The escalation of U.S.-China trade tensions has recently introduced an uptick in market volatility after a strong market rally in early 2019. In our recent Q1 2019 market summary, we discussed the expectation that volatility is likely to appear during the course of the year. However, this level of volatility in the markets is normal by historical standards. Since 1970, the S&P 500 has experienced an average pull-back of 8.5% during the first five months of the year1 ; as of 5/31/19, we have reached a pull-back of approximately 6.5% from recent highs. Additionally, since 1929, the U.S. stock market has averaged 3 pull-backs of 5% or more on an annual basis2 .

Given that this recent volatility has been directly related to trade tensions, we want to share the key risks and considerations that Shepherd Financial Partners is monitoring in light of the recent geo-political events.

Three Key Risks that we are Monitoring:

1. Will tariffs remain in effect for longer than anticipated (no deal is reached), thereby hampering global growth for a longer period of time?

2. The U.S.-China trade war continuing as a “tech-war” given significant differences in the two country’s positions on intellectual property rights.

3. For the longer-term, our view is that the weaponization of tariffs and other economic sanctions is not a sustainable negotiating tactic for the U.S.

Historical Economic Impact of Tariffs

In the past, tariffs have resulted in higher inflation due to consumers bearing the burden of taxes on imports. Additionally, given the policy uncertainties that tariffs present, we have historically seen slower capital expenditure (investment) by domestic companies, slower employment growth, and weaker productivity growth. These factors eventually drag on the domestic country’s Gross Domestic Product (GDP). Economically speaking, tariffs result in a net decrease in welfare for both countries involved.

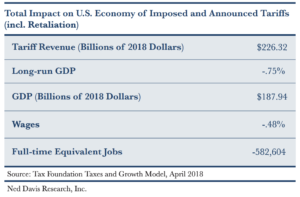

Proponents of tariffs generally point to features such as reduction of trade deficits, protection of domestic industries from foreign competition, short-term government revenue generation, and domestic employment protection. The Tax Foundation (see Table 13 ) published a report aggregating the estimated impact of the imposed tariffs from a benefit (tariff revenue), and cost (reduction of GDP) perspective. Tariff revenue is a component of GDP, and therefore the inflow of tariff revenue is offset by the negative impacts to productivity and output. The longer tariffs are in place, the longer economic growth will face headwinds.

Table 1 Tariffs reduce output, employment, and wages

Trade War Continuing as a Tech War?

One of the major sticking points referenced in the breakdown of trade negotiations in May 2019 was the issue of intellectual property rights. Since the inception of the trade conflict, intellectual property of U.S. technology companies has been at the center of negotiations. The U.S. has an economy that is centered around intellectual property rights as a way for firms to differentiate and create competitive advantages within a free-market economy. Many point to China’s state owned enterprises as a key component driving alleged theft of intellectual property. This is an ideological difference in the two economies that may spread beyond the resolution of a trade deficit.

We are closely watching this factor and how it may hamper specific areas of the U.S. economy. We have already seen this dynamic start to play out in the market’s split reaction within the technology sector. The Hardware & Equipment and Semiconductor industry groups have been among the worst performers given high revenue exposure to China. Conversely, Software & Service companies have outperformed as they have lower revenue exposure to China, and lower risk of tariff impact on earnings. For context, 4 of the 10 largest companies in the U.S. Semiconductor industry generated over 40% of their 2018 revenue from China4 . We must continue to ask ourselves: can continued misalignment on intellectual property issues further impede areas of the U.S. economy even after a deal is struck in the “trade-war”?

The Impact of Continued Tariff Use as a US Policy

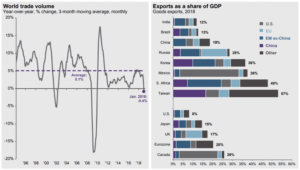

The final risk that we are monitoring is the potential long-term impact of the U.S. using tariffs as a strategy to advance policy agendas. As we write this note on 5/31/2019, the U.S. just announced planned tariffs on Mexico starting 6/10/2019 unless the Mexican government takes action to deter the flow of Central American migrants passing through its borders5 . Per research from J.P. Morgan (see Figure 16 ), world trade volume has decreased year-over-year since the start of the trade war. In the same chart, we can see exports as a percent of GDP for many major developed and developing economies. Given that trade is a major driver in our increasingly global world, the heightened use of tariffs may hamper growth on a global scale. Additionally, frequent use of tariffs may force countries to seek alternative trading partners to the U.S. in the long term.

Figure 1 World Trade Volume & Exports as a Share of GDP

Summary: A Focus on Risk Management

In summary, we continue to closely monitor developments in the U.S.-China trade war and the potential impacts on global growth. Specifically, we are focusing on the three key risks we have summarized in this note: 1. Will the trade-war last longer than expected, thereby slowing global growth? 2. Will the trade-war turn into a tech-war given key issues around intellectual property? 3. Will the continued use of tariffs cause long-term disruption in global trade? As stated in our Q1 2019 market summary, our positioning has continued to favor domestic equities over international, in part due to the lower percentage of U.S. GDP that is derived from foreign trade (see Figure 1). We view the level of volatility caused by the trade tensions to be normal by historic standards. As we have said in the past, as opportunistic long-term investors, we view volatility as a chance to take advantage of dislocations as long as we feel the risk/return dynamics are balanced in our favor.

Please reach out to your advisor to discuss the current trade situation as it relates to your overall portfolio and financial plan.

Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. All investing involves risk including loss of principal. No strategy assures success or protects against loss. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training. Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

1 Research Bloomberg 2 Ned Davis Research

3 Ned Davis Research

4 Ned Davis Research 5 Source: Wall Street Journal. https://www.wsj.com/articles/global-stocks-and-bond-yields-drop-on-mexico-tariff-concerns11559289992?mod=hp_lead_pos1 6 JP Morgan Asset Management