by: Brian Davies, CFA – Chief Investment Officer

Key Points

- The bearishness of Q4’18 has been long forgotten as investors took the exact opposite tone in the 4th quarter of 2019.

- The 4th quarter saw an aggressive rally in global equity markets which has helped markets see outsized positive returns for the year.

- The global economy slowed during the year but central banks loosened monetary policy aggressively across the globe. As a result, almost all assets worked in 2019.

- Interest rates plunged and we saw a peak level of negative-yielding debt during the summer months of 2019.

- We dive deeper into what happened during the 4th quarter of ’19, how the year played out and also how we are positioned as we head into 2020.

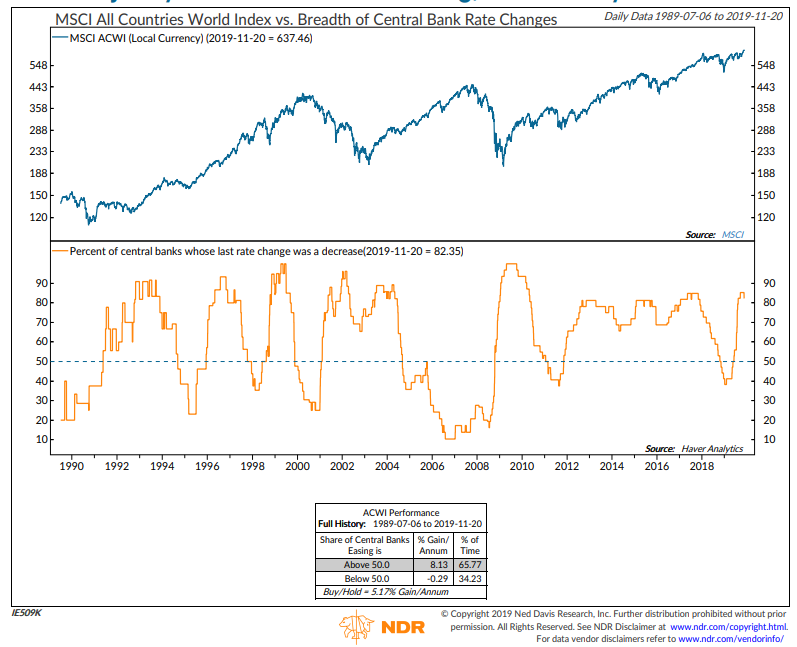

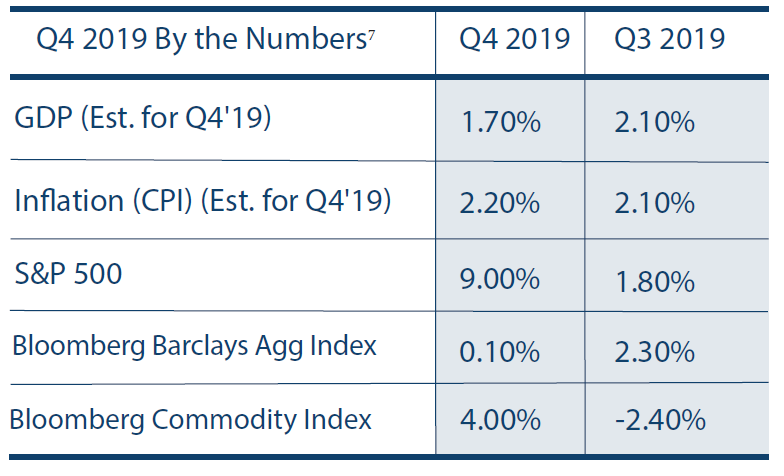

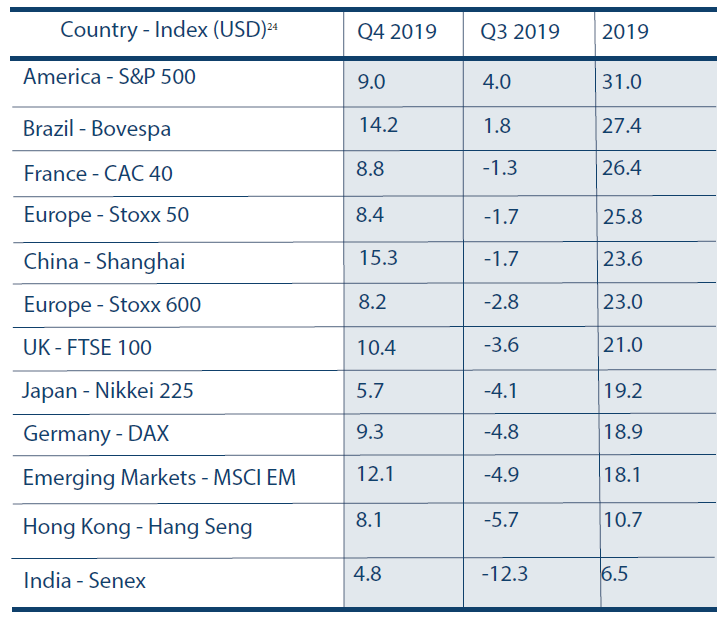

The 4th quarter saw a strong rally in risk assets as sentiment switched quickly from “cash is king” to “I need to be invested”. The Santa Claus rally helped propel the S&P 500 up 9.0% during Q4 (Factset). Emerging market stock markets were up over 13.0% (Factset) and developed international markets were not far behind the U.S. as the MSCI EAFE was up over 8.0%. The rally to end the year was the culmination of a dramatic reversal by global central banks from tight to loose monetary policy. As we end the year, we have over 80% of central banks with interest rate cuts as their last move. Compare this to Q4’18 when that number was less than 40% (see Chart 1 below). That shift has propelled risk assets higher and in fact, has propelled many asset classes higher this year. Stocks and bonds both had solid years. The Barclays Aggregate Bond Index (AGG) was up 8.6% in 2019. High Yield debt as measured by the SPDR High Yield Bond ETF (JNK) was up 14.5%5. Gold was up 17.4% (Factset). So, it was a year where pretty much everything worked. Markets climbed the proverbial wall of worry that consisted of everything from trade to Brexit to recession worries to impeachment. The question now is what does that mean for investors moving forward? This paper will take a deeper dive into what happened in the economy and capital markets in 2019. We will end with our thoughts about 2020 and how we are positioned as we enter the new year.

Chart 1: Percentage of Central Banks Whose Last Rate Change Was a Decrease

Economic Review

The U.S. saw GDP growth fall throughout the year culminating in an overall GDP number for 2019 that should come in around 2.4%. This compares with 2.9% GDP growth in 2018. While we started the year on a relatively strong foot the back half of ’19 saw U.S. GDP average something less than 2.0% (Factset). The lag effects of the Federal Reserve interest rate hikes in 2018 and the uncertainty around the trade conflict with China combined to slow activity below this cycle’s trend. A slowdown in manufacturing activity as a result of trade uncertainty elevated fears of an oncoming recession in the U.S. with fears peaking during the late summer.

Today, manufacturing is only 11% of GDP in the U.S. and while it has contributed to a slowdown in activity, it has yet to be enough to push the economy into contraction (JP Morgan). The consumer drives almost two-thirds of the U.S. economy and has been a stalwart. A strong jobs market is helping to maintain consumer confidence and as a result consumer spending. Retail sales for the 2019 holiday season are estimated to come in over 3.0%, signaling a solid end to the year on behalf of the consumer. Unless we see a crack in employment in the U.S., we expect the consumer to carry the day as we move forward. Household balance sheets are in great shape this cycle and have spent the better part of this decade deleveraging. This again should allow the consumer to carry the economy forward at trend GDP growth rates around 2.0%.

The Federal Reserve helped reignite animal spirits in 2019. Entering 2019, the consensus was for the Fed to raise rates three times. In reality, they did the exact opposite of the that and cut rates three times. The market correction in Q4’18 spooked the Fed and as a result they have turned dovish. This helped reverse the negative sentiment that prevailed at the start of 2019 and the markets were off and running with very little volatility to be seen. The Fed halted the balance shrinking that took place in the last few years and is back to growing it. Whether this is a new version of Quantitative Easing or not, it is clear to us the Fed will lean monetary policy accommodative for the foreseeable future.

Economies outside the U.S were impacted to a much greater extent by the trade spat between the U.S. and China. Global GDP looks to be coming in around 3.0% in 2019 compared to 3.7% in 2018. According to the IMF, a 3.0% growth rate for the global economy will be the lowest this decade. Developed economies outside the U.S. are bearing the biggest hit from this trade upheaval. Europe looks to be seeing GDP growth of only 1.5% for ’19 according to the IMF. This compares with growth of 2.2% in ’18 (IMG.org). Countries like Germany, which rely heavily on auto exports, are struggling to get back on track. The recent phase one trade deal could help and in fact, estimates for Europe’s GDP growth are expected to grow a bit off the ’19 low.

Emerging Markets also suffered from trade uncertainty as the group’s growth expectations slowed from 4.7% in ’18 to an estimated 3.9% in ’19. China is the largest of the emerging markets and although double-digit GDP growth rates are a thing of the past, it does look like they will trend at an attractive 6.0% growth rate for 2019. Combine that with India’s 6.0% growth and EM continues to have an attractive growth profile relative to developed markets who struggle to maintain a 2.0% rate of growth (IMG.org). When or if a phase one deal is signed, it should provide some stimulus for international economies in 2020 and we are starting to see some green shoots in recent data. Manufacturing seems to be finding a bottom and economic surprises seem to be in an upswing.

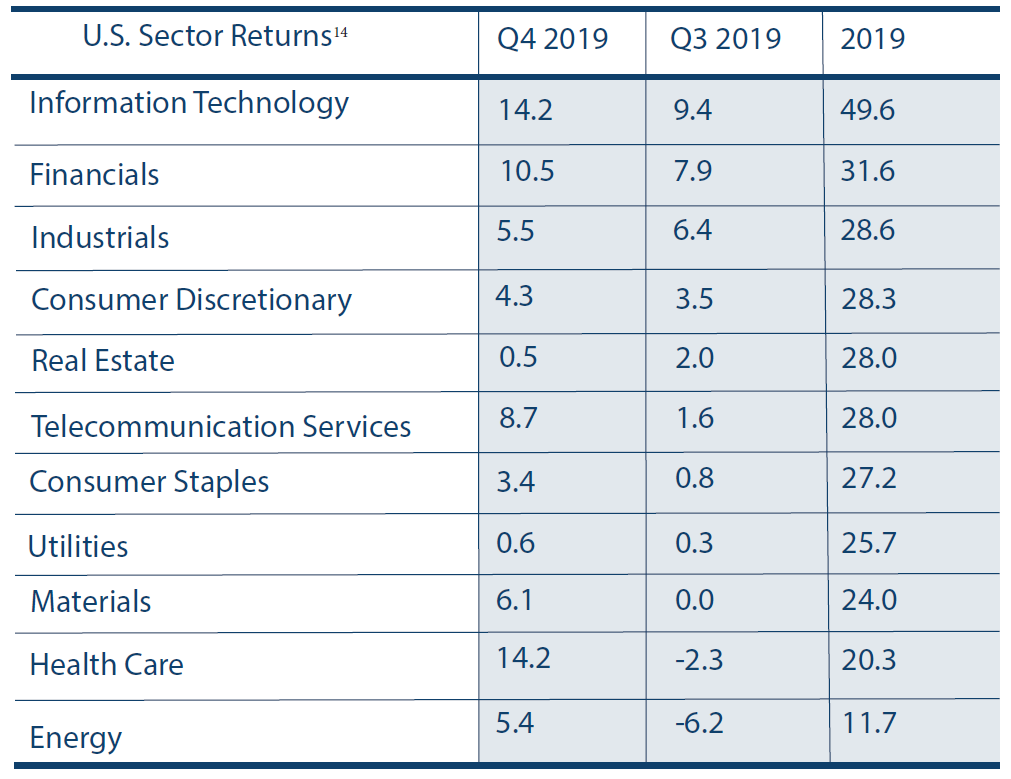

Equity Markets

The 4th quarter performance in the U.S. equity markets saw widespread positive returns. Utilities and REITs were the only laggards as they garnered a flat return. Healthcare, Technology and Financials were the sector leaders as all three saw returns great than 10%. The healthcare sector’s performance was catapulted by a tremendous performance within the biotech industry. The SPDR S&P Biotech ETF (XBI) was up over 26% in the quarter (Factset). The Q4 turnaround quickly reversed what was shaping up to be a disappointing year for healthcare as the sector was a laggard for the first nine months of the year.

Financials did well in the quarter thanks to a rise in interest rates and a steepening of the yield curve. The 10-year treasury started the quarter at 1.63% and finished at 1.90% (Wall Street Journal). The spread between the 2-year treasury and the 10-year treasury widened from 5 basis points to start the quarter to 33 and the end of the quarter. Financials benefit from higher rates and wider spreads. On the opposite side of the rate spectrum, bond proxy stocks like Utilities and REITs underperformed the rest of the market as investors viewed higher interest rates as a chance to take profits in the bond proxies.

Most equity sectors saw stellar returns for the year. The tech sector saw an amazing return of close to 50.0% for the Technology Select Sector SPDR ETF. Financials and Industrials were not that far behind, up 31.6% and 29.6% respectively. Even after a subpar 4th quarter, the Utilities and REITS sectors finished with strong returns of 27.2 & 23.5% respectively. The worst performing sector, Energy, was up double digits coming in at 11.5% (Factset).

The result of these strong equity returns in 2019 is that we enter 2020 at a much higher level of valuation than we did last year. Most of the 30.0% return for the S&P 500 in 2019 came from multiple expansion. Earnings growth was less than 5% and dividends only added about 2.0%. That means that over 75% of the return came from an increase in PE (Price to Earnings ratio). When we started 2019, the forward PE on the S&P 500 was just over 14.0x which is below 25-year average of 16.3x (JP Morgan). We thought there was room for expansion and that turned out to be true and then some. Fast forward a year and we enter 2020 at 18.4x, which is nicely above average. While we do not view this multiple as excessive, we most likely are not going to see a repeat of the type of multiple expansion we saw in 2019. It is all about where you start from and it just happens that because of the selloff in Q4’18, the starting point for this year was low enough to produce stellar 12-month returns.

Emerging and Developed International Markets

The 4th quarter saw a reversal of the risk-off mentality that permeated in Q3. Emerging market (EM) stocks were up 12.1% in the quarter. They fell 4.9% in Q3. Developed international (EAFE) stocks were up 8.0% after being down in Q3. Investors started to anticipate a phase one trade deal getting done and are now pricing in a return to better global economic activity as uncertainty abates a bit. China led the markets higher as the iShares China Large Cap ETF (FXI) increased by 11.8% during the quarter (Factset).

For the year, while the U.S. dominated from a relative performance standpoint, equities outside the U.S. did very well on their own. Developed international (EAFE) stocks returned 21.5% for the year. Emerging market (EM) equities were up 18.0%. Valuations in these markets, while higher than at the start of the year, continue to be well below those in the U.S. If the green shoots we are seeing in global economic data continue, we could be seeing in attractive time to start considering a larger position in international stocks. EM and EAFE have underperformed the U.S. for several years now but the combination of accommodative monetary policy on the part of global central banks and phase one of the trade deal could be the catalyst to reverse the negative growth rate in global trade volume we have seen.

Fixed Income Markets

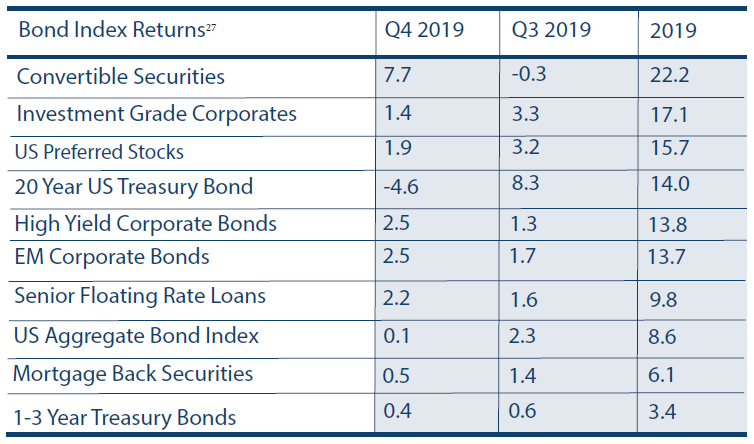

Unlike Q3 when bonds were the story, in Q4’19, bonds took a back seat to equities and finished the quarter essentially flat. As rates moved higher throughout the quarter, duration was a slight handicap. Long duration bonds were negative in Q4 after seeing unusually strong returns in Q3. Credit, which is normally highly correlated to equity markets, saw another decent quarter. High yield was the winner as junk bonds returned 2.5% in Q4. Investment-grade corporate credit was up 1.4% in the quarter (Factset). Spreads in the credit markets continue to be historically low. As a result, we continue to view the risk/return in corporate credit as unattractive. While we are not calling for a major credit event anytime soon, the pricing of credit today does not price in enough for the risk of a future negative credit event. We would rather take that risk in the equity markets where, on a relative basis, the risk-adjusted returns are better.

For the year, bonds did very well with the Bloomberg Barclays Aggregate (AGG) up 8.6%. That is an exceptional return when you consider the starting yield for the index was only 2.6% (Factset). That means 70% of the return for the year was driven by capital appreciation not income. Historically, over 90% of your return is driven by the starting yield. For 2019, bonds acted a lot like stocks with a great majority of the return coming from price movement, not income. While anything is possible, we view a bond market where returns are majority driven by price and not income as unlikely. We target bond returns that are more in-line with starting yields. While those are low today, that is just the reality of the markets we have to live with.

Summary: Positioning Heading Into 2020

As we enter 2020, we are still overweighting equities relative to bonds but less so than when we started 2019. We started the piece with a chart that looks at global central bank positioning. When a large percentage of the world’s central banks loosen monetary policy, risk assets have tended to do well. We saw that in 2019 and we think that will be the theme for most of 2020. The Federal Reserve in the U.S. is now forecasted to be on hold for the year. Chairmen Powell has stated he wants to see inflation much higher than the targeted 2.0%. For us, this means there is very little chance the Fed is raising interest rates anytime soon. Could they cut rates again if the global economic recovery fails to materialize? Yes, but we are in line with the consensus that the Fed will sit tight for a while. This should continue to help U.S. stocks moving forward but given how far multiples have moved in ’19, we felt it prudent to take a bit of risk-off throughout the year.

One area that will change in 2020 is our equity positioning outside the U.S. We do think, after being underweight for over two years, it is time to rethink our position outside the U.S. As we have mentioned a few times in this piece, the economic data outside the U.S. looks to be bottoming out. While we are not calling for a robust recovery, we do think the conditions exist for a recovery and we need to adjust for this. There are still structural forces (think demographics and productivity) in areas like Europe and Japan that will prevent us from being overweight. However, we can move close to neutral in these areas as a cyclical recovery based on the catalysts mentioned in this piece provide support for those markets to outperform the U.S.

We already are equal weight across balanced portfolios in emerging markets and we look to maintain that as we move forward. Growth rates and valuations are attractive across these markets. We did very well in the asset class in 2019 and we look forward to similar performance as we move forward. We do not want to give the impression that we dislike U.S. equities. We have been overweight for some time and that has been the right move. However, now is the time to consider a more diversified approach.

Please reach out with any questions and we look forward to our discussion on your long-term investment goals and any concerns you may have about the markets.

Disclosures

*Forward Price to Earnings is price divided by consensus analyst estimates of earnings per share for the next 12-months

** A basis point is commonly used to express differences in expenses or interest rates. 1bp=0.01%

Bond Indexes Definitions:

iShares 20+ Year Treasury Bond ETF – invest in 20+year U.S Treasury Bonds

iShares iBoxx Investment Grade Corporates Corporate Bond ETF – Invests in U.S Investment Grade Corporate Bonds that have ratings between AAA to BBB.

iShares iBoxx EM Corporate Bonds Corporate Bond ETF – Invests in Emerging Market Corporate Bonds

iShares Core U.S Aggregate Bond ETF – The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. invest¬ment-grade fixed-rate bond market, including both government and corporate bonds.

iShares U.S. Preferred Stock ETF – Invests in U.S. Preferred equity securities

iShares iBoxx High Yield Corporate Bond ETF – Invests in U.S. Corporate Credits that are non- investment grade meaning they are rated BB or worse.

iShares Mortgage Bond Security ETF – Invests in U.S. Mortgage backed securities.

SPDR Blackstone/GSO Senior Loan ETF – Invests in bank loans that are tradeable.

SPDR Bloomberg Barclays Convertible Securities – Invests in U.S Convertible Securities. These are fixed income instruments that have an option to convert into equity (shares) of a company.

iShares 1-3-year Treasury Bond ETF – invests in 1-3 years U.S. treasury bonds.

Bloomberg Barclays U.S. aggregate bond: The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. invest¬ment-grade fixed-rate bond market, including both government and corporate bonds.

S&P 500: The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommen¬dations for any individual. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Stock investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates. It is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. The bigger the duration number, the greater the interest-rate risk or reward for bond prices.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher

interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Floating-rate loans are often lower-quality debt securities and may involve greater risk of price changes and greater risk of default on interest and principal payments. The market for floating-rate loans is largely unregulated and these assets usually do not trade on an organized exchange. As a result, floating-rate loans can be relatively illiquid and hard to value.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

1-933870