Market Summary

Top Market News

US-China Trade Headlines Volatile

Lot of volatility in the headlines surrounding US-China trade after Reuters reported yesterday that a phase one trade deal may not get completed this year. The article followed a pickup in reports highlighting a number of complications facing a deal. President Trump said yesterday after the close that China is not stepping up to the level he wants in trade talks. In addition, House followed the Senate in passing the Hong Kong democracy bill, which Trump is reportedly likely to sign. However, Bloomberg noted that Chinese Vice Premier Liu said that he is “cautiously optimistic” about a deal. In addition, the Wall Street Journal reported Liu invited his US counterparts to China for new face-to-face talks. South China Morning Post (SCMP) said even without a deal, the US unlikely to proceed with December tariffs.

October Housing Starts Light of Consensus but Permits Hit a 12-year High

October housing starts came in at a 1.314M SAAR, below consensus for 1.320M but better than September’s upwardly revised 1.266M pace (was 1.256M). Up 3.8% m/m and 8.5% y/y. Single-family starts helped by strength in the West. Multifamily starts also higher, up 6.8% m/m. October building permits at a 1.461M SAAR, highest point since May 2007. Above consensus for 1.385M and September’s 1.391M level. Up 5.0% m/m and 14.1% higher y/y. The report adds to a trend of generally positive housing data amid lower rates and resilient consumer confidence. Next data points this week tomorrow’s weekly mortgage application data and Thursday’s existing-home sales report.

Trump Says He Told Powell US Rates Too High

President Trump tweeted on Monday evening that he protested to Fed Chair Powell at a meeting at the White House on Monday that US rates are too high relative to those of competitor countries. Added that US rates should be lower than all others. Also said that excessive dollar strength is hurting manufacturers and US economic growth. Trump had earlier tweeted that he and Powell discussed interest rates, negative rates, low inflation, easing, and dollar strength. Fed had earlier released a statement confirming the Trump-Powell meeting and noting that Powell’s comments were consistent with remarks at least week’s congressional hearings and that he did not discuss expectations for monetary policy.

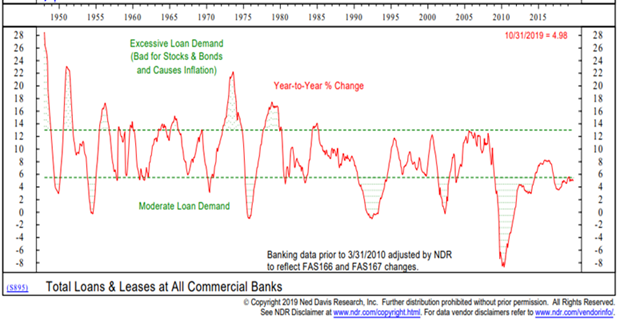

Chart of the Week

Bank loan growth continues to be sub-par this cycle. October bank loan growth came in at 4.98% signaling moderate loan demand. We have not seen loan growth hit double digits this cycle. Every cycle before this one has had loan growth in double-digit territory for a number of years. Again, this points to the lack of imbalances in the financial system today.

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

1-919681