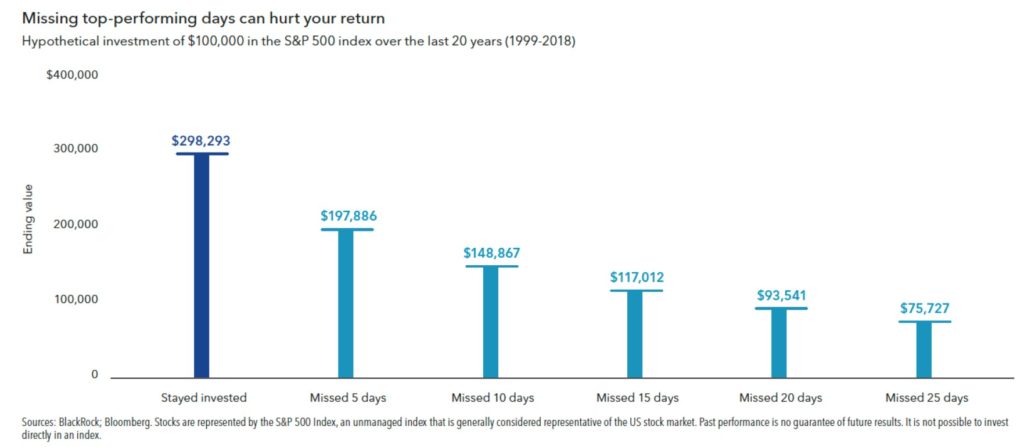

When volatility picks up, it is natural for investors to worry and ask themselves, “Should I get out of the market?”. At Shepherd Financial Partners, we manage money under the mantra: it’s time in the market not timing of the market that is important. The chart above from Blackrock helps put data behind this philosophy and shows how market timing can be incredibly difficult and potentially damaging to long-term returns.

Our clients generally have investment time horizons that are measured in years, not days or months. As the above chart shows, staying invested over long time periods dramatically improves your results relative to trying to time the market. Psychology can have influence on investor decision making. When emotions take over and you decide to “get out,” the biggest challenge is deciding when to get back in. The data above shows there is a significant penalty if you sit out the best twenty to twenty-five trading days over a 20-year period. In fact, missing the best twenty or twenty-five trading days over a 20-year period results in a negative return in an all stock portfolio. As you can see, participating in the top market trading days has a large impact on a portfolio’s long-term results; the only way to participate in these days is to be invested in the market. The ability to achieve long-term financial goals is seriously impacted by attempting to market time to the extent that an investor could miss out on 75% of the upside from staying invested.

The small number of “best” trading days in this study helps illustrate how difficult market timing can be. The 25 best days above represents only ½ of 1 percent of the trading days in a twenty-year period; an incredibly small sub-set of days within a long-time frame; yet this 0.5% of days can lead to a 75% difference in outcome. In this context, it is hard to fathom predicting when to be in or out of the market based on such a small subset of trading days. At Shepherd Financial, we create portfolios based on risk objectives. While the investments or asset classes in the portfolios might change, the assets will always be invested. It is our belief to let time work for you because being invested over long time periods can go a long way to helping reach your long-term financial goals.

Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult me prior to investing. All performance referenced is historical and is not a guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The hypothetical example provided is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

All investing involves risk including loss of principal. NO strategy assures Success or protects against loss.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.