by: Brian Davies, CFA – Chief Investment Officer

Summary

- The U.S economy continued to slow down in Q3 as trade rhetoric impacted certain sectors.

- Interest rates fell dramatically during the quarter as investors looked forward to additional rate cuts by the Federal Reserve.

- Bonds performed very well. Duration outperformed in the quarter with long-dated treasuries having one of their best three-month periods ever.

- U.S. Stocks performed OK in the quarter but have slowed from the rapid gains seen in Q1 and Q2.

- We dive deeper into what happened this quarter and also discuss how we are positioned as we head into the 4th quarter

As the summer and the 3rd quarter came to a close, all investors seemed to want to talk about was interest rates and how far they could fall. The quarter saw rates across the globe fall. Global economic activity continued to slow, driven by the continued trade skirmish between the U.S. and China. The monetary response by the federal reserve banks around the globe has been to cut targeted interest rates. The rapid drop in interest rates saw an equity-like performance in certain fixed income instruments. Long-dated treasuries (ishares20+year Treasury Bond ETF) were up 11.6% in Q3. This would turn out to be one of the best quarters ever for this security. Around the world investors have poured money into the bond market a record pace as the “lower for longer interest rates” mantra reached a fever pitch. Duration was the name of the game in Q3. Negative yielding bonds globally topped $17 Trillion in August. The thirst for what we call “volatility protection” seemed to have no end. We saw a 100-year term Austria bond go up over 90% year-to-date at some point in August. A prime example for us of that the interest rate sentiment pendulum had swung too far one way. This 3rd quarter review will discuss what drove this lust for duration and how we are positioning portfolios in light of this.

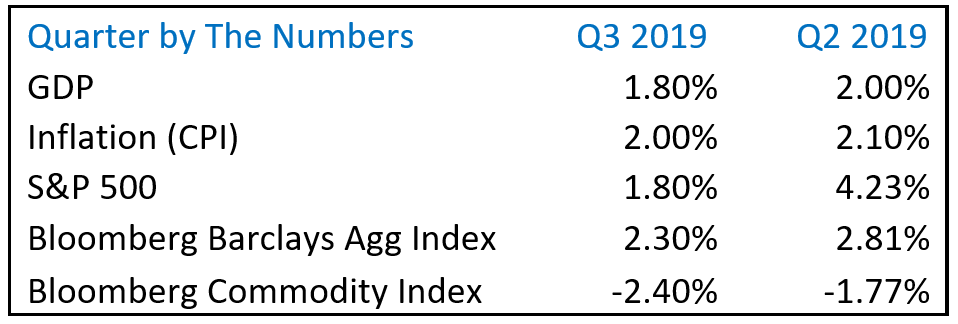

Economic Review

The U.S. economy has continued on the decelerating growth path it has been on all year. We started the year with Q1 GDP growth of 2.9% and we are now are likely to see Q3 GDP growth come in close to 1.8%. The slowdown is not unexpected. The sugar high of the 2017 tax cuts boosted activity in 2018 and year over year comparisons were going to be very hard to repeat. The trade situation is not helping things. Manufacturing activity has slowed and recent monthly readings are pointing to a contraction for that industry. This has yet manifest itself into an outright recession in the U.S. despite the predictions of many a pundit. The U.S is a consumption-driven economy. Two-thirds of U.S. GDP is consumption-based while, today, only 11% is based on manufacturing. The consumer seems to be in good shape today. Personal balance sheets are much improved from the depth of the great financial crisis. Retail sales have held up very well. Residential Real Estate activity is growing and signaling decent economic activity. The labor market is as strong as its been in decades and, in the short-term, shows no signs of weakening. These all point to a healthy consumer in the U.S. and one that has not been tainted (yet) by the continued issues around global trade.

Economies outside the U.S, on the other hand, are struggling to adjust to this trade spat. The International Monterrey Fund (IMF), just recently, downgraded global growth to 3.0% in 2019, which would be the lowest growth reading in a decade. Countries outside the U.S. are much more dependent on trade and they have struggled to regain their economic footing as the trade situation drags on. Monetary policymakers in developed international markets have responded by continuing to push interest rates further into negative territory. This has yet to have a meaningful effect on growth. Negative rates seem to be doing the opposite and stymieing growth. Loan growth rates in Europe have been negative until recent readings. Normally at this point in past cycles that growth rate was in double-digit territory. This seems to be more of a demand for capital problem and not a supply of the capital problem, which is what negative rates are supposed to address. Because of these growth struggles, we continue to be underweight developed international equities in our balanced portfolios. We recognize the valuations are more attractive in these developed markets but until we see a sustainable change in growth, we will maintain an underweight position.

Emerging markets (EM) are also heavily influenced by this trade spat. Some of these markets drive a significant percentage of their GDP from trade. China is the biggest proxy for emerging markets and they just reported the lowest growth rate in GDP in almost 30-years. A trade truce would greatly benefit the economic activity of these developing countries. Like developed international equities, EM equities are attractively priced but the weight of this trade conflict gives us concern when considering a bigger position in balanced portfolios. If the developments around trade move in a positive direction, we will determine if that good news is enough to consider a bigger allocation.

Equity Markets

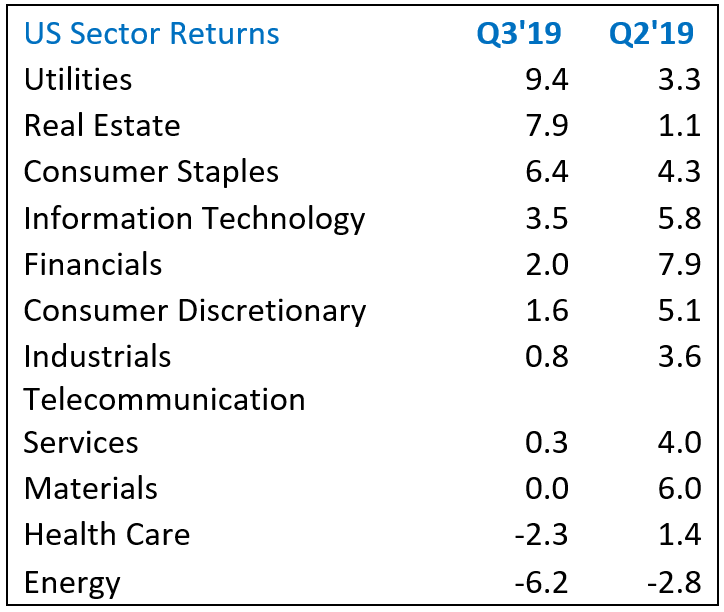

Equity markets in the U.S. had a solid quarter with the S&P 500 up 1.8%. This is a slowdown from the dramatic returns of the first six months of 2019. The focus on defensive positioning dominated the quarter as “bond proxies” Utilities, REITS and Consumer Staples were the best performers. The swift drop in interest rates has investors rushing to these stocks, thanks to dividend yields that are well above current fixed income rates. The technology sector has a decent quarter as the growth profile of this sector continued to garner investor attention in a world that seems to be starved of growth.

On the downside, the Energy industry continued to struggle and the sector was the worst performer in the quarter. There has been a dramatic change in the supply/demand dynamics of the energy industry. Technology has resulted in a big increase in supply in the last few years and demand growth has not caught up. Also, the demand profile of the sector is changing as renewables become a greater percentage of the world’s energy source. We believe these issues are structural and will be a challenge for the industry for many years to come.

Equity valuations changed very little from the levels at the end of Q2. The current forward Price to Earnings (PE) ratio of the S&P 500 is about 17.0x. We came into the year expecting about 5% growth in earnings for 2019. The consensus numbers are now at or slightly below that earnings growth target. While the PE, at its current level, is higher than long-term averages, it is not excessively high in our view. That PE level implies an earnings yield of 5.9% which is the middle of the treasury curve and higher than yields on investment-grade corporate credits. This is one we reason why our balanced portfolios have an overweight to equities relative to bonds today.

Emerging & Developed International Markets

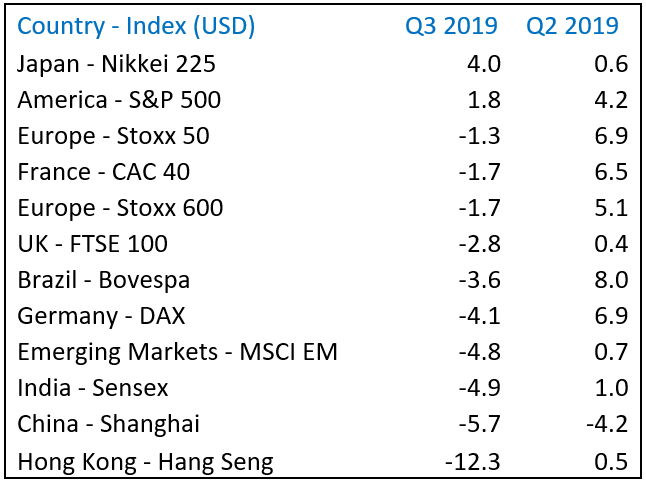

The quarter overseas was highlighted by a risk-off stance in emerging market stocks (EM). The trade war, tensions between Hong Kong and China and weak macro data all worked together to drive negative returns. China, India, Brazil were all negative and well off the performance of the S&P 500. Skittish investors focused on Japan, a typical haven these days, as the Nikkei 225 was up 4.0% during the quarter.

Foreign economies are much more susceptible to economic disruption due to trade tensions. As mentioned earlier, China is now seeing the lowest economic growth in 30-years. Germany’s manufacturing base has been hard hit and is in full contraction mode. Although some traction has been made on the trade front as of this writing, the issue does not seem to be going away anytime soon. Developed international markets and emerging markets need some good news on trade to stem the trade induced slowdown. Major progress seems difficult to come by and only recently have we seen some on the margin. Valuations in these markets are much more attractive than the U.S. but, the near -term fundamentals point to continued weakness and thus warrant a slow move off our underweighting of these areas.

Fixed Income Markets

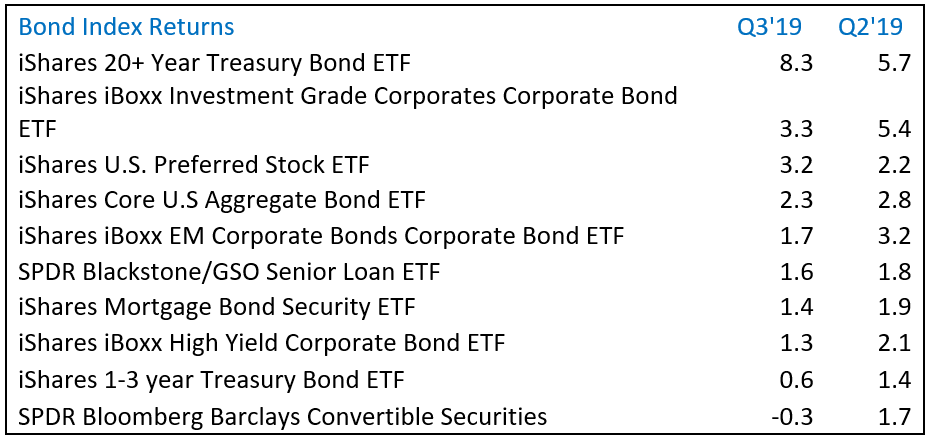

The bonds markets were the major story of Q3. The more duration you had the better you did and then some. iShares 20+year treasury ETF was up 8.3% in the quarter while short-dated treasuries (1shares 1-3years treasury bond ETF) were only up 60 basis points. That 770 basis points in outperformance from across the treasury curve was amazing for three months.

The federal reserve is cutting rates which clearly helped duration assets. Coming into the year the expectation was for the fed to be raising rates this year. Today, we have seen two cuts already and more are expected. That dramatic shift in policy is very hard to get in front of and one most did not see coming. At this point, the duration trade might be a bit ahead of itself. We won’t be chasing performance and as always would look to change out interest rate positioning only if we saw attractive risk-adjusted return opportunities. Low rate, fixed income investing is very much about stock volatility hedging today and less about income. We understand why this is but don’t believe after such a strong performance it means we should chase this and add more duration to the portfolios.

Corporate credit continues to perform very well this year despite historically low spreads relative to Treasuries. These narrow credit spreads signal solid credit trends to date and there have been very few credit-related issues in corporate America this year. Low rates are allowing corporations to carry debt at a low cost. As long as the economy can grow and rates stay low, corporations can play the debt game for a while. We worry that price and fundamentals might be too good right now. Such narrow spreads relative to Treasury securities are normally not the best time to initiate new corporate credit positions. We made changes late last year to reduce our corporate credit exposure and although that has hurt a bit this year, we are confident in our positioning. We equate grabbing yield today in corporate bonds as picking up pennies in front of steamroller. The risk of getting rolled over seems to increase to us.

Summary: Positioning heading into Q4’19

In summary, we continue to be overweight equities relative to bonds and cash in our balanced portfolios. The equity overweight has come down as we have moved through the year thanks to robust equity markets this year. Our analysis shows stocks still showing solid risk-adjusted returns moving forward relative to bonds and cash. The strong duration rally in bonds this quarter only helped widen out the stock relative gap. When we have looked to take equity exposure off-balanced portfolios, we have looked for fixed income that has some bit of income component to it. That is very hard to do today given the lower for longer interest rate environment we are in. The reality is rates are low but you can find relative value in parts of fixed income markets. You just can’t get the yields you would have in past cycles. But that is just the reality of the investing world we live in today. We have to do our best to find opportunities and best manage the risk inherent in all securities.

We say it often, but our mantra at Shepherd Financial Partners is successful investing is about managing risk not avoiding it. Headlines today are causing investors anxiety and that’s one reason why low-interest rates continue to head lower. Some bond yields in the world are in negative territory. We make investment decisions based on our analysis of risk-adjusted returns and look to consider if securities have risk appropriately priced. We don’t follow the crowd and make decisions just because they feel comfortable. Negative bond yields or low yielding cash accounts are not prudent for most of our clients today. Clients have long time horizons that can be measured in decades. It is vitally important their hard-earned money work for them over that long-term. We look to be flexible with our framework and as markets change and opportunities present themselves, we will make prudent moves that will benefit our clients over the long-term.

We will be reaching out to you soon and look forward to our discussion on your long-term investment goals and any concerns you may have about the markets.

Disclosures

* Forward Price to Earnings is price divided by consensus analyst estimates of earnings per share for the next 12-months

** A basis point is commonly used to express differences in expenses or interest rates. 1bp=0.01%

Bond Indexes Definitions:

iShares 20+ Year Treasury Bond ETF – invest in 20+year U.S Treasury Bonds

iShares iBoxx Investment Grade Corporates Corporate Bond ETF – Invests in U.S Investment Grade Corporate Bonds that have ratings between AAA to BBB.

iShares iBoxx EM Corporate Bonds Corporate Bond ETF – Invests in Emerging Market Corporate Bonds

iShares Core U.S Aggregate Bond ETF – The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

iShares U.S. Preferred Stock ETF – Invests in U.S. Preferred equity securities

iShares iBoxx High Yield Corporate Bond ETF – Invests in U.S. Corporate Credits that are non- investment grade meaning they are rated BB or worse.

iShares Mortgage Bond Security ETF – Invests in U.S. Mortgage backed securities.

SPDR Blackstone/GSO Senior Loan ETF – Invests in bank loans that are tradeable.

SPDR Bloomberg Barclays Convertible Securities – Invests in U.S Convertible Securities. These are fixed income instruments that have an option to convert into equity (shares) of a company.

iShares 1-3-year Treasury Bond ETF – invests in 1-3 years U.S. treasury bonds.

Bloomberg Barclays U.S. aggregate bond: The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

S&P 500: The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Stock investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates. It is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. The bigger the duration number, the greater the interest-rate risk or reward for bond prices.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher

interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Floating-rate loans are often lower-quality debt securities and may involve greater risk of

price changes and greater risk of default on interest and principal payments. The market for floating-rate loans is largely unregulated and these assets usually do not trade on an organized exchange. As a result, floating-rate loans can be relatively illiquid and hard to value.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.