Meanwhile, the aggregate spread is far below long-term averages which may signal to investors that credit conditions are benign.

Why is this happening? Our primary theory is that there are structural headwinds to the constituents of the CCC junk bond space. Issuers of CCC bonds are primarily in the energy and retail sectors; these are two sectors of the economy that continue to be under heavy pressure in the US. As this divergence progresses, we must ask ourselves: is this price correction limited to the secular trends of the CCC market, or could there be systemic problems in credit that eventually arise?

Disclosure

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-924109